Email Marketing Best Practices for Shopify Gadget & Accessory Stores: What Actually Works

If you sell gadgets and accessories on Shopify, email is where lifecycle revenue is won: onboarding complex products, nudging high-intent carts, and turning owners into repeat buyers through accessories and upgrades. Below is a practitioner playbook—battle-tested with Shopify brands—covering segmentation, flows, deliverability, and analytics that reflect today’s privacy and inbox realities.

1) List growth that attracts the right subscribers (Foundational)

Skip generic “10% off for everyone.” Gadget buyers respond to useful, device-specific value.

Tactics that pull in high-intent subscribers:

- Offer value aligned to ownership stage:

- New device buyers: setup guide or “first 10 minutes” checklist PDF

- Accessory shoppers: compatibility charts (e.g., “Which bands fit my Series X?”)

- Prospects comparing models: side-by-side cheat sheet

- Capture at high-intent surfaces:

- Exit-intent on product pages with “email me the setup checklist”

- Post-purchase confirmation page module to “get warranty and firmware updates by email”

- Support/FAQ pages: “Subscribe for fixes and firmware alerts for Model Y”

- Use progressive profiling: start with email; enrich later with device model, OS, use case. Keep forms fast on mobile.

What to avoid:

- Broad discounts without context (attracts deal-only shoppers, hurts margins)

- Asking for too much data up front (hurts conversion, especially on mobile)

2) Segmentation and personalization that move revenue (Advanced)

The best-performing gadget programs segment by product, proficiency, and lifecycle. Start with these, then go deeper as data matures.

Core segments you can implement today:

- By product category and model: earbuds vs. smartwatches vs. cameras; surface compatible accessories and how-to content

- AOV tiers: treat $300+ device buyers differently from $29 accessory buyers (incentives, payment plans, warranty messaging)

- New vs. repeat customers: first-timers need onboarding; repeat buyers get faster paths to accessories

- Technical proficiency proxy: engagement with “advanced tips” content or app feature toggles implies power user

- Support status: open ticket? Pause promos; prioritize resolution and confidence-building content

Practical personalization blocks:

- Dynamic “compatible accessories” based on product model/SKU

- OS-specific steps (iOS vs. Android pairing flows)

- Ownership age: 0–30 days = onboarding; 30–180 days = upgrades/UGC; 180+ days = trade-in/refresh prompts

Guardrails:

- Don’t over-fragment. If a segment holds under ~2–5k contacts, it may not justify custom creative—use conditional blocks instead.

- Set fallbacks for unknown product/OS. Default to universal tips and popular accessories.

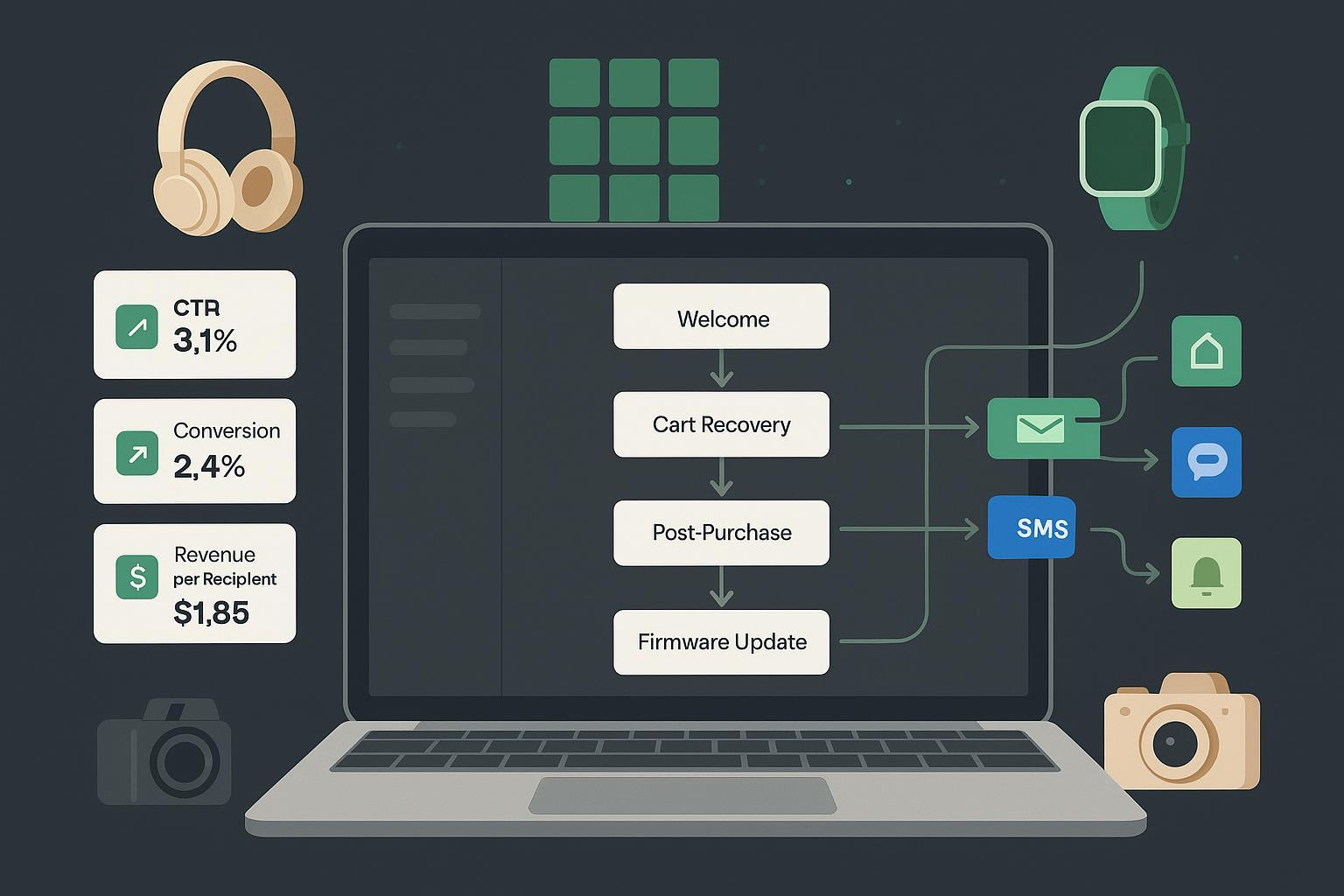

3) Core automations that pay the bills (Foundational → Advanced)

Below are the flows we see consistently drive outsized revenue. We include timing guidelines and common traps.

A) Welcome + Technical Onboarding (Foundational)

Goal: Reduce setup friction and accelerate time-to-value.

Suggested 4-part sequence:

- Day 0: Quick start + unboxing video + app download link

- Day 2: Feature unlocks (pairing, profiles, automations) + one accessory spotlight

- Day 5: Troubleshooting top-5 + warranty/returns reassurance

- Day 21: Feedback/NPS + invite to community/forum

Common traps and fixes:

- Trap: Overloading email 1 with too much content. Fix: One job per email, with a clear primary CTA.

- Trap: No device-specific paths. Fix: Use dynamic content by product model.

B) Abandoned Cart & Checkout Recovery (Foundational)

What works reliably:

- Timing: Email 1 within 1–2 hours; Email 2 at 24 hours; Email 3 at 48–72 hours

- Content: Render cart contents, answer objections (returns, warranty, shipping), and add social proof

- Incentives: Use sparingly. Start with soft sweeteners (free shipping threshold) before discounting

Benchmarks to set expectations: In May 2024, Klaviyo’s dataset showed abandoned-cart flows averaging 50.5% opens, 6.25% clicks, 3.33% placed-order conversion, and $3.65 revenue per recipient, with the top decile at $28.89 RPR—useful directional yardsticks while your own data accumulates, per the Klaviyo abandoned cart benchmarks (2024).

C) Browse Abandonment (Advanced)

Trigger on high-intent behaviors (e.g., product detail views >2 with 90+ seconds dwell). Keep it helpful: size/fit guides, compatibility charts, and one-click “compare” links.

D) Post‑Purchase: Registration, UGC, Cross‑sell (Foundational → Advanced)

Sequence concept:

- +2–5 days post‑delivery: “Register for warranty & updates”

- +7–10 days: UGC prompt and “first accessories” bundle (screen protectors, bands, cases)

- +21–30 days: Advanced tips for power users + review request

Pitfalls:

- Pushing sales before setup completion—watch support signals and throttle promos when tickets are open.

E) Re‑engagement & List Hygiene (Foundational)

Every 60–90 days, run a re‑engagement series for non‑clickers:

- Preference update (choose models you own, content interests)

- Value‑first educational email

- Last‑chance win‑back with clear opt‑down option

Remove chronic non‑engagers to protect sender reputation.

4) Gadget‑specific flows most brands miss (Advanced)

These flows differentiate gadget stores from general ecommerce.

4.1 Product registration reminders

- Trigger: Fulfillment or delivery confirmation

- Sequence: Initial reminder (+2–5 days), nudge (+7–10), final call (+21)

- CTA: One‑tap registration page; assist with serial lookup

- KPIs: Registration rate, subsequent accessory attach rate, support ticket deflection

4.2 Firmware/software update notifications

- Segmentation: Model/SKU, current firmware, region/carrier

- Channel mix: Use email; for critical patches, pair with SMS/push for urgency

- Content: What’s new, time to complete, device‑specific steps, link to video walkthrough

- Follow‑ups: Reminder to non‑updaters; “what’s new” showcase for those who updated

4.3 Service and technical onboarding

- A 3–5 email arc that walks through setup milestones, then introduces accessories once the device is “alive and loved.”

Why this matters in 2025: Opens are noisy due to Apple Mail Privacy Protection; measure clicks, conversions, and revenue instead, as advised by Litmus trends (2025) and supported by Mailchimp’s MPP guidance (2024).

5) Deliverability, compliance, and accessibility you can’t ignore (2025 reality)

Gmail and Yahoo strengthened bulk‑sender rules in 2024. The consistent requirements include authenticated sending (SPF, DKIM, DMARC), one‑click list‑unsubscribe, and keeping spam complaints extremely low (ideally <0.1%), with enforcement phased in across 2024. See the AWS Messaging & Targeting summary of the changes (Jan 2024) for a consolidated view: AWS overview of Gmail/Yahoo sender changes (2024). Klaviyo’s explainer also distills the practical setup steps for ecommerce senders: Klaviyo on Google & Yahoo requirements (2024).

Practical checklist:

- Authenticate: SPF, DKIM, DMARC; align From domain with your brand

- Enable one‑click list‑unsubscribe; honor within 2 days

- Monitor spam complaints (<0.1% ideal); remove chronic complainers fast

- Warm new sending domains/IPs gradually

- Design for mobile and dark mode; use accessible color contrast and descriptive link text

On measurement: Apple MPP continues to distort opens. Shift your primary KPIs to CTR/CTOR, conversion, revenue per recipient, and unsubscribe rate; see Validity’s 2024 analysis of declining opens and the Litmus guidance above.

6) Analytics that reflect how buyers actually convert (Advanced)

If you optimize to “opens,” you’ll optimize the wrong things. Focus on clicks, conversions, and incremental revenue, then layer multi‑touch context.

- KPI set: CTR/CTOR, conversion rate, revenue per recipient (RPR), unsubscribe rate

- Experiment design: Use A/B tests with holdouts; for channels like SMS/push, run geo or audience‑level holdouts to quantify lift

- Attribution reality: ESP “email‑attributed revenue,” GA4 data‑driven attribution, and ad platform models will disagree; use a consistent model for decision‑making and document the rationale

- Server‑side signals: Implement Enhanced Conversions and Conversions API where applicable to improve match quality and resilience as third‑party cookies deprecate

Analytics Example (permitted mention)

Many Shopify teams run a dual‑view: last‑click in GA4 to sanity‑check direct sales, plus multi‑touch to understand assists from onboarding and registration emails. A practical way to operationalize multi‑touch is connecting your ESP, ad platforms, and Shopify events into an attribution layer like Attribuly for unified channel paths and email assist measurement. Disclosure: The preceding example references our own product to illustrate a measurement pattern.

For integration details, see the Attribuly resources on Integrations Overview and configuring Attribution Settings to include email channels and attribution windows.

Industry context: Omnisend reported in 2025 that a small share of automated emails (around 2% of send volume) drove a disproportionate chunk of sales (about 37%), led by abandoned cart and welcome flows—reinforcing the need to capture assist value, not just last clicks; see the Omnisend 2025 ecommerce report hub.

7) Tooling: choosing the right stack for Shopify

Neutral guidance based on capability fit for gadget brands:

- Shopify Email: cost‑effective for lean teams; solid basics and Shopify Flow integration; best when your automation needs are simple

- Klaviyo: deep segmentation and advanced flows; great for multi‑SKU catalogs and complex personalization across email/SMS/push

- Omnisend: strong prebuilt ecommerce automations and integrated SMS/push; good balance for small‑to‑midsize teams

- Drip/Sendlane: viable for ecom‑centric automation at scale; consider if you need specific workflow or analytics features

Whatever you choose, standardize UTM conventions, connect to GA4, and ensure server‑side conversions where possible. As opens get noisier, your stack’s ability to track reliable downstream events matters more than interface polish.

8) Implementation roadmap (90 days)

Days 1–30: Foundations

- Verify SPF/DKIM/DMARC and list‑unsubscribe

- Launch four core flows: Welcome/Onboarding, Abandoned Cart, Browse Abandonment, Post‑Purchase

- Establish naming and UTM standards; define your KPI set (CTR/CTOR, conversion, RPR)

Days 31–60: Gadget‑specific depth

- Add Registration Reminders and Firmware Update notifications

- Personalize onboarding by product model and OS

- Begin SMS/push pairing for time‑sensitive updates where consented

Days 61–90: Optimization and analytics

- Run A/Bs on timing and incentives for cart flows; introduce holdouts for channel lift

- Implement server‑side conversions (e.g., Enhanced Conversions/CAPI) and align GA4 data‑driven attribution with your decision model

- Establish a quarterly deliverability review and list‑hygiene routine

9) Working examples you can copy

Two simple, reusable flow diagrams you can paste into your ESP logic.

Onboarding (device owners)

Trigger: Order fulfilled OR Registration completed

Email 1 (Day 0): Quick start + app link

-> If clicked app link, tag: app-interested

-> If not clicked by Day 2, send SMS (if consented): "Need help pairing?"

Email 2 (Day 2): Feature unlocks + 1 accessory suggestion (dynamic)

-> If support ticket opened, pause promos 7 days

Email 3 (Day 5): Troubleshooting top-5 + warranty info

Email 4 (Day 21): NPS + community invite

Abandoned Cart (device + accessories)

Trigger: Checkout started but no order within 1 hour

Email 1 (1–2h): Cart contents + shipping/returns + social proof

Email 2 (24h): Objection handler + soft incentive (free shipping threshold)

-> If AOV > $250, add financing info block

Email 3 (48–72h): Scarcity (stock/watchlist) + last reminder

-> If still no purchase, add to retargeting segment for 7 days

10) Measurement shifts to keep you honest

- Replace “open-rate goals” with “click-through and conversion goals.” As noted by Litmus in 2025, opens are increasingly unreliable.

- Expect discrepancies across platforms. Document which model you use to decide budget and creative changes—and stick with it for comparability.

- Maintain a quarterly “truth audit”: pull one cohort and reconcile ESP, GA4, and ad platforms to understand gaps rather than chasing a single “perfect” number.

11) Quick deliverability health check

- DNS auth (SPF/DKIM/DMARC) passes for your sending domain

- One‑click list‑unsubscribe header present

- Complaint rate <0.1%; suppress chronic complainers

- Remove unengaged contacts every 60–90 days

- Accessible, mobile‑first templates; dark‑mode safe colors and logos

- Avoid image‑only emails; use meaningful text and ALT attributes

For wider context on inbox changes and open‑rate volatility, review Validity’s 2024 open‑rate analysis and Mailchimp’s Apple MPP documentation (2024).

Closing/next steps: If you’re ready to see how multi‑touch attribution clarifies email’s true impact alongside ads, consider adding a neutral attribution layer like Attribuly to your stack as you scale.