Leveraging Lower-Funnel Strategies to Maximize Customer Retention (2025)

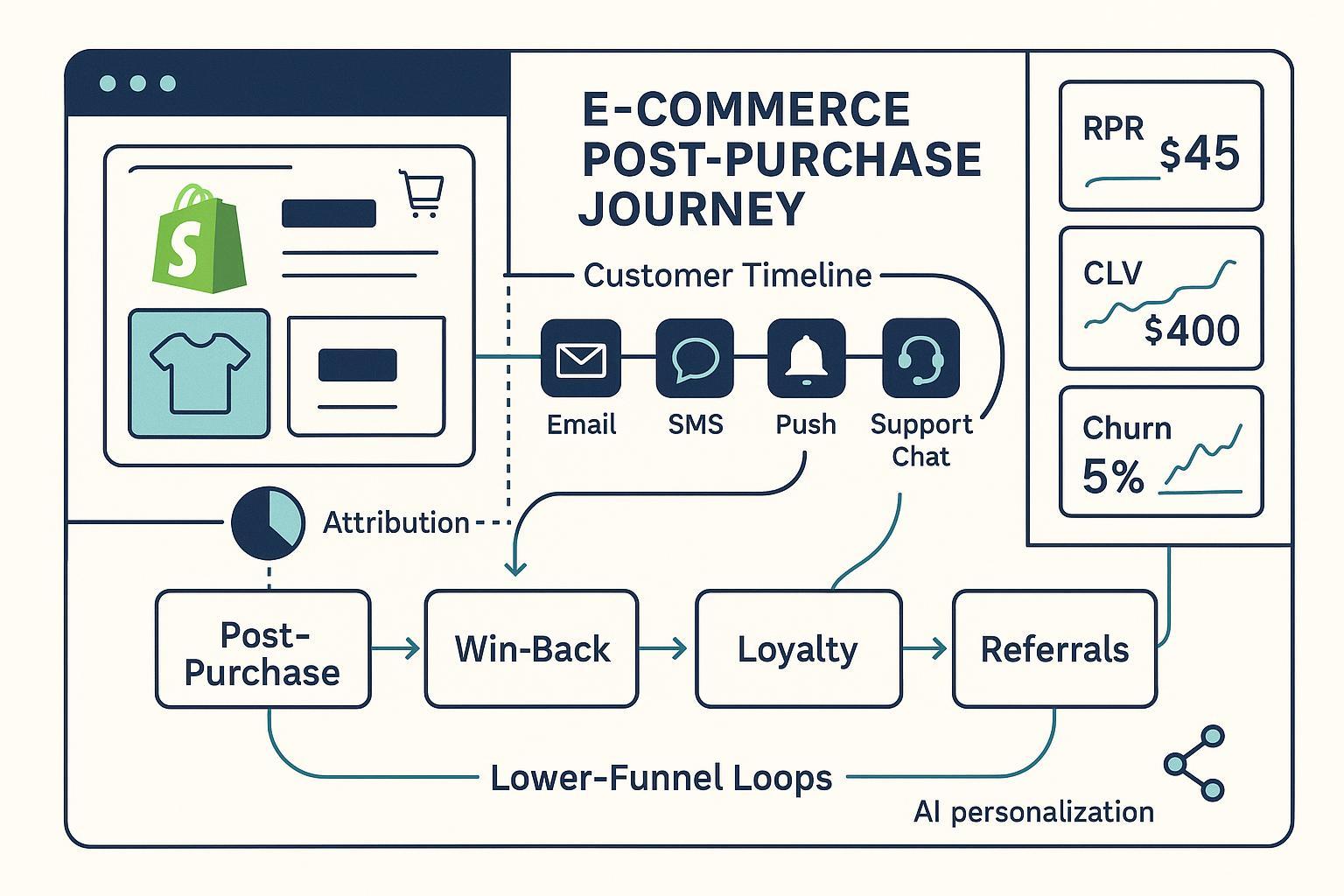

If you’re feeling the squeeze from rising CAC and flatter top-of-funnel returns, you’re not alone. The brands that are still compounding in 2025 are the ones operationalizing the lower funnel: post‑purchase experiences, triggered re‑engagement, loyalty mechanics, and support‑led retention—systematically measured and optimized.

Below is a practitioner’s playbook I’ve used across Shopify/DTC stacks. It favors concrete workflows, channel orchestration, and clear measurement gates over theory.

What “lower funnel” means in practice (2025)

Think of the lower funnel as the operational engine that turns first‑time buyers and high‑intent visitors into repeat purchasers and advocates. It includes:

- Automated behavioral triggers (cart, browse, post‑purchase, win‑back)

- Personalization and segmentation (RFM, churn propensity, VIPs)

- Owned-channel programs (email/SMS/push) and timing rules

- Loyalty, reviews/UGC, and referrals

- Friction reduction (checkout, returns, delivery comms) and repurchase UX

- Real‑time support and proactive issue resolution

This framing aligns with 2025 guidance from Shopify on practical retention levers like loyalty and personalized emails, plus service fundamentals that drive repeat purchase behavior, as outlined in the updated resources from Shopify’s customer retention strategies (2025 update) and Shopify Enterprise retention guidance (2025). It echoes how Unbounce defines the action/re‑engage stages that emphasize upsell, loyalty, and re‑engagement in the funnel per the Unbounce conversion funnel primer (2025).

Baseline KPIs to watch

I keep these on a single dashboard so the team sees movement daily/weekly:

- Repeat purchase rate (RPR)

- Time to second purchase (T2SP)

- Churn/At‑risk segment size and velocity

- Revenue per recipient (RPRc) for automated flows vs campaigns

- CLV by cohort and segment (e.g., VIPs vs at‑risk)

- Support SLAs: first response time (FRT), first contact resolution (FCR)

Why automation first? Across very large datasets, automated flows consistently outperform batch campaigns. Omnisend’s 2024–2025 benchmarks report automated emails driving materially higher open, click, and conversion rates—e.g., abandoned cart RPR far outpaces broadcast campaigns according to the Omnisend 2024/2025 e-commerce benchmarks. SMS tells a similar story: Attentive’s 2025 report shows automations represent a minority of sends but a disproportionate share of revenue, with higher click and conversion performance than campaigns per the Attentive 2025 SMS and email marketing report.

Blueprint 1: Automated behavioral triggers that compound revenue

Start here for 80/20 wins. Sequence and suppression matter as much as copy.

- Abandoned cart (email/SMS/push)

- Timing: 30–60 minutes, 20 hours, 48 hours (test window by AOV).

- Content: Social proof, value prop, shipping/returns clarity; only add incentives in the final touch if margins allow.

- Channel logic: Email first for depth; SMS for urgency on touch 2 or 3 for opted-in users; push as a quick follow-up for web/app subscribers.

- Benchmarks and expectations: Automated cart flows typically convert 5–15% of abandoners when well‑segmented, aligning with performance spreads noted by the Omnisend email automation benchmarks (2024–2025).

- Browse abandonment

- Timing: 1–6 hours post‑session; shorten for high‑intent signals (e.g., repeat PDP views).

- Content: Dynamic recommendations or recently viewed items; include low‑friction CTA.

- Suppression: Exclude if cart flow has already fired.

- Post‑purchase cross‑sell/education

- Timing: Split by SKU and repurchase window. For consumables, educate at day 1–2; recommend refills near predicted depletion; for durables, upsell accessories within 3–7 days.

- Content: Onboarding, care guides, usage tips; then cross‑sell with relevance.

- Win‑back (re‑engagement)

- Timing: Anchor to cohort behavior (e.g., 25% longer than median repurchase interval). Use 3–4 touches over 14–28 days.

- Content: Personalized reason to return—new drops, category‑level recommendations, loyalty perks; reserve incentives for the last touch.

- Impact ranges: Automated, behavior‑based campaigns reduce churn in the 15–28% band in DTC programs according to a synthesis of cases compiled in the Retainful retention marketing analysis (2025).

Testing and governance

- Always test time delays, subject lines/headers, incentive thresholds, and channel priority.

- Create a contact fatigue rule (e.g., max 1 automation + 1 campaign per 24 hours) with exceptions for critical ops.

Blueprint 2: AI-driven personalization and segmentation that actually scale

“Personalization” is only effective when it’s anchored to lifecycle states and intent. In practice, deploy:

- RFM cohorts: Define quintiles for Recency, Frequency, Monetary; target VIPs, loyal, promising, at‑risk, and hibernating segments with distinct offers and cadences. Klaviyo documents practical RFM properties and dynamic segments you can trigger off, as detailed in the Klaviyo RFM segmentation guide (2025).

- Propensity modeling: Likelihood to churn, likelihood to buy next category, discount affinity.

- Next‑best‑offer: Pair SKU graph + margin guardrails.

- Predictive timing: Optimize send times to purchase windows.

Why invest? 2025 studies indicate AI‑assisted personalization lifts retention and CLV. Emarsys reports increases across loyalty likelihood and CLV, noting predictive personalization winning back a substantial share of at‑risk customers; see the 2025 overview in the Emarsys e‑commerce personalization trends (2025). McKinsey similarly emphasizes that scaling personalization with AI enhances growth and loyalty outcomes in the McKinsey “next frontier of personalized marketing” (2025).

Operational notes

- Don’t overfit: Start with interpretable RFM + a few high‑signal propensities before layering complex models.

- Guardrails: Set strict incentive caps for discount‑affine segments to protect margin.

- Validation: Use holdout groups to measure true incremental lift of personalized flows.

Owned-channel orchestration: Email vs SMS vs Push (and how to sequence)

-

Roles

- Email: Rich content and education; best for onboarding, bundles, and detailed offers. See the sustained performance trends in the Omnisend open rate analysis (2024).

- SMS: Immediacy; time‑sensitive nudges (restocks, expiring offers). Automations punch above weight per the Attentive 2025 report.

- Push: Lightweight, instant visibility; complements inbox dependence (see Omnisend on Shopify push notifications).

-

Sequencing and suppression

- Default: Email first, SMS second for high intent or urgency; push as augment.

- Suppress overlapping triggers: If cart fires, hold browse for 24 hours.

- Fatigue caps: Define per segment (e.g., VIPs tolerate more relevant touches; dormant users require fewer, stronger reasons).

- Compliance: Follow regional opt‑in/quiet hours; maintain clear frequency controls.

Loyalty, advocacy, and UGC you can actually operationalize

Loyalty programs and UGC are powerful only when they integrate with lifecycle messaging.

-

Loyalty mechanics

- Tiers: Use experiential benefits for top tiers (priority support, early access) to preserve margins.

- Earn/burn: Encourage early redemption to build habit loops.

- Triggered moments: Post‑purchase “points earned” + “next tier progress” messages; VIP exclusives.

- Evidence: Corporate‑level research indicates strong correlations between loyalty engagement and repeat sales; for instance, Antavo’s global research (2024, based on 30.5M+ member actions) shows a majority of brands attribute incremental sales to loyalty programs and highlights outsized spend among redeemers, summarized in the Antavo GCLR 2024 findings and the Antavo loyalty statistics hub (2025).

-

UGC and reviews

- Capture flows: Request a photo/video review 7–10 days post‑delivery; incentivize with loyalty points.

- Placement: Syndicate top reviews to PDPs and post‑purchase emails; push “as‑worn/as‑used” galleries.

- Advocacy loop: After a 5‑star review, trigger a referral invite and VIP tier bump.

-

SMS + loyalty integration

- Yotpo notes a high share of SMS purchases from repeat customers and strong returns when loyalty triggers are integrated; see the 2024–2025 patterns summarized in the Yotpo retention recap (2025) and the Yotpo loyalty‑SMS strategy brief (2025).

Friction reduction and repurchase UX

Small operational fixes compound—this is where many brands leave money on the table.

-

Checkout

- Reduce fields, auto‑fill, show trust badges and delivery promises. Baymard’s 2024 research documents thousands of UX issues and quantifies the impact of reducing friction; see the large‑scale findings in the Baymard 2024 checkout research launch and supporting metrics like average form field counts in the Baymard checkout form fields analysis (2024).

-

Returns and delivery comms

- Transparent, self‑serve returns with instant labels; proactive delivery updates and delay alerts.

- Practical note: Even when exact 2025 percentages vary by report, industry studies consistently tie hassle‑free returns and clear delivery comms to higher repeat intent; consider mining Narvar’s reports hub for your vertical benchmarks via the Narvar resources center.

-

Subscriptions and re‑order UX

- For consumables, offer smart replenishment intervals and skip/modify controls.

- Add low‑friction “buy again” modules in account and order confirmation pages.

Real-time support and proactive issue resolution

Customer service is now a revenue function. Two patterns repeatedly pay off:

- Speed to reassurance: Under 60 seconds for chat first response on high‑volume stores materially reduces cancellation and chargebacks.

- Proactive alerts: Back‑in‑stock, delivery delays with compensation options, and warranty triggers curb churn.

Real‑world examples from e‑commerce‑native platforms show how support can drive conversions and loyalty: Gorgias case studies report dramatic improvements in conversion rates and revenue attributed to support interactions when response and resolution times are optimized, as seen in the Gorgias “One Block Down” case results and the Gorgias “Nude Project” KPIs. Broader survey data supports channel continuity and fast resolution as loyalty drivers; see directional stats in the Zendesk e-commerce service guidance (2025).

Operational checklist

- SLAs by channel: Chat FRT < 60s; email FRT < 4h; FCR > 70%.

- Macros: Pre‑approved goodwill gestures and exchanges.

- Revenue attribution: Tag tickets influenced by purchases for better budgeting.

Measurement and attribution for retention retargeting

Marketing teams are funding retention better in 2025 by improving measurement fidelity.

- Hybrid models: Blend multi‑touch attribution (MTA) with MMM and experiments. This tempers the blind spots of each approach under privacy constraints.

- Incrementality tests: Holdouts, geo splits, or on/off tests to validate the true lift of win‑back ads and triggered offers.

- Decision rules: Allocate more budget to segments and channels with proven incremental lift and shorter payback windows.

Vendor documentation in 2024–2025 underscores the role of MTA and predictive analytics in clarifying channel impact for DTC brands—see the Admetrics predictive analytics and MTA overview (2025), the Triple Whale handbook on MTA models (2025), and the Northbeam explainer on MTA approaches (2025). Platform reports also point to improved ROI accuracy when moving from last‑click to multi‑touch methods for retention and retargeting allocation; see the Admetrics e-commerce funnel analysis (2025).

Retention Technology Toolbox (neutral, 2025)

- Attribuly: Marketing attribution and tracking for e‑commerce with multi‑touch models, server‑side tracking, identity resolution, and integrations into Shopify and major ad platforms; useful when you need unified journey analytics and automated triggered segmentation tied to retention workflows. Disclosure: We are affiliated with Attribuly.

- Triple Whale: DTC‑focused analytics with attribution models, cohort views, and media mix insights; a fit when you prioritize paid media efficiency and creative performance with simple rollups across stores.

- Northbeam: Advanced attribution and forecasting options (clicks‑only and clicks+views models); helpful for brands with complex media mixes and needs for granular channel impact modeling across prospecting vs retargeting.

Choose based on: internal analytics maturity, required identity resolution depth, support for server‑side tracking, and how well the tool integrates with your messaging stack and data warehouse.

Troubleshooting playbook: If results stall

- Low engagement on automations

- Diagnose: Overlapping triggers, stale creative, frequency fatigue.

- Fixes: Re‑sequence touches; introduce dynamic content; add clear value (care tips, fit guides); test plain‑text variants.

- High churn in new cohorts

- Diagnose: Mis‑set expectations pre‑purchase, operational friction (shipping/returns), or product fit.

- Fixes: Tighten PDP clarity; add proactive delivery comms; offer easy exchanges; delay incentives to preserve value while repairing trust.

- Loyalty program apathy

- Diagnose: Rewards aren’t meaningful; redemption too hard; benefits generic.

- Fixes: Tier experiences (access, service); lower first redemption threshold; personalize earn/burn nudges.

- Support backlog dragging NPS

- Diagnose: Channel sprawl; no macros; no ownership.

- Fixes: Route by intent; create macros with guardrails; define SLAs; escalate rules for at‑risk/VIP segments.

- Measurement confusion

- Diagnose: Conflicting platforms; last‑click bias; no experiments.

- Fixes: Establish a source of truth; run holdouts/geo splits; adopt MTA+MMM hybrid and document decision rules.

30–60–90 day rollout plan

Days 1–30: Foundation and quick wins

- Implement or audit core automations: cart, browse, post‑purchase, win‑back.

- Add fatigue caps and suppression logic across channels.

- Stand up baseline dashboards for RPR, T2SP, automated RPRc, and support SLAs.

- Launch a review/UGC capture flow post‑delivery.

Days 31–60: Personalization and operations

- Build RFM cohorts; trigger VIP and at‑risk flows.

- Add AI‑assisted recommendations to post‑purchase and win‑back.

- Improve checkout friction per Baymard patterns; publish a clear returns policy with self‑serve tools.

- Define support SLAs and macros; set up proactive delivery alerts.

Days 61–90: Scale and validate

- Layer propensity models (churn, discount affinity) with incentive guardrails.

- Integrate loyalty into automations; launch VIP exclusives and referral triggers.

- Run holdout or geo split tests to validate incremental lift for your largest flows and retargeting audiences.

- Rebalance budget based on incremental CLV and payback improvements.

When not to push harder on lower-funnel tactics

- Unresolved product fit or quality issues: Fix the root cause before adding incentives or more messages.

- Severe ops gaps: If delivery reliability is low, automate proactive comms and service recovery first.

- Thin margins: Prioritize non‑discount value (content, access, service) and limit incentives to the final touch in win‑back.

Source notes and further reading

- Retention strategy framing: Shopify’s retention playbooks (2025); Unbounce funnel definitions (2025)

- Automation performance: Omnisend e‑commerce email/SMS/push benchmarks (2024–2025); Attentive 2025 SMS report

- AI personalization impact: Emarsys personalization trends (2025); McKinsey on scaling personalization (2025)

- Segmentation frameworks: Klaviyo RFM segmentation (2025)

- Loyalty/UGC: Antavo GCLR 2024; Yotpo retention patterns 2025

- UX and support: Baymard checkout UX (2024); Zendesk e‑commerce service (2025); Gorgias case studies

- Attribution: Admetrics predictive analytics (2025); Triple Whale MTA models (2025); Northbeam MTA explainer (2025)

Implement the playbooks, measure incrementally, and iterate. In 2025, lower‑funnel excellence isn’t about one silver bullet—it’s the compounding effect of a dozen well‑run systems working in sync.