Understanding ROAS: What Is a Good ROAS for Ecommerce and How to Achieve It

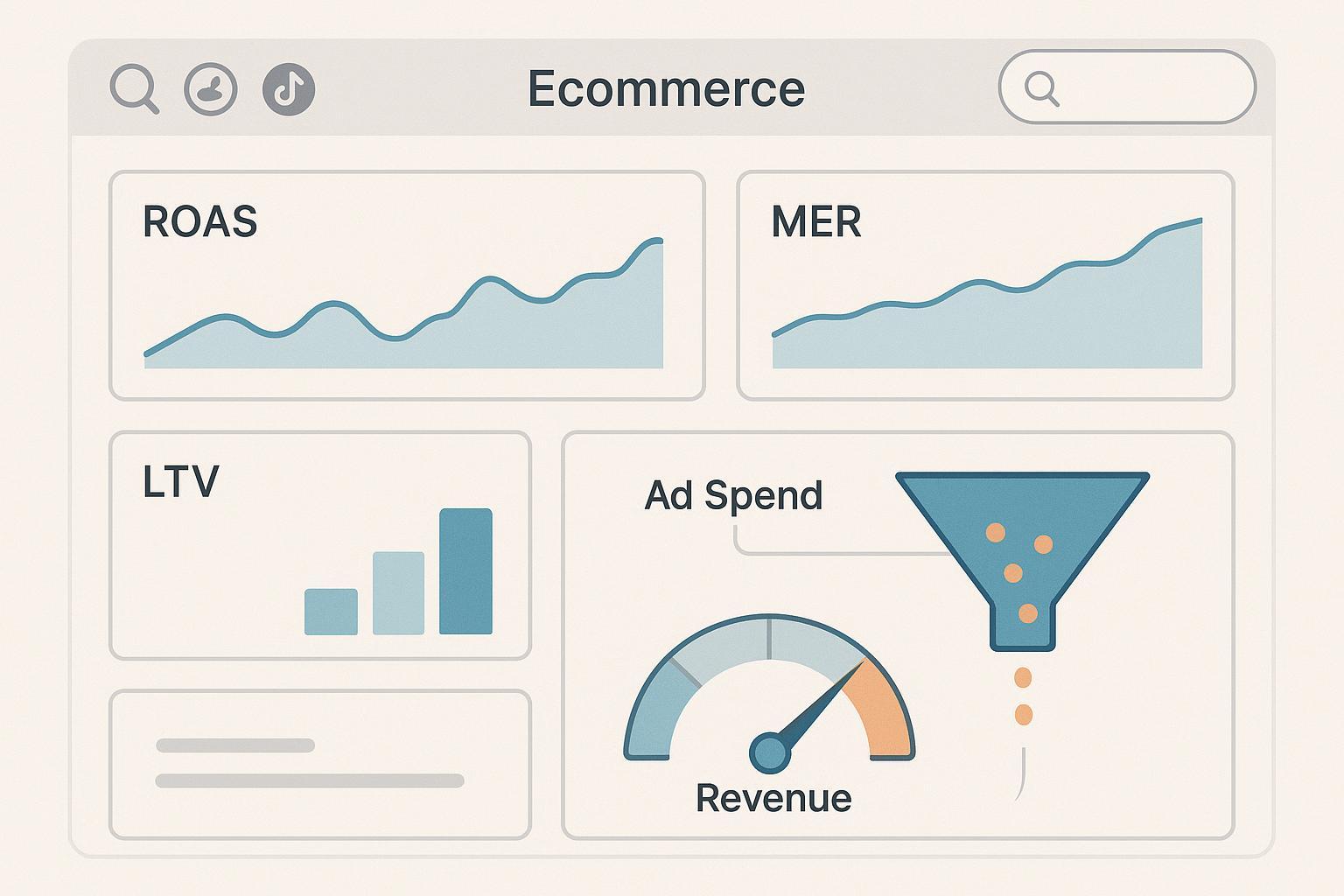

ROAS—Return on Ad Spend—tells you how much revenue you generate for every dollar of advertising. If you spend $1 and attribute $4 in sales to that spend, your ROAS is 4:1 (or 400%). It’s simple, but it’s also one of the most misinterpreted metrics in ecommerce.

ROAS, in plain English

- The core formula is straightforward: ROAS = revenue attributed to ads ÷ ad spend. Google expresses the same idea as “conversion value per cost” and powers bidding around it in Target ROAS. Google clarifies this in its help documentation for Smart Bidding, explaining that a target like “for every $1 you spend, get $5 in revenue” corresponds to 500% ROAS (Google Ads Help — About Target ROAS bidding, 2025).

- You can report ROAS as a ratio (e.g., 5:1) or a percentage (500%). Shopify’s practical guide notes that 200% ROAS equals 2:1—$2 in revenue for each $1 spent (Shopify’s “Return on Ad Spend: How To Calculate Your ROAS”, updated 2025).

What ROAS is not: ROAS is not ROI. ROI accounts for all costs (product cost, shipping, overhead) to show profit. You can have a high ROAS but poor ROI if margins are thin or operational costs are high. Several authoritative explainers walk through this distinction, including Impact.com and HawkSEM (2023).

Related terms you’ll hear:

- MER (Marketing Efficiency Ratio), sometimes called blended ROAS, is total revenue ÷ total ad spend across all channels. It’s useful when individual platform attribution is noisy. Triple Whale’s education pages outline MER’s role as a “north-star” efficiency view (2025).

- POAS (Profit on Ad Spend) shifts focus from revenue to profit per dollar of ad spend. It’s a helpful overlay when margin and costs vary widely across products.

So, what is a “good” ROAS for ecommerce?

There isn’t a universal target. Context drives what’s “good”: product margins, average order value (AOV), repeat purchase rates, attribution windows, and channel mix. Still, directional ranges as of 2025 can help you anchor expectations:

- Search and Shopping (Google): Many ecommerce programs cluster around 2.0–4.5× when well-structured, with medians lower when measured broadly. A 2025 industry dataset shows paid PPC averages around 1.55× and Facebook Ads around 1.80×, underscoring how measurement scope changes the picture (First Page Sage — ROAS Statistics 2025).

- Social (Meta/TikTok): Commonly 1.5–2.2× on prospecting, with wide variance depending on creative, targeting, and price points (corroborated in multiple 2025 roundups).

- Display and programmatic: Often below search performance unless focused on high-intent retargeting; outcomes depend heavily on audience quality and offer.

Treat these as ranges, not rules. A brand with 70% gross margin can scale at lower first-order ROAS than a brand with 30% margin. Subscription and high-repeat models can tolerate lower first-order ROAS if lifetime value (LTV) supports payback.

Profit-aware ROAS targets: break-even and LTV

A practical way to set ROAS goals is to start with margin.

- Break-even ROAS ≈ 1 ÷ gross margin (decimal). Example: if your gross margin is 60%, break-even ROAS ≈ 1 ÷ 0.60 = 1.67 (167%). That means at 167% ROAS, you’ve covered ad spend and product cost but not overhead—profit requires higher than break-even.

- If you aim for a profit overlay (say, 20% net after overhead), raise the target accordingly.

- For repeat or subscription businesses, you can set first-order ROAS lower if you achieve payback over time. Estimate LTV (e.g., AOV × purchase frequency × lifespan) and apply gross margin to understand how much CAC you can afford. Then translate that CAC into a ROAS target per channel and campaign type.

Segment targets by:

- Campaign intent: prospecting typically targets lower ROAS than retargeting or branded search.

- Product economics: high-margin bundles may warrant aggressive scaling at lower ROAS; low-margin SKUs require stricter targets.

How to improve ROAS, step by step

- Targeting and account structure

- Tighten queries and audiences; add negative keywords and exclude low-quality placements.

- Segment campaigns by product profitability, bestsellers, and intent (prospecting vs retargeting).

- Creative and offer

- Test hooks, formats, and value props—especially price anchoring, bundles, and guarantees for higher AOV.

- Refresh creatives frequently on social; align messaging to the audience’s stage in the funnel.

- Product feed and landing pages

- Optimize titles, attributes, and categorization in Shopping feeds; ensure images and pricing are accurate and compelling.

- Match landing page content to the ad’s promise; streamline checkout and add trust signals to reduce friction.

- Bidding and automation

- Use Target ROAS in Google Ads with accurate conversion values and realistic goals. Google’s documentation recommends starting near historical performance and avoiding overly restrictive bid caps (Google Ads Help — About Target ROAS bidding, 2025).

- On Meta, value-based optimization requires purchase values and currency parameters to be tracked correctly. Server-side events improve data completeness and performance stability in 2025.

- Measurement quality and attribution

- Implement server-side tracking for Facebook/Instagram via Conversions API and ensure event deduplication with consistent event_id values; this improves match quality and attribution fidelity (Meta Conversions API — Using the API, updated 2024–2025).

- Understand attribution models in GA4: data-driven attribution distributes credit across touchpoints, while last-click attributes all credit to the final interaction. Changing models will change reported ROAS; align windows and models to your decision framework (GA4 — How to attribute credit for key events, updated 2025).

- Cross-check platform-reported ROAS against blended MER for a holistic view. Triple Whale’s education resources describe MER as a useful north-star when platform signals are noisy (2025).

- Funnel optimization and retention

- Identify drop-offs (product page, cart, checkout) and run focused CRO experiments.

- Drive repeat purchases with email/SMS and loyalty programs to lift blended ROAS over time.

Practical workflow: turning accurate measurement into better ROAS decisions

Disclosure: Attribuly is our product.

Here’s a neutral, practical example of how better attribution supports ROAS management in a Shopify/DTC setup:

- Connect advertising platforms and track purchase values server-side to reduce data loss.

- Use multi-touch journey views to see how prospecting, retargeting, and branded search combine to drive conversions, rather than crediting only the last click.

- Compare platform-reported ROAS with blended MER monthly; adjust budgets toward the channels and campaigns that show true incremental contribution.

- When feed and landing page tweaks lift AOV or conversion rate, reflect those changes in your Target ROAS settings and value-based optimization.

In tools like Attribuly, you can view cross-channel journeys and improve tracking fidelity, which helps reconcile platform ROAS with your blended targets. To understand how to get started and measure ROAS across touchpoints, see the Attribuly Help Center’s guide on getting started. For a product overview of multi-touch attribution and ROAS measurement, visit the page on measuring campaign ROAS.

Common pitfalls to avoid

- Confusing ROAS with ROI and setting targets that ignore product margins and overhead.

- Letting retargeting or branded search “eat” all the credit under last-click, starving prospecting that actually drives incremental growth.

- Inaccurate conversion values or missing currency/value parameters, which break value-based bidding and skew ROAS.

- Misaligned attribution windows across platforms, leading to apples-to-oranges comparisons.

- Relying solely on platform ROAS without cross-checking blended MER.

Bottom line

ROAS is a powerful metric, but it’s only truly useful when anchored to profit and measured accurately. Define your break-even ROAS using margins, set realistic targets by channel and campaign type, improve the funnel and feed, and invest in trustworthy tracking and attribution.

If you want multi-touch accuracy and server-side tracking to make smarter ROAS decisions across Shopify and major ad platforms, explore Attribuly.