Skincare Email Automation (2025): From Welcome Series to Loyalty Programs

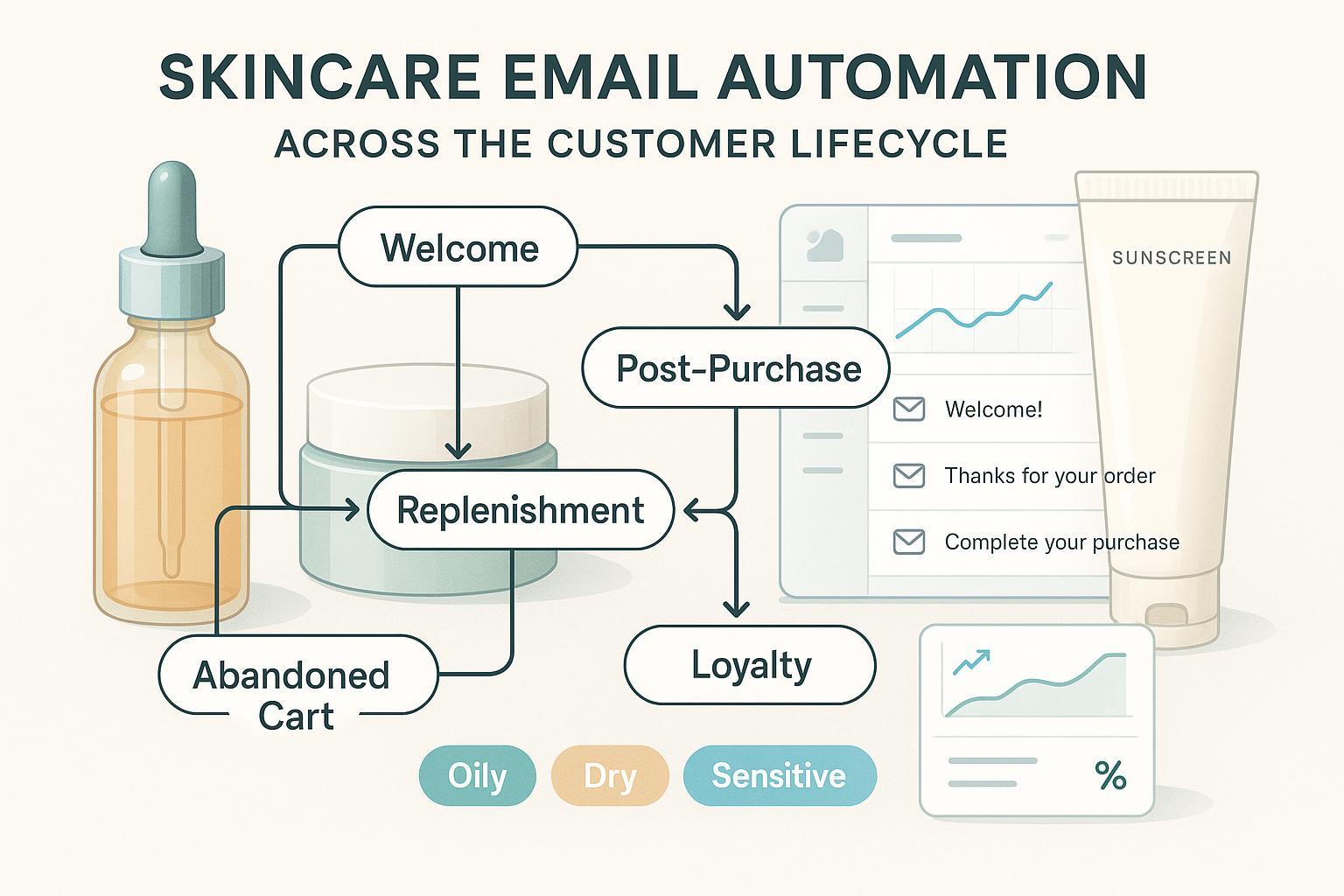

Automation is the difference between a good skincare email program and a compounding growth engine. In 2025, automated flows consistently outperform batch campaigns across open, click, and conversion metrics—ecommerce analyses show that automated emails can drive a disproportionate share of orders from a small fraction of sends, as documented in the Omnisend 2025 Ecommerce Marketing Report. Skincare adds unique personalization needs (skin types, ingredient sensitivities, routine cadence), so your workflows must meet customers where they are—from discovery to long‑term loyalty.

Below is a practitioner‑level playbook: segmentation recipes specific to skincare, step‑by‑step workflows, deliverability safeguards under Gmail/Yahoo rules, and measurement practices that prove revenue impact.

Segmentation That Actually Personalizes Skincare

Skincare buyers expect tailored guidance. Build segments you can act on, not just label.

-

Skin type and concern

- Capture during signup and early touchpoints: oily, dry, combination, sensitive; concerns like acne, aging, hyperpigmentation.

- Use this to drive recommended routines and ingredient education in the welcome, onboarding, and replenishment flows. Practical frameworks are echoed in platform guides like Klaviyo’s segmentation ideas and Litmus overviews; the theme is consistent: segment by customer need and lifecycle, not just demographics.

-

Ingredient sensitivity and preference

- Flags: fragrance‑free, non‑comedogenic, retinol tolerance, vitamin C preference. Use to personalize education and to exclude incompatible products from dynamic recommendations.

-

Routine adoption and behavior

- Signals: first purchase, time‑to‑second purchase, browse categories (cleansers vs serums), routine completion (cleanse‑treat‑moisturize‑SPF). Feed behavior into cadence and content depth.

-

Lifecycle stage and value

- New subscriber, first‑time purchaser, repeat purchaser, VIP, at‑risk. Combine with spend tiers for loyalty triggers and exclusivity.

-

Seasonality and environment

- Geo/season (hydration stories in winter; SPF education in spring/summer). Time content to skin‑need cycles.

Segmentation isn’t one‑and‑done—refresh traits with every form, quiz, and post‑purchase survey. I’ve found that mapping segments to workflows early prevents “Frankenstein” flows later.

Welcome Series: A 4‑Step Workflow That Converts and Educates

Objective: turn new subscribers into informed first‑time customers while collecting data for personalization.

-

Day 0—Welcome and Skin Profile Start

- Trigger: signup; send immediately.

- Content: brand promise in 2–3 lines; visual routine framework; ultra‑short skin profile question (e.g., one‑click “Oily/Dry/Combination/Sensitive”). Offer a modest incentive only if needed for acquisition quality.

- KPI: profile completion rate, click‑through to routine builder.

-

Day 2—Education First, Offer Second

- Content: routine logic by skin type with ingredient basics (retinol at night, vitamin C in morning, SPF daily). Include UGC and dermatologist quotes for credibility. Soft offer or sample bundle on relevant SKUs.

- A/B test: subject lines emphasizing routine vs incentive; keep preheader educational.

- KPI: first purchase rate, content engagement depth (scroll/click on routine steps).

Micro‑example integration (tooling): In practice, I map these early signals into unified profiles before branching content. Using Attribuly to resolve identities across channels, I create segments like “New subscriber + Oily + retinol‑curious” and route them into distinct educational paths without duplicating flow logic. Disclosure: Attribuly is our product.

-

Day 5—Conversion Focus with Social Proof

- Content: dynamic product blocks keyed to declared skin type and last browse category; pull top‑rated reviews and before/after visuals. Offer clarity: shipping, returns, routine starter kits.

- KPI: placed order rate, revenue per recipient (RPR).

-

Day 9—On‑the‑Fence Nudge (Optional)

- Content: decision FAQs (retinol irritation, fragrance sensitivity, SPF shade match), quiz link if no profile yet. Time‑bound incentive only if margins allow.

- KPI: incremental conversions vs control; unsubscribes (ensure fatigue is low).

Why this works: 2025 benchmarking consistently shows welcome flows among top revenue drivers for automation, with strong placed‑order rates and RPR, a pattern reflected in Klaviyo’s abandoned cart and flow benchmarks when flows are well‑timed and personalized.

Post‑Purchase Onboarding and Replenishment

Objective: increase satisfaction, minimize returns, and set up replenishment and cross‑sell.

-

T+0: Order Confirmation and Expectations

- Content: transparent shipping timelines; “How to start” instructions tailored to product (e.g., retinol: start 2–3x/week; pea‑sized amount; moisturize after). Keep sales pitch out.

-

T+3–7 Days: First‑Use Guidance and Routine Integration

- Content: troubleshoot common issues (purging vs irritation), morning vs night routines, ingredient do’s and don’ts (vitamin C before sunscreen; avoid mixing strong actives). Invite feedback via quick emoji ratings.

-

T+21–30 Days: Replenishment Prompt (Product‑specific)

- Timing: base on typical usage windows. Evidence‑informed ranges from dermatology basics suggest cleansers (~1–2 months) and moisturizers (~1 month) with daily use; sunscreen depletes faster when applied correctly. Cite general cadence and adapt to SKU size and customer frequency.

- Content: “If you’re using 1/4 tsp daily, face sunscreen runs out in ~2–3 weeks—here’s a bundle with moisturizer and cleanser.”

-

T+45–60 Days: Cross‑sell by Declared Need

- Content: if acne concern, introduce BHA; if hyperpigmentation, support with niacinamide or azelaic acid. Always include safety notes.

Anchor your care guidance in credible dermatology norms and retailer‑verified usage expectations; for frequency norms and basic skincare routines, see the 2024–2025 resources compiled by the American Academy of Dermatology in their everyday skin care basics.

Cart and Browse Abandonment That Respects the Customer

Objective: recover intent without over‑sending.

-

Triggers

- Cart: item added, no checkout within ~1–3 hours.

- Browse: repeat product/category views within 24 hours, no add‑to‑cart.

-

Cadence and Caps

- Send 1–2 emails within 24–48 hours; cap at 2 per abandonment cycle. Pause if purchase occurs.

-

Content

- Cart: show the exact product with ingredient highlights; add a routine explainer and review excerpt; shipping cutoff clarity.

- Browse: education‑forward, “Is retinol right for sensitive skin?” plus dynamic recommendations.

-

Benchmarks

- Abandoned cart flows consistently top RPR and placed order rate among automations; 2025 peer data shows they’re often the highest‑performing flow category, as outlined in Klaviyo’s abandoned cart benchmarks and corroborated by the Omnisend 2025 ecommerce analysis.

Loyalty Automation: Design for Reciprocity, Not Just Discounts

Objective: build durable relationships and higher CLTV with tiered value and personalized rewards.

-

Structure

- Tiers (e.g., Insider, Pro, Elite) with experiential benefits: early access, dermatologist Q&A webinars, sample kits, exclusive drops.

- Points with clear redemption value (e.g., cash‑back style) to avoid confusion.

-

Triggers

- Tier ascents, point expiration reminders, anniversary milestones, “routine mastery” badges for educational completion.

-

Personalization

- Use declared skin type/concern to tailor rewards (e.g., sensitive‑skin sampler) and content pathways.

-

ROI expectations

- Global loyalty research in 2024–2025 reports positive returns and uplift when personalization is embedded; for instance, program owners reported average ROI around 4.8x globally, with higher figures in North America, per the Antavo Global Customer Loyalty Report (2024/2025). Align rewards with genuine skincare outcomes to sustain engagement.

Content and Creative Tactics That Move Metrics

-

- Lead with outcome and clarity: “Build your routine for sensitive skin” beats generic promos. Keep preheaders educational.

-

Visuals

- Before/after UGC with consent; ingredient callouts; short motion demos. Mobile‑first design: single‑column, large tap targets.

-

Copy

- Education first, offer second; address common fears (retinol irritation, fragrance concerns). Keep tone empathetic and clinical‑but‑friendly.

-

- Use declared skin type, last browse category, and loyalty tier to swap in product and content modules.

Deliverability and Compliance: 2025 Essentials

Bulk‑sender rules tightened in 2024 and continue to matter in 2025. If you send at scale, you must meet authentication and unsubscribe standards.

-

Authenticate your domain

- SPF and DKIM on sending domain; DMARC on the From domain with alignment to SPF or DKIM. Google began enforcing in Feb 2024 for bulk senders; see Google’s guidance in the Email sender guidelines (Google Admin Help, 2024) and an overview of Yahoo/Gmail changes in the AWS Messaging & Targeting blog (2024).

-

One‑click unsubscribe

- Implement List‑Unsubscribe and honor requests promptly.

-

Complaint control

- Keep spam complaint rates well below ~0.3%; many ESPs advise targeting ~0.1% for safety. Operate with strict segment hygiene and sunset policies.

-

Hygiene

- Remove chronic non‑openers; use double opt‑in for aggressive acquisition periods; validate DNS PTR; align From domain.

Measurement and Attribution You Can Defend

You need visibility beyond last‑click.

-

UTM discipline

- Standardize source/medium/campaign and include content identifiers for flow emails.

-

GA4 ecommerce and attribution

- Validate checkout and purchase events, then compare attribution models cautiously. Data‑driven attribution (DDA) assigns credit across touchpoints based on observed paths; see Google’s description of data‑driven attribution in Google Ads Help and ensure your ecommerce events follow GA4’s ecommerce implementation guidance (Google Developers).

-

Flow‑level KPIs

- Revenue per recipient (RPR), placed‑order rate, time‑to‑repeat purchase, churn risk by cadence, and loyalty engagement.

For deeper lifecycle context and retention playbooks tailored to ecommerce, review our guide on a Customer Retention Manager’s best practices in 2025 and how the customer lifecycle differs from the customer journey when building automation.

Optimization and Pitfalls: Lessons from the Trenches

-

Don’t over‑incentivize in the welcome series

- You’ll attract deal‑seekers and hurt margins. Start with education and fit; deploy incentives surgically.

-

Respect irritation risks

- Retinol and strong acids need gradual onboarding; overpromising leads to returns and unsubscribes.

-

Frequency caps

- Limit abandonment and promotional overlaps; set quiet hours; suppress purchasers from prospecting flows.

-

Privacy and consent

- If you use AI personalization, keep data minimal, transparent, and consented. Leaders who execute personalization well see outsized revenue lifts—McKinsey’s 2024 analysis notes that leaders generate materially more revenue from personalization than peers, but only when customer trust is maintained; see McKinsey’s “Unlocking the next frontier of personalized marketing”.

-

- A/B test subject lines, send times, and content modules; measure educational engagement, not just clicks.

Quick Implementation Checklist

-

- Collect skin type, concerns, ingredient sensitivities at signup/onboarding.

- Map behavior: browse categories, first purchase, routine gaps.

-

Welcome flow (4 steps)

- Day 0: immediate welcome + 1‑click profile.

- Day 2: education‑first by segment.

- Day 5: dynamic recommendations + reviews.

- Day 9: decision FAQs and optional incentive.

-

Post‑purchase & replenishment

- T+3–7: usage guidance; T+21–30: SKU‑specific replenishment; T+45–60: cross‑sell by concern.

-

Abandonment

- Cart/browse triggers; 1–2 emails; caps; dynamic content.

-

- Tier design; personalized rewards; trigger emails for ascents, expirations, anniversaries.

-

Deliverability

- SPF/DKIM/DMARC; list‑unsubscribe; complaint control; hygiene.

-

Attribution

- UTM discipline; GA4 DDA; flow‑level KPIs; compare models.

If you operate across multiple ad and commerce platforms, validate your connections and data flow so segments stay current across channels. For a snapshot of major ecommerce and ad platform connections, see our integration overview.

By executing these workflows with skincare‑specific segmentation, you’ll educate customers, reduce friction, and grow revenue that you can actually attribute. Expect to adjust cadences by SKU, season, and audience response—there’s no silver bullet, but disciplined iteration wins in skincare email automation.