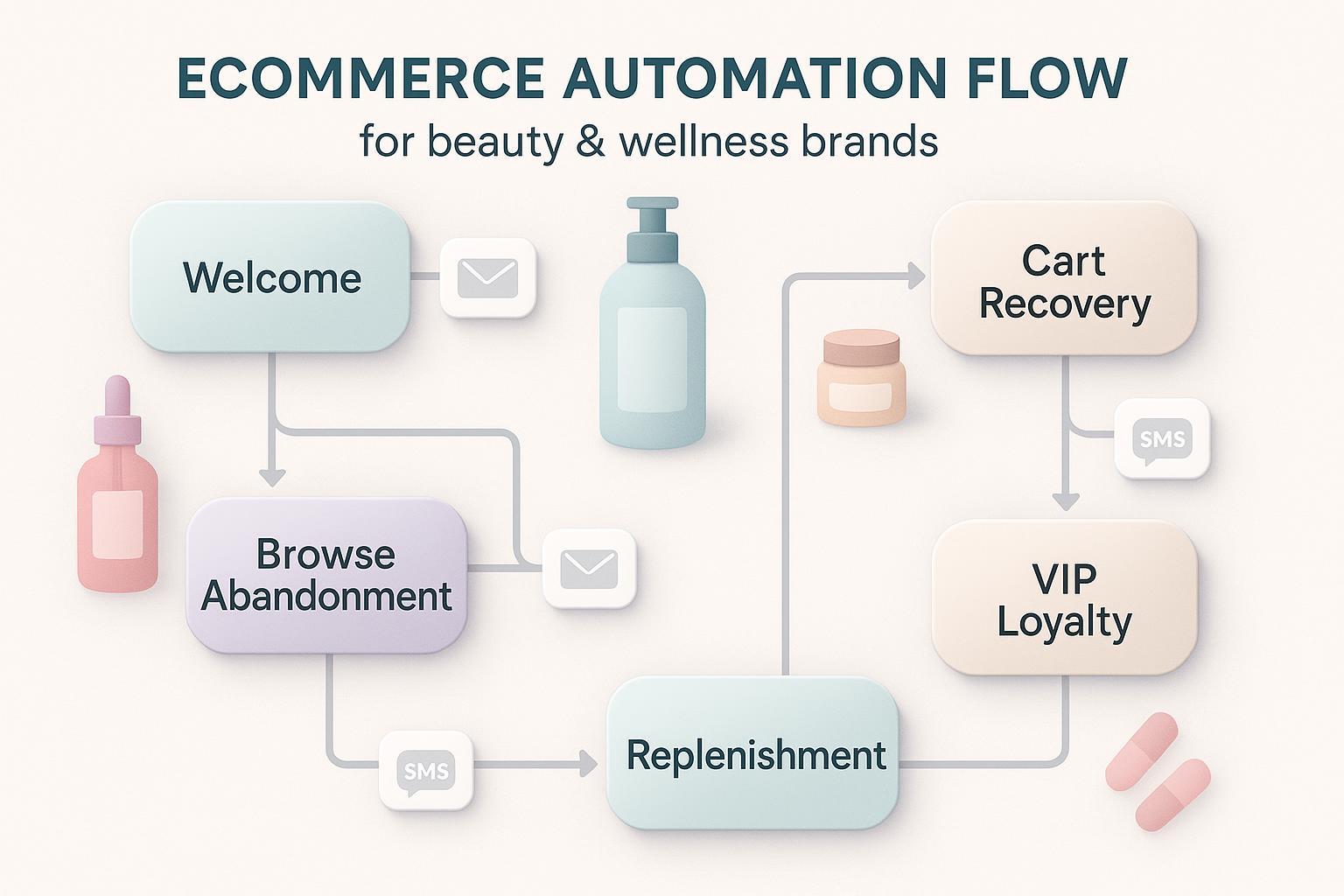

Omnisend Flows That Work for Beauty & Wellness Brands

Beauty and wellness ecommerce lives and dies by lifecycle discipline: timely onboarding, helpful education, and consistent replenishment nudges. Automation is the force multiplier. In Omnisend, automated messages make up a small share of volume but a large share of revenue—according to the 2025 Omnisend Ecommerce Marketing Report, automated emails drove a disproportionate slice of sales in 2024–2025 thanks to higher intent and relevance (Omnisend 2025 Ecommerce Marketing Report).

This guide distills the flows and configuration patterns that reliably perform for Shopify/DTC beauty and wellness brands, with step-by-step setups, segmentation logic, replenishment cadences, and 2024–2025 compliance realities.

Flow 1: Welcome Series (3–5 messages)

Objective: Turn new subscribers into first-time buyers and capture zero‑party data for personalization.

Recommended structure

- Message 1 (Immediate): Brand intro, value proposition, top sellers, and a clear first‑purchase CTA. Consider a modest incentive (e.g., 10%) only if unit economics allow.

- Message 2 (Day 2–3): Education: routines, product selection guidance, or a short quiz to personalize future messages.

- Message 3 (Day 5–7): Social proof: reviews, UGC, dermatologist tips, or “starter bundle” CTA.

- Optional Message 4–5: Objection handling (sensitivity, sustainability, refunds), then incentive last chance.

Omnisend configuration

- Automation → Create workflow → Welcome preset.

- Trigger: “Subscribed to email” (and SMS if applicable). Add conditional splits for source (popup vs quiz), location, or interest tags.

- Timing: Immediate, +2 days, +5 days. Use send‑time optimization sparingly; prioritize consistency.

- Content blocks: Dynamic product recommendations, review snippets, quiz prompt.

- SMS pairing: If consented, a short SMS after Message 1 with a link to your best‑seller collection (include STOP/HELP footer).

Compliance note: For SMS, ensure prior express written consent and A2P 10DLC registration; see Omnisend’s guidance on consent in the 2024–2025 period in the article “SMS compliance best practices” (Omnisend Help, updated 2025).

Flow 2: Browse Abandonment (1–2 messages, capped)

Objective: Re‑engage high‑intent browsing without over‑messaging.

Omnisend configuration

- Trigger: “Viewed product/page.” Exit conditions: “Added to cart,” “Started checkout,” or “Placed order.”

- Frequency cap: Once per 10–15 days per contact to avoid fatigue.

- Timing: Send within 4–8 hours of the browse session.

- Conditional splits: Category affinity (e.g., skincare vs haircare), price bands, returning vs new visitor.

Content tips

- Use the browsed item as the hero, plus 2–4 related SKUs.

- Include soft CTAs: “Compare routines,” “See how it fits your regimen.”

- Add social proof and usage highlights; avoid incentives on the first touch.

Reference: Setup details are documented in “Browse Abandonment” (Omnisend Help, accessed 2025).

Flow 3: Abandoned Cart (3 messages, multi‑channel)

Objective: Convert nearly‑purchased intent with progressive urgency and optional incentive.

Omnisend configuration

- Automation → Abandoned Cart preset.

- Trigger: “Added products to cart” or “Started checkout.” Exit: “Placed order.”

- Timing: Message 1 at ~1 hour; Message 2 at 24 hours; Message 3 at 48 hours.

- Conditional splits: Cart value tiers, discount affinity, inventory sensitivity (e.g., limited stock).

- SMS: Add a concise reminder at 24–36 hours for consented contacts.

Content tips

- Message 1: Cart summary, images, shipping/return reassurance.

- Message 2: Objection handling or product education; consider alternative SKUs.

- Message 3: Incentive if margin allows; time‑boxed code.

Reference: Best practices and templates in “Abandoned cart emails best practices” (Omnisend Blog, 2025) and setup in “Abandoned cart and checkout” (Omnisend Help).

Flow 4: Post‑Purchase & Education (5–6 messages)

Objective: Reinforce satisfaction, stimulate reviews/UGC, and educate for optimal results, especially with actives (retinol, vitamin C) and supplements.

Omnisend configuration

- Trigger: “Order placed” → “Fulfilled” → “Delivered.”

- Sequence and timing:

- Order confirmation (Immediate): Transactional details and a gentle cross‑sell module.

- Shipping update (Fulfilled): Expectation setting and a “how to” video link.

- Delivery confirmation (Delivered): Quick start tips; support contact.

- Review request (3–7 days after delivery): Make it one‑click; ask for photo UGC.

- Care/education (1–3 days post delivery): Usage cadence, sensitivity tips, SPF reminder for retinol/vitamin C.

- Cross‑sell (7–14 days post delivery): Complementary SKUs or bundle.

Reference: Practical timing and content ideas in the Omnisend guide “Post‑purchase emails: guide + examples” (Omnisend Blog, 2025).

Flow 5: Winback (60–120 days inactivity)

Objective: Re‑activate lapsed buyers with tailored offers and replenishment logic.

Omnisend configuration

- Trigger: “Last purchase date” > 60–120 days, adjusted by category.

- Conditional splits: Historical AOV, discount affinity, category affinity, VIP status.

- Sequence: 2–3 messages—education/benefit refresh, social proof, then a restrained incentive.

- SMS: Use one concise nudge in the series for consented contacts.

Tip: Suppress recent engagers who clicked in the past 7 days to avoid feeling spammy.

Advanced Flows That Move the Needle in Beauty & Wellness

Quiz‑Triggered Onboarding

- Use a short quiz (skin type, hair goals, supplement needs) to collect zero‑party data, gate results behind opt‑in, and map answers to fields/tags.

- Trigger a personalized sequence: regimen guides, starter bundles, and content addressing the user’s goals.

- Many beauty brands employ quizzes; results vary by execution. Focus on measurement inside Omnisend (placed order rate, revenue per message) rather than generic benchmarks discussed in broad industry roundups.

Product Education Series for Actives

- Segment purchasers of retinol, AHAs/BHAs, vitamin C, or scalp treatments.

- Send safety and effectiveness content: application order, frequency, buffering, and SPF use.

- This content improves satisfaction and reviews, which feeds future conversion via social proof.

Seasonal Launch & Back‑in‑Stock Alerts

- Pre‑launch: Waitlists for new SKUs; early access for VIPs.

- Launch day: Email + SMS announcement; follow‑up reminder.

- Back‑in‑stock: Omnisend has reported high open and conversion rates for stock alerts relative to campaigns, making them worthwhile in beauty and wellness; see the high‑level performance notes in the 2025 statistics summary (Email Marketing Statistics 2025 — Omnisend).

VIP & Loyalty Engagement

- RFM “Champions” and high‑AOV segments receive early access, exclusive bundles, or double points windows.

- Coordinate email and SMS for drops; respect frequency caps and keep copy concise.

Segmentation That Actually Improves Flow Results

Start with simple, reliable rules in Omnisend:

- RFM tiers: “Champions” (top recency/frequency/monetary), “Loyal,” “At‑risk,” “Hibernating.” Use different offers and cadences per tier; the concept is covered in Shopify’s overview of the method in “RFM analysis for ecommerce” (Shopify Blog, 2024).

- Category affinity: Skin vs hair vs supplements. Drive tailored recommendations.

- Engagement: Clicked last 14 days → exclude from reminder flows.

- Discount affinity: Frequent code users → offer modest incentives; full‑price buyers → emphasize education and bundles.

- Zero‑party: Skin type, scalp needs, goals from quiz → personalize content and replenishment.

To align teams on timing logic across lifecycle vs journey building, see the explainer “Customer lifecycle vs customer journey” (Attribuly, 2025) for framing segmentation triggers.

Replenishment Cadences: Practical Starting Points

There is no universal runout schedule; start with SKU‑level defaults and iterate using order intervals and snooze feedback.

Practical ranges backed by usage guidance

- Skincare moisturizers/serums: Often daily use; 50 ml containers frequently last around 30–60 days depending on amount and coverage area, as discussed in the Cleveland Clinic’s skin care guidance in 2024 (Cleveland Clinic skin care product order).

- Haircare shampoo/conditioner: 250–300 ml typically lasts roughly 30–60 days at 2–3 washes/week; adjust by hair length and household size.

- Supplements: Packaging usually indicates 30/60/90‑day supplies; start there and refine by adherence signals.

Omnisend configuration

- Trigger: “Purchased SKU X” → delay based on SKU cadence (e.g., 30, 45, 60, or 90 days).

- Conditional splits: Subscription status, prior replenishment behavior.

- Content: Education + quick reorder link; include “Snooze” and “Still have product?” options.

- SMS: A single reminder at the end of the cadence for consented contacts.

SMS Integration: Where It Helps Most (and Compliance)

High‑impact placements

- Abandoned cart: 24–36 hour reminder.

- Delivery alerts: Transactional SMS improves experience.

- Post‑purchase tips: Short how‑to or review prompt.

- Replenishment: Final nudge.

Copy examples

- “Your cart’s still waiting—grab your vitamin C serum before it sells out.”

- “Delivered! Start with a pea‑sized amount tonight; reply HELP for tips.”

Compliance essentials

- Bulk sender rules tightened in 2024: authenticate email (SPF, DKIM, DMARC), honor one‑click unsubscribe and process within 2 days, and keep spam complaints low; see Proofpoint’s 2024 overview of Gmail/Yahoo requirements in “New email authentication requirements” (Proofpoint, 2024).

- For SMS in the U.S., maintain prior express written consent, include STOP/HELP in every message, and register for A2P 10DLC; see Omnisend’s short guide “SMS flow setup” (Omnisend Blog, 2025) and the help article above.

A/B Testing & Optimization in Omnisend

Testing protocol

- Test one variable at a time: subject, incentive presence/level, send time, content block (UGC vs tutorial), channel path (email vs email+SMS).

- Run tests for 5–7 days or until you have enough events for a clear read.

- Judge by placed order rate and revenue per message, which Omnisend added to reporting in December 2024 (What’s new: revenue per message) (Omnisend Help, 2024).

Methodology tip

- Keep a backlog of hypotheses ranked by impact/effort.

- Roll winners into baselines; then test the next variable.

Reference: Omnisend’s practical primer “Email A/B testing” (Omnisend Blog, 2025).

Measurement & Attribution: Reading Results and Acting on Them

What to watch in Omnisend

- Flow‑level: Placed order rate, revenue per message, and unsubscribe rate.

- Cohort: Repeat purchase rate and days between orders by category.

- Attribution: Avoid judging flows solely by last‑click; consider multi‑touch influence on LTV and repeat purchase.

Example integration: If you enrich segments with multi‑touch attribution and identity resolution, you can target replenishment timing more accurately and see downstream LTV improvements. For instance, linking your Omnisend flows with Attribuly enables segment enrichment, multi‑touch attribution for email/SMS touches, and server‑side tracking that clarifies which flow messages contribute to repeat orders. Disclosure: We reference Attribuly as an example analytics platform because it complements Omnisend flows; evaluate any tool against your stack and data governance standards.

For deeper retention operations context, see the article “Customer Retention Manager best practices 2025” (Attribuly, 2025), which covers attribution views useful for post‑purchase and winback analysis.

Common Pitfalls (and How to Fix Them)

- Over‑segmentation with tiny audiences: Aim for segments with enough weekly events to produce statistically useful results; merge micro‑segments until you have meaningful sample sizes.

- Incentive overuse: Train customers to wait for discounts. Reserve incentives for cart recovery or late winback; lean on education and bundles elsewhere.

- Ignoring frequency caps: Cap browse abandonment to once per 10–15 days; throttle post‑purchase education if clicks fall or complaints rise.

- Not excluding recent purchasers/engagers: Suppress customers who purchased or clicked in the last 7–14 days from reminder flows.

- Static replenishment timing: Start with practical cadences, then refine SKU delays using observed order intervals. Offer snooze options.

- Measuring by open rate: Apple MPP inflates opens; prioritize click, placed order rate, and revenue per message. For a 2024–2025 perspective, see the deliverability overview in “Why email deliverability matters” (Litmus, 2024) and the MPP implications summarized in “Apple MPP and open rate reliability” (EmailToolTester, 2024).

Quick Implementation Checklist

- Welcome: 3–5 emails; immediate, +2 days, +5 days; capture quiz data; modest incentive only if margin allows.

- Browse: Trigger on view; cap 10–15 days; send within 4–8 hours; soft CTA plus social proof.

- Cart: 1h, 24h, 48h sequence; add SMS at 24–36h; incentive last.

- Post‑purchase: Confirm → ship → deliver → review (3–7 days) → education (1–3 days) → cross‑sell (7–14 days).

- Winback: Trigger at 60–120 days inactivity; 2–3 messages with restrained incentive.

- Replenishment: SKU‑based delays (30/45/60/90 days); snooze options; final SMS nudge.

- Segmentation: RFM tiers, category affinity, engagement suppressions, discount propensity, zero‑party quiz data.

- Testing: One variable at a time; 5–7 days; judge by placed order rate and revenue per message.

- Compliance: SPF/DKIM/DMARC, one‑click unsubscribe, low complaints; TCPA consent and A2P 10DLC for SMS.

- Measurement: Flow KPIs + cohort repeat rates; consider multi‑touch attribution for true LTV impact.

Additional Resources for Context and Setup

- Omnisend’s “Email automation guide” (2025) offers a broad orientation to core flows.

- For anonymous visitor identification that can improve browse/cart retargeting and segment quality, see “How to identify anonymous website visitors” (Attribuly, 2024).

- Gmail/Yahoo 2024 sender changes overview: “Bulk sender changes at Yahoo/Gmail” (AWS Messaging Blog, 2024) — useful when coordinating domain authentication and unsubscribe standards.

Balanced takeaway: There is no silver‑bullet flow or cadence. Beauty and wellness brands win by pairing Omnisend’s proven automations with smart segmentation, realistic replenishment timing, and consistent testing—while meeting 2024–2025 deliverability and SMS compliance rules. Implement the baseline sequences above, measure by placed order rate and revenue per message, then iterate until your flows feel as tailored as your best in‑store consultation.