Unlocking the Potential of Search Retargeting in 2025: Strategies for Effective Audience Engagement

Search retargeting (and its close cousin, site retargeting) remains one of the most dependable ways to turn intent into revenue—if you execute with precision, consent, and measurement discipline. In 2025, privacy changes and platform convergence have raised the bar: you need solid first-party data, thoughtful segmentation, and lift-based validation. This guide distills field-tested workflows you can copy, plus the pitfalls to avoid.

To align on terms: “search retargeting” often means reaching users based on queries they made on search engines (even if they never visited your site), typically via programmatic or display networks. That differs from “site retargeting/remarketing,” which targets people who have visited your website or appear on your first‑party lists across Search, Shopping, Display, and social. For clarity on the distinction and execution paths, see the concise primer from Shopify’s search retargeting explainer (2024) and Google’s overview of remarketing and Customer Match (Help Center, updated frequently).

1) Foundations That Determine Success

Before you spend $1 on audiences, lock in the plumbing. Teams that invest a week here routinely save months of debugging later.

-

Consent and compliance

- Implement a CMP aligned with IAB TCF v2.2 in EEA/UK and ensure consent is collected before any retargeting or personalization occurs.

- Enable Google’s Consent Mode v2 so tags adjust behavior and modeled conversions can fill gaps when consent is denied, per Google Ads Consent Mode v2 overview (2024–2025) and GA4 Consent Mode documentation.

- Track Chrome’s third‑party cookie timeline and test Privacy Sandbox where possible; Google’s own updates indicate phased progress under CMA oversight in 2025, see Privacy Sandbox next steps (2025) and the UK regulator’s CMA consultation document (2025).

-

First‑party event integrity

- Use server-side tracking (e.g., server-side GTM) to improve event reliability and audience match rates, especially under consented conditions. Ensure CMP signals propagate server‑side.

- Enrich events with custom parameters: product_id, page_type, value, and content_category. Google’s developer guide on remarketing custom parameters details the standard schema.

-

Data layer and warehousing

- Standardize a data layer: user status, last product viewed, cart value, SKU list. This is the backbone for granular segments.

- Export GA4 to BigQuery (or your data lake) to model RFM/LTV, then push high‑value cohorts back into ad platforms via Customer Match or APIs.

Quick readiness check

- Do we block retargeting tags until consent is granted (where required)?

- Are key product and cart parameters flowing into tags and server‑side endpoints?

- Can we export/import audiences across Google, Microsoft, Meta, and TikTok cleanly?

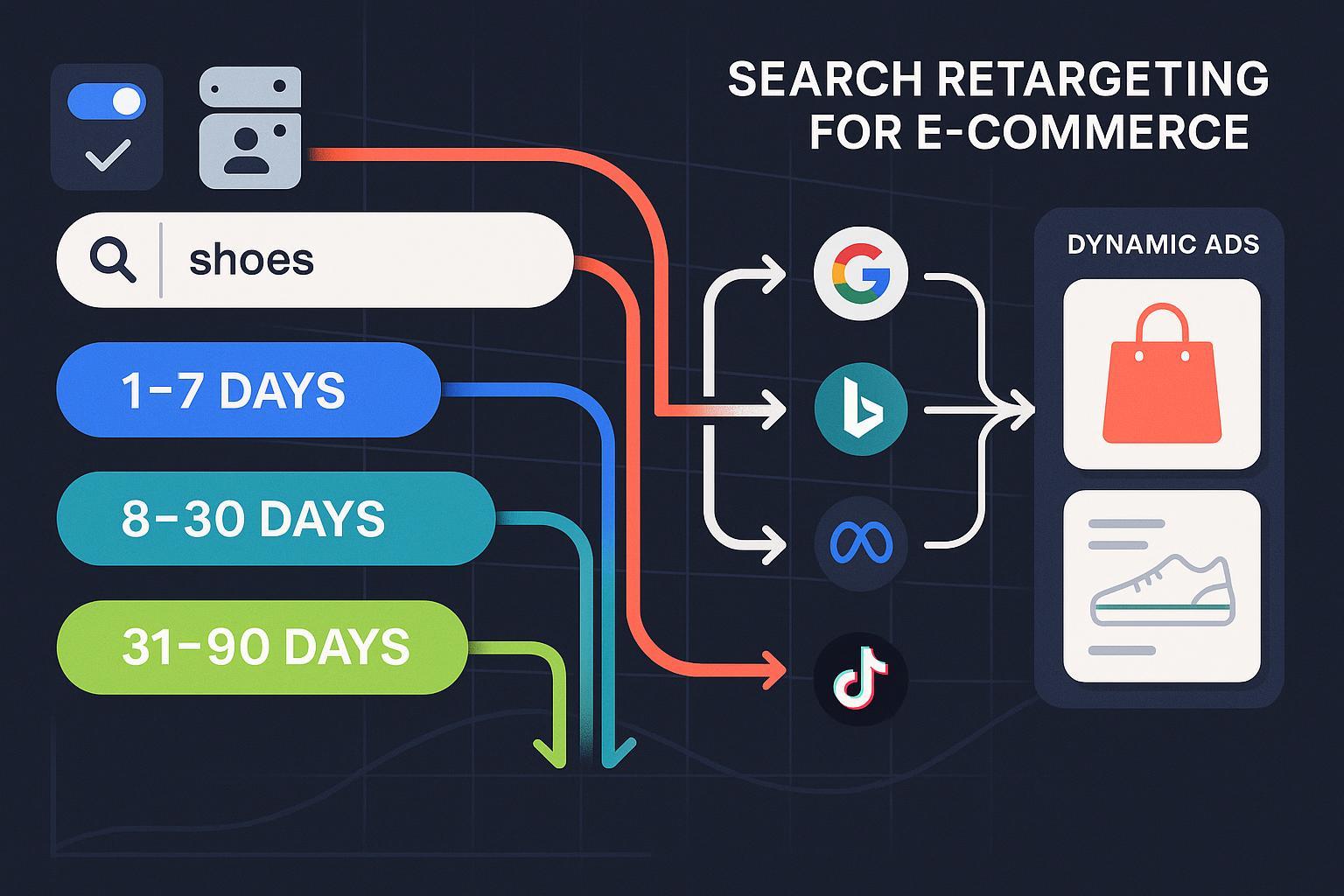

2) A Practical Segmentation Playbook (Intent × RFM)

Winning retargeting is mostly orchestration: define segments that reflect intent and value, then align bids, messages, and caps.

-

Recency tiers (align with your buying cycle)

- 1–7 days: high urgency. Show social proof and low-friction offers.

- 8–30 days: consideration. Rotate benefits, UGC, and category breadth.

- 31–90 days: light touch. Focus on new releases or value props; lower frequency.

-

Intent layers

- High-intent landers: product detail pages, cart/checkout starters.

- Mid-intent landers: category pages, comparison content.

- Low-intent landers: blog/how‑to pages; nurture with educational creative.

-

RFM overlays

- High RFM customers: protect margin; cross‑sell over discounting.

- Mid RFM: time‑bound offers and bundles.

- Low RFM or churn risk: limit spend; rely on email/SMS nurture primarily.

-

Product interest and margin filters

- Build segments by SKU/category using the product_id parameter; map creatives accordingly.

- Exclude low‑margin SKUs from heavy discount creative to protect contribution.

-

Exclusions to keep you efficient

- Recent purchasers (e.g., 7–30 days post‑purchase depending on repurchase interval).

- Serial returners or chronic one‑and‑done discount seekers (if you can identify them compliantly).

Implementation note: Audience size thresholds apply per platform, so balance granularity with reach. Start broader, then split winners.

3) Channel‑by‑Channel Setup That Actually Works

The nuances matter. Here’s a tested way to deploy across your core channels.

-

Google Ads: Search, Shopping, and Display

- Build data segments in Audience Manager, then attach at the campaign/ad group level. Start with “Observation” to learn elasticities, then move proven segments to “Targeting” to narrow reach. Google explains the difference in audience targeting settings.

- For Shopping, audience layering is supported; pair with product feed hygiene and exclusions. See Google’s guide on using audiences with Shopping.

- Bidding: use Smart Bidding (e.g., Target ROAS) and apply bid adjustments to high‑value segments. Reference Google’s automated bidding overview.

- Creative pairing: for Search, use IF functions and ad customizers to personalize copy by audience/device; see Google’s creative best practices hub and ad customizer sample for RSAs. Consider pairing DSAs with retargeting audiences to scale coverage; details in Dynamic Search Ads overview.

-

Microsoft Advertising (Bing)

- Set up UET once across the site for conversion tracking and remarketing. Microsoft’s UET guide lives on Microsoft Learn (ongoing).

- Create remarketing lists (page rules or events) and associate with Search/Shopping using “Bid only” or “Target and bid.” See the remarketing list reference.

- Keep an eye on platform updates like dynamic remarketing and impression‑based remarketing that extend full‑funnel options; Microsoft covered these in their product updates (Oct 2024) and impression-based remarketing post (2024).

-

Meta (Facebook/Instagram)

- Use Website Custom Audiences built from the Meta Pixel. Create rules by URL path or query parameters (e.g., category or search results pages from your site), adjust retention windows, and exclude converters. The step sequence is documented in Meta’s Create a Website Custom Audience (Help Center) with retention options up to 180 days.

-

TikTok

- Install the TikTok Pixel, then build Website Custom Audiences using URL and event filters; minimum audience size thresholds apply before serving. See TikTok’s Custom Audiences guide and the Pixel getting started overview on TikTok Business.

Pro tip: Keep segment naming predictable across platforms so reporting and exclusion logic stays coherent (e.g., RFM_Hi|Recency_1-7|Intent_PDP).

4) Dynamic Creative and Personalization Tactics

Small personalization touches compound across millions of impressions.

- IF functions in Search ads: tailor headlines to “Cart Abandoners” with shipping reassurance, and to “Product Viewers” with benefit-driven copy. See Google’s creative/asset guidance.

- Ad customizers for price/stock: inject dynamic price or countdowns tied to promotions; reference the RSA with ad customizer sample.

- DSAs + audience overlays: leverage DSAs for long‑tail coverage while restricting to high‑intent segments; review search terms and add negatives per the DSA overview.

- Feed hygiene for Shopping: keep product data fresh; fix disapprovals promptly; leverage Merchant Center feed rules to normalize attributes.

- Tag parameters for granular segments: pass product_id/page_type/value via your tags as shown in Google’s remarketing parameters guide, then build creative by product/category.

5) Measurement, Incrementality, and Frequency Control

Retargeting can look amazing in last‑click but disappoint in lift. Measure what matters.

-

Lift testing

- Google Ads Conversion Lift offers user‑ or geo‑based experiments to estimate true incremental outcomes; see the Conversion Lift overview and setup guide.

- Meta’s Conversion Lift uses randomized control designs inside Ads Manager; ensure adequate budgets and windows (documented in Meta Business Help Center).

-

Beware of over‑attribution

- Tinuiti’s 2025 update cautions that while some channels may attribute a majority of sales to retargeting, true incrementality can be far lower; their April 2025 note estimates 25–35% incremental share in some e‑commerce cohorts. See the Tinuiti media update (2025).

-

Frequency and recency governance

- Start with caps like 3–5 impressions per week for Display and social; adjust by segment performance and recency.

- Maintain separate budgets for 1–7, 8–30, and 31–90 day windows; monitor diminishing returns by frequency band, then reallocate.

6) What the Data Says (and How to Use It)

-

Macro demand and efficiency

- AdRoll’s State of Digital Advertising (2025) reported that retargeting CPMs declined 8% YoY in Q1 2025 versus a 27% decline for prospecting display CPMs—retargeting remains resilient in lower‑funnel media. See the AdRoll 2025 report.

-

Multi‑format lift

- Criteo observed that retailers using multi‑format exposure generated materially higher revenue per user and organic sales lift across regions, reinforcing the value of diversified placements. See Criteo’s retail media incrementality analysis (2024–2025).

-

Case evidence

- Eyeful Media’s Peacock Alley program improved ROAS by 128% through smarter audience segmentation and creative optimization in retargeting. Review the Eyeful Media case study (2024) for tactic‑level context.

How to apply

- Prioritize spend to segments that prove lift in tests; don’t chase last‑click glory.

- Use diversified formats (Search, Shopping, social) to reinforce intent with fresh creative.

- Reinvest CPM savings (when present) into experimentation, not just reach.

7) Toolbox and Stack Selection (with trade‑offs)

Disclosure: The following mention includes our own product.

-

Audience analytics and identity

- The platform Attribuly consolidates multi‑touch journeys, supports server‑side tracking, and builds segments for retargeting across major ad channels. Use it when you need cross‑channel identity resolution and ecommerce‑ready audience building alongside attribution. Compare this to Shopify’s native modeling for Plus merchants.

-

E‑commerce native modeling

- Shopify Audiences (Plus‑only, US/CA availability) exports high‑intent cohorts to major ad platforms. It’s strong if you’re on Shopify Plus and want commerce‑native lookalikes without extra integration overhead; see Shopify Audiences on the App Store and the enterprise overview.

-

Platform‑native remarketing

- Google RLSA/Customer Match and Meta/TikTok Website Custom Audiences are lowest‑friction if you’re primarily optimizing inside those platforms. They’re fast to deploy but siloed—cross‑channel insights may be limited to what each platform exposes.

Selection tip: Choose based on data ownership needs, channel mix, plan eligibility (e.g., Shopify Plus), and privacy/consent enforcement maturity.

8) A 10‑Day Practical Workflow (Shopify brand example)

Disclosure: This example includes our product neutrally as one of several tools.

Day 1–2: Enable CMP and Consent Mode v2; verify GA4 data and BigQuery export. Standardize data layer (product_id, page_type, value).

Day 3–4: Configure server‑side tracking and ensure consent signals flow server‑side. Ingest recent orders to flag purchasers for exclusion.

Day 5–6: Build segments—Recency tiers (1–7, 8–30, 31–90), Intent tiers (PDP, cart starters, category viewers), and RFM overlays from your data warehouse or a tool like Attribuly. Sync to Google (Customer Match/data segments), Microsoft (UET lists), Meta (Website Custom Audiences), and TikTok.

Day 7–8: Launch campaigns with Observation mode on Google for learning; use “Bid only” in Microsoft; stand up Meta/TikTok retargeting ad sets. Map creatives using IF functions/ad customizers and feed‑driven Shopping assets.

Day 9–10: Start a small geo‑based or user‑based Conversion Lift test on Google; cap frequency (3–5/week) and exclude purchasers. Review first signals and adjust budgets to winning segments.

9) Common Mistakes (and How to Fix Them)

-

Over‑narrowing too early

- Symptom: CPCs up, volume down, CPA unstable. Fix: start with Observation/Bid‑Only for learning; move to Targeting once elasticity is proven as described in Google’s audience settings.

-

Ignoring incrementality

- Symptom: great last‑click ROAS, flat total revenue. Fix: run Conversion Lift or geo tests; see Google’s Conversion Lift overview.

-

Frequency saturation

- Symptom: rising CPAs, falling CTR. Fix: cap by segment; rotate creatives every 7–14 days; re‑balance toward fresher recency tiers.

-

Privacy missteps

- Symptom: inconsistent conversions, lower match rates. Fix: ensure consent precedes tags (EEA/UK), enable Consent Mode v2 per Google guidance, and keep clear user choices.

-

Feed neglect

- Symptom: Shopping disapprovals, stale pricing. Fix: daily feed refresh, Merchant Center rule checks, and rapid troubleshooting.

10) Quick Launch Checklist

-

Compliance and data

- CMP live; Consent Mode v2 enabled; server‑side tracking passing consent.

- Data layer includes product_id, page_type, and value; GA4→BigQuery export active.

-

Segmentation

- Recency tiers: 1–7, 8–30, 31–90 days

- Intent tiers: PDP/cart, category, blog

- RFM overlays applied; purchaser and low‑margin exclusions set

-

Channels

- Google: Audiences attached in Observation; DSA + customizers ready; Shopping synced

- Microsoft: UET lists linked; “Bid only” to learn; Shopping remarketing configured

- Meta/TikTok: Website Custom Audiences with URL/param rules; exclusions live

-

Measurement

- Frequency caps set by tier; creative rotation schedule ready

- Lift test design and budget approved; reporting dashboard built

11) Advanced Notes and Edge Cases

-

Chrome’s Privacy Sandbox

- Protected Audience API (formerly FLEDGE) enables on‑device interest group retargeting. Adoption is ongoing; consult Google’s Protected Audience API documentation and platform updates before committing major budgets.

-

Eligibility thresholds

- Platforms enforce minimum audience sizes for privacy; if a segment won’t serve, aggregate to a broader cohort (e.g., combine category SKUs) until eligible.

-

Search retargeting vs site retargeting

- Third‑party search intent signals are more constrained in 2025; prioritize first‑party site retargeting and Customer Match, and treat third‑party search retargeting as supplemental where compliant. Shopify’s explainer on search retargeting remains a useful conceptual reference.

12) Bringing It All Together

If you want retargeting that actually moves the revenue needle in 2025, do three things well: engineer consent‑aware data collection, design segments that mirror real buying intent and value, and prove incrementality before you scale. The upside is real—case work like the 128% ROAS lift from Peacock Alley shows what’s possible when segmentation and creative work together, while macro trends suggest retargeting inventory is still a resilient place to invest when measured properly via lift.

Soft CTA: If you’re evaluating how to unify identity, attribution, and audience building across channels, consider trialing a specialized analytics layer alongside platform‑native tools to validate lift and operate privacy‑first—platforms like Attribuly can play that role while you continue to run campaigns in Google, Microsoft, Meta, and TikTok.

References and further reading (selected)

- Shopify — Search retargeting explainer (2024)

- Google Ads Help — Remarketing overview; Audience targeting settings; Consent Mode v2; Conversion Lift overview

- Google Developers — Remarketing custom parameters; RSA with ad customizer

- Microsoft — UET guide; Remarketing list reference

- Meta — Create a Website Custom Audience

- TikTok — Custom Audiences

- Privacy Sandbox — Next steps update (2025); Protected Audience API

- AdRoll — State of Digital Advertising 2025

- Criteo — Retail media incremental impact

- Eyeful Media — Peacock Alley ROAS +128% case

- Tinuiti — Media update (Apr 2025)