Shopify Case Study (2025): Driving Repeat Purchases With Personalized Home Decor Emails

Home decor has one of the most fragmented purchase cycles in ecommerce: some items are seasonal, others are big-ticket, and many decisions are inspiration-led. That makes retention programs—especially personalized email—do the heavy lifting. In 2024–2025, automated lifecycle flows consistently outperform one-off campaigns in both engagement and conversions. For example, the 2025 Omnisend analysis of 24B+ sends reports materially higher click-to-conversion rates for automated flows and rising engagement across 2024 cohorts, underscoring the ROI of lifecycle automation according to the Omnisend 2025 Ecommerce Marketing Report.

This article distills a practitioner playbook for Shopify-based home decor brands: segmentation that actually moves repeat purchases, a proven automation sequence mapped to decor lifecycles, creative tactics that avoid the discount trap, strict 2024–2025 deliverability compliance, and a measurement framework that reconciles ESP reports with GA4.

What “good” looks like in 2025 (benchmarks and expectations)

Treat industry benchmarks as guardrails, not goals. Your brand mix (textiles vs. furniture vs. consumables) will push numbers up or down. That said:

- Automated flows generally deliver higher CTR and conversion than bulk campaigns in 2024 cohorts; flows often sit in the ~4–10% CTR range with superior click-to-conversion rates, as summarized in the 2025 findings from the Omnisend Ecommerce Marketing Report.

- Peer medians by flow type and industry are available in Klaviyo’s current resources; use them to set targets for post‑purchase, win‑back, and replenishment performance, referencing Klaviyo’s 2024–2025 benchmark reports.

How to apply benchmarks:

- Prioritize flow-level goals (revenue per recipient, click-to-conversion) over vanity opens, given Apple Mail Privacy and bot inflation.

- Build a weekly readout that compares your flow metrics against peer medians and your own prior four-week average.

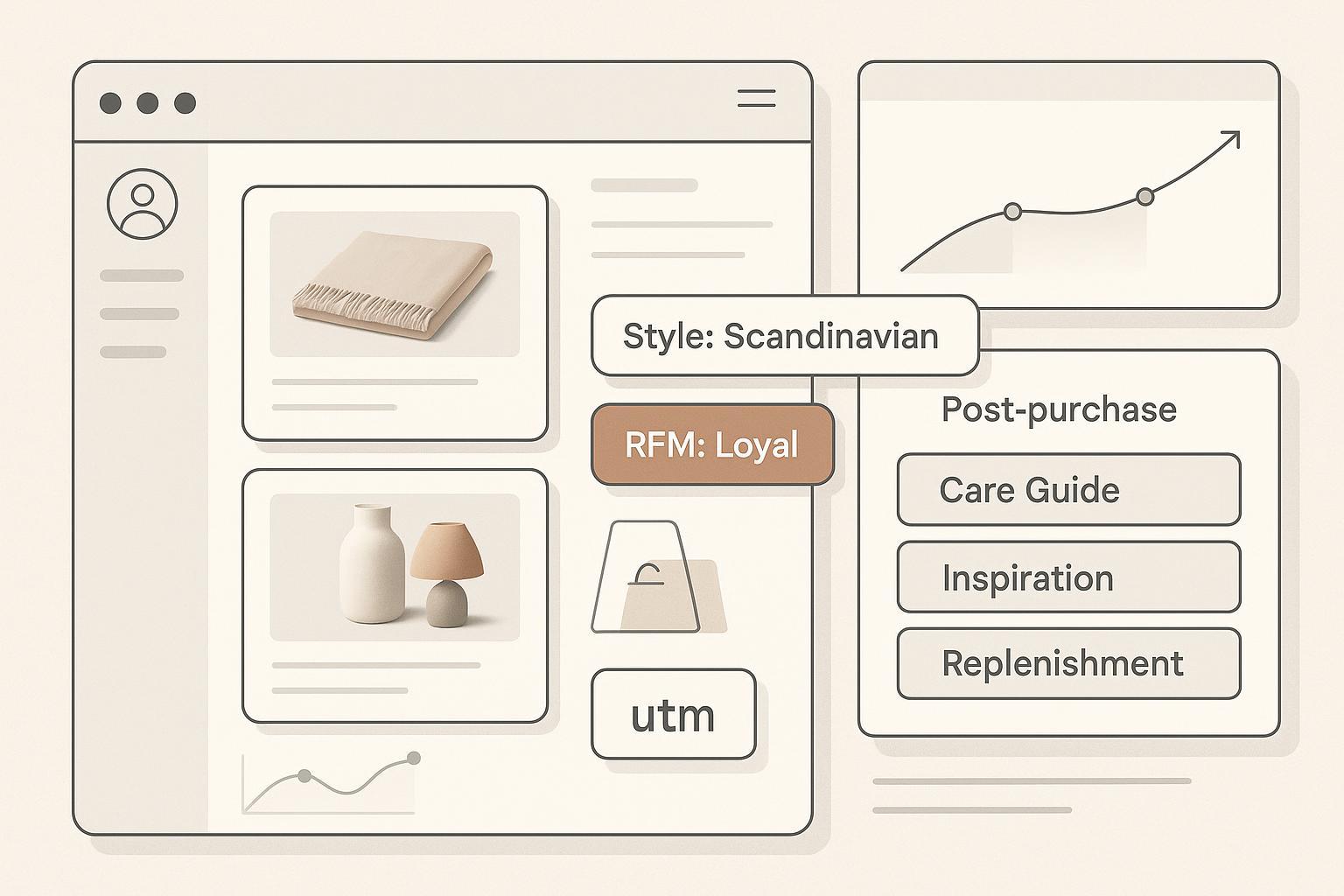

Segmentation that actually lifts repeat purchases

You don’t need a hundred segments—you need the right five to seven that consistently predict the next order. For home decor, the following have proven reliable in practice:

- RFM customer tiers

- Champions: High recency, frequency, and spend. Use early access and curated sets; these customers respond to inspiration and exclusivity more than discounts.

- Potential Loyalists: Good recency and frequency but lower monetary. Test bundles to raise AOV.

- At-Risk/Churn: Declining recency. Use gentle reminders and value-led content; discounts only when intent signals are weak.

Rationale: RFM is a durable predictor in ecommerce and remains widely validated for retention targeting; it’s also simple to implement across ESPs and analytics stacks. For background on the method’s use in modern datasets, see the 2024 overview of RFM’s predictive utility in consumer behavior published in Nature Scientific Reports (2024).

- Style affinity and product taxonomy

- Tag purchases and browse events by style (Scandinavian, Rustic, Modern), material (linen, oak, ceramic), and colorway.

- Power cross-sells with visual sets that match the shopper’s last order style.

Context: Shopify’s recent editorial content highlights how hyper-personalization and affinity-based targeting improve relevance for retail audiences; see Shopify’s discussion of real-world personalization examples in the Shopify enterprise personalization trends (2024–2025).

- Lifecycle cohorts by product type

- Textiles/Accessories: Shorter repurchase windows; emphasize styling guides and replenishment.

- Furniture/Lighting: Longer windows; emphasize care, room transformations, and complementary accents.

- Consumables (candles/diffusers): Predictive “next order date” segments, then trigger replenishment with low-friction CTAs.

- Predictive flags (where available)

- Churn risk, price sensitivity, and expected next order date. Use these flags to sequence incentives and to throttle frequency for sensitive cohorts.

Implementation tip: Start with RFM + style affinity. Add predictive segments once you have 90–120 days of reliable events after implementing tracking.

The home decor automation playbook (timing that fits real lifecycles)

Below is a sequence that repeatedly performs for Shopify home decor brands. Tweak timing and content to your catalog and shipping realities.

-

Order confirmation and shipping (Immediate to Day 1)

- Set expectations and reduce WISMO tickets with tracking clarity. Invite customers to save preferences (room type, style) via a one-click survey.

-

Care and setup guide (Day 2–3)

- For textiles: care and cleaning cards; for lighting/furniture: mounting or assembly videos; for decor: placement tips and safety notes.

- Goal: deepen product satisfaction and reduce returns.

-

Style inspiration cross‑sell (Day 5–7)

- Show “complete the look” bundles mapped to the buyer’s style affinity and room context (e.g., “Scandi bedroom refresh”).

- Pair one dynamic recommendation block with one editorial block; avoid all‑promo layouts.

-

Replenishment or seasonal refresh (Day 30–60)

- Consumables: trigger replenishment ahead of predicted depletion.

- Seasonal: email before key turns (spring refresh, holiday decor) with style‑matched showcases.

-

VIP recognition and early access (Monthly)

- For Champions and high AOV cohorts: previews of new collections; no blanket discounts—use exclusivity and limited drops.

-

Win‑back sequence (90–120+ days inactivity)

- Lead with value content (room makeovers, collection lookbooks), then a limited incentive if engagement is still cold.

These timings align with broader retail guidance on post‑purchase and lifecycle messaging patterns captured in Shopify’s 2024–2025 resources, including the Shopify retail email marketing guide and the complementary ideas in the Shopify post‑sales email guide.

Creative and offer personalization that doesn’t rely on blanket discounts

A home decor inbox is visual first. Use creative that respects aesthetics and reduces cognitive load:

- Dynamic hero blocks by style or room: Swap hero image sets by affinity tags (e.g., Nordic neutrals vs. warm rustic). Keep color palettes consistent with the customer’s last purchase.

- “Complete the look” bundles: Build sets around top SKUs; limit to 3–5 items to prevent paralysis.

- Micro‑copy that educates: Care, material, origin stories, and styling suggestions—especially effective for premium items.

- UGC and reviews: Curate room shots by style; social proof converts better when it mirrors the subscriber’s aesthetic.

- Incentive logic: Offer free shipping thresholds for Potential Loyalists; reserve %-off for At‑Risk cohorts only after value content fails to re‑engage.

- Subject lines that signal relevance: Combine a style token with an outcome, e.g., “Scandi calm, living room ready” or “Rustic oak: elevate your entryway.”

Compliance and deliverability (non‑negotiable in 2024–2025)

If your emails aren’t delivered, nothing else matters. Major inbox providers tightened requirements in 2024–2025:

- Authenticate: SPF, DKIM, and DMARC (at least p=none with alignment). Yahoo outlines these practices in its updated sender guidance; see the Yahoo Sender Best Practices (2024).

- One‑click unsubscribe: Must be present via list‑unsubscribe header; honor within 2 days. Microsoft’s 2025 requirements reaffirm these standards for bulk senders; review Microsoft’s requirements for bulk senders (2025).

- Complaint rate discipline: Keep spam complaints under ~0.3%. Monitor via provider tools.

- Enforcement cadence: Gmail/Yahoo enforcement began February 2024 and ramped through April 2024; Microsoft escalated to rejection of non‑compliant bulk mail in May 2025, summarized in Postmark’s 2024 overview of Gmail/Yahoo rules and AWS’s policy recap in the AWS Messaging & Targeting blog (2024).

Practical checklist:

- Send from a branded domain; never a free mailbox.

- Warm up new sending subdomains gradually.

- Maintain list hygiene: remove persistent bounces and inactives; suppress complainers.

- Favor clicks and conversions as success metrics; opens are noisy.

Measurement and attribution: proving repeat‑purchase lift

Your goal isn’t just revenue per send—it’s incremental repeat orders by cohort. Here’s a proven workflow that keeps analytics honest and useful.

- Standardize UTMs for every email link

- utm_source=email; utm_medium=email; utm_campaign=<flow_or_campaign_name>; utm_content=<link_variant>.

- Keep a shared naming doc so analytics and ESP teams stay aligned.

- Ensure GA4 ecommerce events are firing

- Implement view_item, add_to_cart, begin_checkout, purchase. Google’s developer guide details the event schema in the GA4 ecommerce setup documentation and the GA4 ecommerce overview.

- Use data‑driven attribution and compare models

- GA4 defaults to Data‑Driven Attribution; use the Model Comparison and Conversion Paths reports to understand email’s assist role across journeys. A concise practitioner overview of these settings is provided in the Search Engine Land GA4 attribution guide (2024).

- Reconcile ESP revenue with GA4

- Expect differences: ESPs often credit last click within their own window; GA4 distributes credit across touchpoints. Document lookback windows and attribution logic.

- Cohort‑based repeat rate reporting

- Track repeat purchase rate by segment (e.g., Champions vs. At‑Risk) before and after launching flows. Use revenue per recipient and click‑to‑conversion to judge creative and offer tests.

Example tool workflow (disclosed): In practice, we attribute repeat‑purchase campaigns by combining Shopify order data with multi‑touch analytics. A platform like Attribuly can unify journey touchpoints across email, paid social, and organic to show how post‑purchase flows contribute alongside other channels in a single view. Disclosure: Attribuly is our product.

For teams formalizing their instrumentation on Shopify, review the integration overview to set up tracking foundations via the Shopify + Attribuly integration. For a deeper explanation of channel contributions across journeys, see our overview of multi‑touch attribution methods for ecommerce.

Mini‑evidence and context for 2025

Public, named, home‑decor‑specific case studies with full 2024–2025 email metrics are scarce. However, cross‑vertical evidence consistently shows automated lifecycle flows contributing a substantial share of email revenue, with stronger click‑to‑conversion than bulk campaigns—patterns echoed in the 2025 findings from Omnisend referenced above and in current peer benchmark dashboards from Klaviyo. In other words: the mechanism works; the creative and segmentation must be tailored to your catalog and timing.

Pitfalls, trade‑offs, and how to scale safely

- Over‑segmentation: Too many micro‑segments reduce volume and block learning. Start with 5–7 high‑lift segments; expand only after each proves incremental revenue.

- Open‑rate mirages: Apple Mail Privacy and bot filters inflate opens; judge by clicks, purchase rate, and revenue per recipient.

- Discount dependency: Broad promotions may spike short‑term revenue but erode brand equity and margin. Use discounts sparingly and conditionally for At‑Risk cohorts.

- Attribution whiplash: ESP vs. GA4 numbers won’t match. Document windows, report both, and use GA4’s Model Comparison to triangulate assist value.

- Data sparsity: Big‑ticket decor has longer cycles. Run tests longer (4–6 weeks), and aggregate results at the cohort level.

- Deliverability debt: Ignore DMARC/SPF/DKIM or one‑click unsubscribe and you will lose reach. Fix this before creative optimization.

Step‑by‑step implementation checklist

Foundation (Week 0–1)

- Authenticate sending domain: SPF, DKIM, DMARC (p=none or stricter) and one‑click unsubscribe.

- Implement GA4 ecommerce events; verify via debug tools.

- Create UTM naming conventions and templates in your ESP.

Segmentation & data (Week 1–2)

- Build RFM scores and define Champions, Potential Loyalists, At‑Risk.

- Tag products by style, material, color, room; map historic orders and key browse behaviors.

- Define predictive flags if your ESP supports them (e.g., next order date).

Automation build (Week 2–3)

- Post‑purchase flow: Day 2 care; Day 5–7 inspiration; Day 30–60 replenishment/seasonal; Day 90 win‑back.

- VIP monthly drop for Champions; limited incentives for At‑Risk only.

- Creative: dynamic style hero, 1 editorial block, 1 curated bundle, UGC tile.

Measurement (Week 2–4)

- Turn on GA4 DDA and validate Conversion Paths show email touchpoints.

- Align ESP conversion windows with your documentation.

- Set a weekly dashboard: revenue per recipient, click‑to‑conversion, repeat rate by cohort.

Optimization (Ongoing)

- A/B subject line tokens (style + outcome), dynamic block variants, and incentive logic for At‑Risk cohorts.

- Frequency tuning by cohort; cap sends when complaint rates rise.

- Quarterly segment health check: rebalance RFM thresholds and style tags.

FAQ: Practical operator questions

Q: How often should I email post‑purchase customers without causing fatigue?

- Start with the sequence above and a monthly VIP or inspiration touch for engaged cohorts. Watch complaint rates; if they approach 0.2–0.3%, throttle frequency and focus on value content.

Q: Do I need discounts to drive repeat purchases in decor?

- Not universally. Champions and style‑engaged cohorts often respond to exclusivity, early access, and curated bundles. Reserve heavier incentives for At‑Risk segments after value content underperforms.

Q: What about big‑ticket furniture buyers with long cycles?

- Extend your cadence: more education and room transformations, fewer promotional pushes. Cross‑sell smaller complementary accents 3–6 weeks after delivery.

Q: How do I measure incremental lift, not just attributed revenue?

- Run holdout tests within segments (e.g., 10–15% control) for 4–6 weeks. Compare repeat purchase rate and revenue per recipient. Use GA4’s Model Comparison to check cross‑channel assists.

Q: Which metrics best predict repeat success?

- Click‑to‑conversion, revenue per recipient, and cohort repeat rate. Benchmarks for these change by vertical; calibrate against the most current resources from Omnisend and Klaviyo noted above.

Where to go next

- If you’re instrumenting Shopify for lifecycle attribution, review the integration pathways in our brief guide to Shopify + Attribuly. For channel contribution analysis, learn how ecommerce brands use multi‑touch attribution to understand repeat journeys. If you’re expanding your stack to paid channels and need server‑side signals (e.g., for Meta), see the overview of supported integrations for your analytics stack.

By pairing pragmatic segments with lifecycle‑aware creative, strict deliverability hygiene, and honest attribution, home decor brands can transform one‑time buyers into repeat customers—without training everyone to wait for discounts.