Omnisend vs Klaviyo (2025): Which Works Best for Furniture and Lifestyle Stores?

If you sell sofas, dining sets, rugs, or lifestyle decor, your email/SMS platform has to do more than blast promos. You need back‑in‑stock and price‑drop alerts for high‑AOV items, visuals that make big products feel shoppable, lead capture that understands style intent, and reliable deliverability through peak periods like BFCM. This late‑2025 comparison focuses on those realities. Pricing and features referenced are as of October 2025 and can change—always validate on live pages before switching.

Quick answer by scenario

- You want advanced predictive segmentation and deep testing for long consideration cycles (e.g., sectional sofa buyers): choose Klaviyo.

- You want speed‑to‑value, lower entry pricing, and strong out‑of‑the‑box ecommerce automations (plus push): choose Omnisend.

- You’re SMS‑heavy for appointments/delivery updates: compare actual per‑message costs and consent mechanics in both tools; your pick may vary by country rates and compliance needs.

- You’re scaling fast and worried about total cost: model email+SMS sends at 10k–50k contacts. Omnisend’s Pro with SMS credits is predictable at mid tiers; Klaviyo’s active‑profile billing can escalate without strong suppression/engagement hygiene.

At a glance: furniture/lifestyle workflows that matter

| Workflow or need | Omnisend | Klaviyo | Practical note |

|---|---|---|---|

| Back‑in‑stock alerts | Available via email/SMS, plus web push; headless stores supported via JS/API | Pre‑built Back in Stock flows with native Shopify triggers | For limited‑run or bulky items, both work; push can add incremental reach for Omnisend. |

| Price‑drop notifications | Supported via automations; push optional | Documented Price Drop flows using catalog + events | Useful for high‑ticket hesitation. Klaviyo docs are detailed; validate Omnisend setup in your stack. |

| Visual merchandising for large catalogs | Product blocks and automations; fast templates | Deep catalog/event payloads; granular segmentation/testing | If you need precise variants/personas, Klaviyo has an edge; Omnisend is faster for standard flows. |

| SMS compliance & costs | Transparent examples; Pro plans include monthly SMS credits; international rate card varies by destination | Credit‑based billing by country/message type; no rollover credits | Run a 3‑month model with US vs. international sends; include quiet hours and 2‑way needs. |

| Forms, quizzes, preference capture | Built‑in forms/popups; growing features | Robust forms and preference tools; predictive fields | For style/room intent, both can work; Klaviyo supports more complex data models. |

| Deliverability controls for BFCM | Engagement filters, sunsetting, push as an alternative channel | Engagement filters, dedicated IP guidance for very high volume | Dedicated IPs and conservative segmentation help both during peak sends. |

| Ecosystem breadth (reviews, loyalty, CRM) | Solid and growing | Broad (350+), CDP‑like profiles | If your stack is integration‑heavy, Klaviyo usually offers more native connectors. |

References for this table are expanded in the sections below.

Pricing and total cost of ownership (TCO)

-

Omnisend entry points and sends. Independent snapshots place Standard at about $16/month for 500 contacts, with sends around 12× list size, and Pro starting around $59 for 500 contacts with unlimited email sends at that tier. See the breakdown in the 2025 update by EmailToolTester in their Omnisend pricing explainer: Omnisend pricing examples (2025). Pro plans include monthly SMS credits equal to your plan cost, which is helpful for predictable budgeting.

-

Klaviyo model and sends. Klaviyo bills on active profiles with auto‑upgrades if you exceed your current tier; email sends are commonly set around 10× active profiles per month. Details are documented in Klaviyo Help — how billing works (2025). For ballpark costs, Flowium’s 2025 explainer shows 2,000 profiles ≈ $60/month and 10,000 ≈ $375/month on email plans: Flowium’s Klaviyo pricing explained (2025). Your actual rate will depend on plan and region.

What this means for furniture/lifestyle:

- If you’re in the 2k–10k contacts range and run standard ecommerce automations, Omnisend’s Pro with included SMS credits can keep early‑stage TCO predictable—especially if you also use push for back‑in‑stock and price‑drops.

- If you have 50k+ active profiles, multiple personas (trade vs. consumer, indoor vs. outdoor), and heavy testing needs, Klaviyo’s costs may be justified by the data depth—just maintain suppression and engagement hygiene to control auto‑upgrades.

Tip: Recalculate during peak seasons. Run a 3‑month model that includes BFCM when send volumes and SMS reminders spike.

Data depth and automation: winning long consideration cycles

-

Klaviyo’s strength is its data model and predictive analytics (e.g., CLV/churn), plus granular segmentation and testing tied to Shopify events and catalog data. Its Shopify integration page summarizes these ecommerce‑native triggers: Klaviyo’s Shopify integration overview (2025). For furniture and lifestyle, that means you can nurture by style, room, and ticket size over weeks without blasting everyone.

-

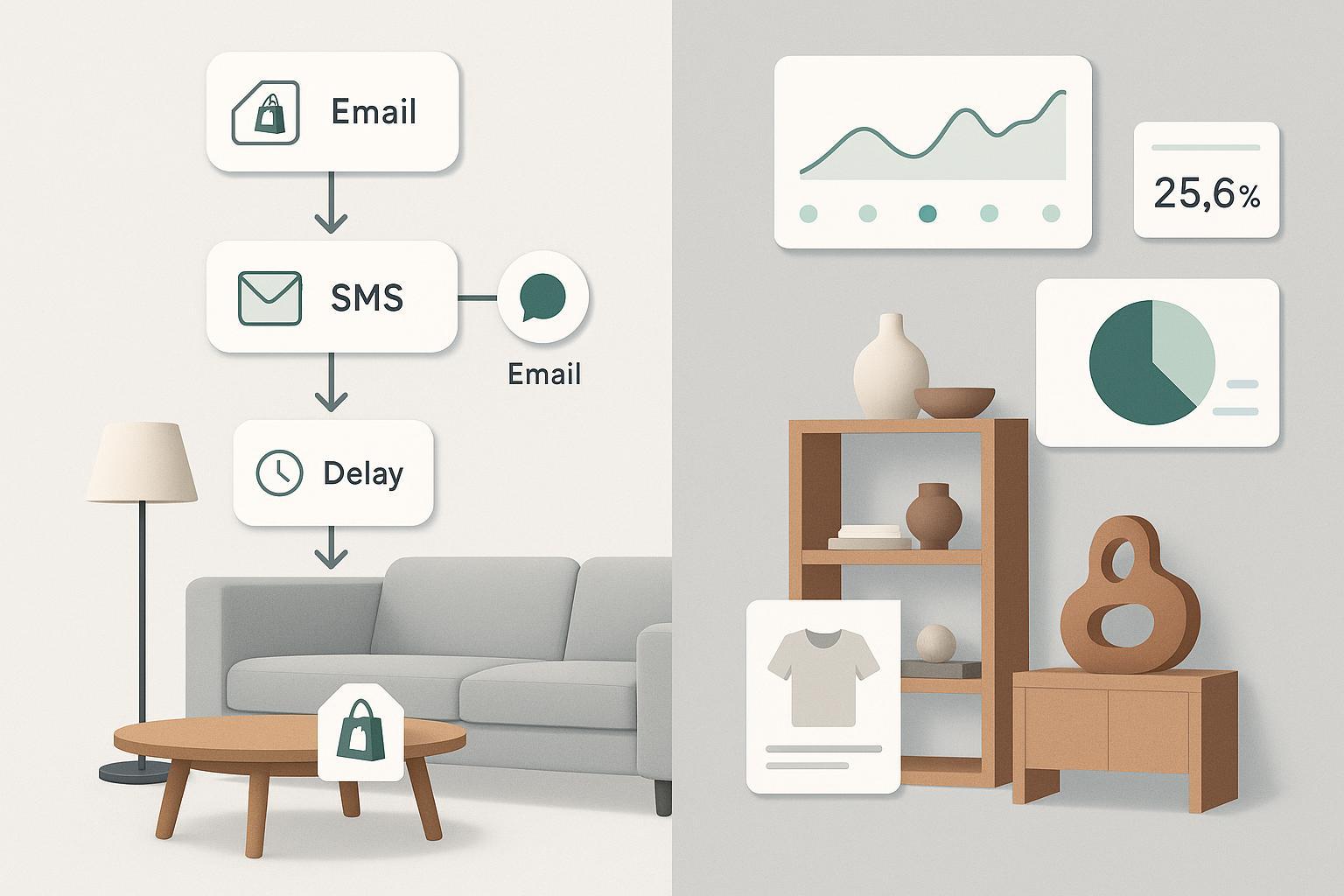

Omnisend emphasizes speed‑to‑value and clear ecommerce automations. If you need to quickly stand up welcome, browse/cart/checkout abandonment, post‑purchase, and price‑drop/back‑in‑stock notifications, you’ll find practical templates and guidance. See their 2025 automation overview: Omnisend on email automation templates (2025).

Bottom line for high‑AOV catalogs: Use Klaviyo when you need sophisticated, persona‑level cohorts with heavy testing. Use Omnisend when a strong “90% solution” plus push and faster rollout matters more than niche predictive models.

SMS, consent, and compliance

-

Omnisend pricing and inclusions. Omnisend publishes concrete examples for US SMS (~$0.015) and MMS (~$0.045), with Pro plans including monthly SMS credits equal to plan cost; unused credits roll over for a short window. Their 2025 explainer is a helpful starting point: Omnisend’s SMS pricing explained (2025). For international sends, check in‑app rate cards by destination.

-

Klaviyo compliance and credits. Klaviyo’s documentation stresses separate consent for SMS, double opt‑in in some workflows, quiet hours, and regional rules; it also explains how mobile credits are consumed and why they don’t roll over. Review Klaviyo’s SMS basics and compliance (2025) before ramping up SMS for appointment confirmations or delivery updates.

Practical SMS recommendations for furniture/lifestyle:

- Collect explicit consent at every touchpoint (forms, checkout where supported, in‑store QR codes). Keep copy crystal‑clear on message frequency/fees.

- Bake quiet hours into flows; furniture buyers often browse evenings/weekends, but don’t text after local cutoff.

- If you use two‑way scheduling or delivery windows, confirm country costs for long/concatenated messages.

Shopify triggers: back‑in‑stock, price‑drop, browse/cart

-

Klaviyo publishes detailed, step‑by‑step guidance for these flows, which is especially important when coordinating inventory‑heavy or limited‑run items. See Back in Stock flow setup (2025) and Price Drop flow overview (2025).

-

Omnisend supports these automations as well, and additionally offers web push as a lightweight channel. Headless and custom storefronts can tie in via their JS/API approach: Omnisend’s headless setup guide (2024). For Shopify checkout SMS consent, verify current capabilities in‑app and with support, as public, step‑by‑step documentation is thinner than for WooCommerce.

Use cases that recur in furniture/lifestyle:

- Sofa back‑in‑stock: combine email + SMS for fast movers; consider push for subscribers who prefer quick taps.

- Outdoor set price‑drop: segment by past interest and budget; add a “compare materials” block to reduce friction.

- Browse abandonment: highlight variant photos and in‑stock finishes; invite showroom appointment via 2‑way SMS if appropriate.

Deliverability during peak sends (BFCM and events)

Black Friday/Cyber Monday and holiday events can swamp inboxes. The fundamentals still matter: authenticate (SPF/DKIM/DMARC), segment by engagement, sunset inactives, and consider a dedicated IP at very high volumes. Klaviyo’s 2025 deliverability guidance is a solid reference point for configuration and IP decisions: Klaviyo deliverability best practices (2025). As a rough bar, Shopify’s 2025 guidance frames healthy programs around delivery ≥95% and tight complaint control; see their overview of email marketing metrics (2025) for context.

Furniture/lifestyle tip: Because purchases are infrequent, let engaged non‑purchasers stay on nurture tracks longer, but throttle BFCM blasts to protect reputation.

Ecosystem and integrations

- Klaviyo typically offers a broader marketplace of native connectors (reviews/UGC, loyalty, quiz tools, help desk, CRM). This helps if you push UGC into emails or coordinate trade/wholesale segments.

- Omnisend’s ecosystem is solid and expanding; many core Shopify apps are covered. Validate specific needs (e.g., your reviews or appointment app) before migrating.

Analytics and ROI measurement for long journeys

Email/SMS platforms often credit revenue to “last campaign touched,” which can overstate impact on long, multi‑touch journeys typical in furniture. To see the full picture, pair your ESP with independent attribution and server‑side event collection.

- For Shopify merchants, start with accurate multi‑touch attribution for Shopify: accurate multi‑touch attribution for Shopify.

- If you’re reconciling ESP vs. ad platform reports, add server‑side tracking and CAPI for Meta: server‑side tracking and CAPI for Meta.

- Planning your broader stack and data flows? You can connect your stack (Shopify, Klaviyo, and more) via vetted integrations: connect your stack.

These concepts help you judge whether to lean harder into email vs. SMS vs. ads during long consideration cycles.

Who should choose what (furniture/lifestyle personas)

-

Emerging Shopify brand (5k–20k contacts; AOV $150–$800)

- Pick Omnisend if you need to launch quickly with proven ecommerce flows, keep costs predictable with SMS credits on Pro, and use push to expand reach on back‑in‑stock/price‑drop alerts. You can still build meaningful segments without heavy setup.

- Pick Klaviyo if you already have a strong data practice or an agency partner, and you intend to run sophisticated tests (e.g., creative variants by material/finish persona) across longer nurture tracks.

-

Established or multi‑location retailer (50k–250k contacts; AOV $800–$2,500+)

- Pick Klaviyo if you require predictive CLV/churn, advanced testing, robust integrations (reviews/loyalty/CRM), and persona‑led segmentation for trade vs. consumer and room‑ or style‑led funnels.

- Pick Omnisend if your workflows are standard ecommerce and you prioritize execution speed, cost control, and the added reach of push without complicating your stack.

Migration notes

- Inventory and catalog data mapping is the hardest lift—plan for variant/finish consistency across forms, flows, and segmentation taxonomies.

- Rebuild high‑ROI flows first (browse/cart/checkout; back‑in‑stock; price‑drop). Then layer nurture by room/style and ticket size.

- Keep 60–90 days of both platforms running (with guardrails) during a phased migration to protect deliverability.

Pros, cons, and “who it’s for”

-

Omnisend

- Pros: Lower entry pricing; Pro includes monthly SMS credits; fast setup for core ecommerce automations; web push baked in; unlimited segmentation; solid Shopify integration; highly rated on Shopify App Store in 2025.

- Cons: Fewer advanced predictive/testing features; some setup docs (e.g., Shopify checkout SMS consent) are thinner than Klaviyo’s; international SMS rate clarity depends on in‑app tables; ecosystem breadth is narrower than Klaviyo.

- Who it’s for: SMB–midmarket brands prioritizing speed‑to‑value and predictable TCO, plus marketers who want push as a complementary channel.

-

Klaviyo

- Pros: Deep data model and predictive analytics; granular segmentation/testing; extensive Shopify triggers and catalog handling; large ecosystem of integrations; widely adopted by established brands.

- Cons: Active‑profile billing can escalate as you grow; learning curve; needs firm suppression/engagement hygiene; app store ratings vary by listing.

- Who it’s for: High‑AOV, multi‑persona brands that need sophisticated lifecycle marketing and integration breadth.

For current social proof snapshots, see the 2025 Shopify App Store listings for Omnisend’s Shopify app page and Klaviyo’s Shopify app page; always verify live ratings and review counts.

Also consider: measuring ROI across channels

If you want to see how email and SMS contribute across long, multi‑touch journeys, consider pairing your ESP with an attribution layer. For a Shopify‑first stack, take a look at Attribuly. Disclosure: Attribuly is our product.

Bottom line

- Choose Klaviyo when advanced data, predictive segmentation, and testing depth will materially improve how you nurture high‑ticket, slow‑cycle buyers and manage complex personas.

- Choose Omnisend when faster rollout, out‑of‑the‑box ecommerce automations, push notifications, and predictable mid‑tier costs get you to results sooner.

- In both cases, model TCO with real send volumes (email + SMS), validate deliverability setup well before BFCM, and use independent attribution to understand each channel’s true impact over long consideration windows.