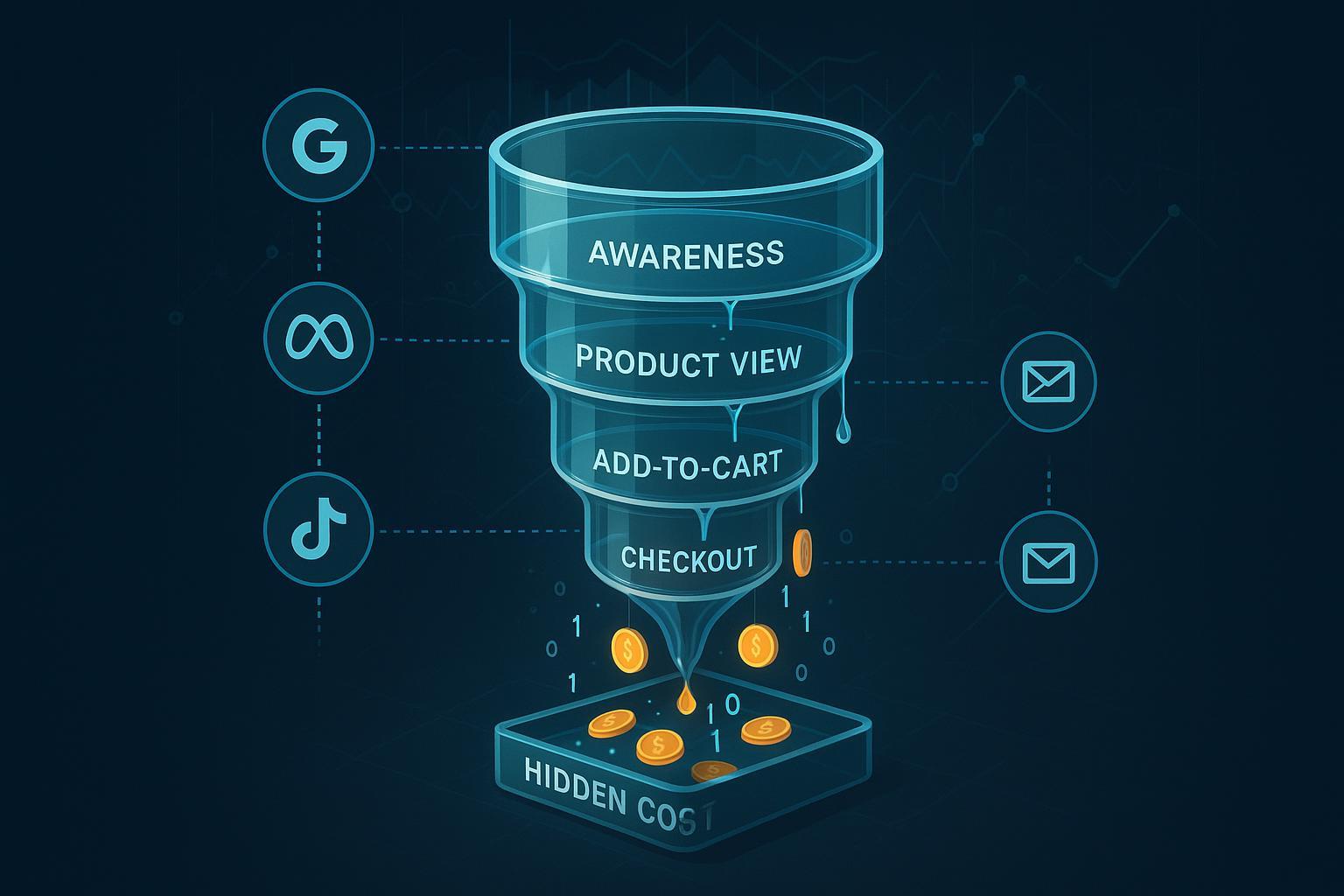

Identifying the Hidden Costs of a Leaky Sales Funnel

If you operate an e-commerce brand in 2025, the worst losses rarely show up in your dashboard’s headline metrics. They hide in misattribution across channels, data loss from privacy changes, broken events, bot noise, false payment declines, and nurture gaps that quietly starve profitable re-engagement. I’ve seen teams chase top-funnel CPCs for months while a single tracking or payments issue quietly drains more revenue in a week than the entire ad test could ever win back.

Two quick reminders underscore the stakes:

- The Baymard Institute’s 2025 synthesis places cart/checkout abandonment around ~70%, and concludes that fixing checkout UX alone can unlock up to a 35% conversion uplift, based on years of large-sample testing summaries in its programmatic research (see the public overview in the Baymard 2025 Current State of Checkout UX).

- Bad bots made up an estimated 37% of all internet traffic in 2025, the sixth straight yearly rise, which can skew analytics and waste ad and ops spend as documented in the Imperva 2025 Bad Bot Report.

Hidden costs compound because they’re systemic, not campaign-level. This article is a practitioner guide to surface, quantify, and fix these leaks with a measurement-first operating model—pairing advanced attribution, server-side tracking, identity resolution, and disciplined audits. Where relevant, I’ll show how a platform like Attribuly plugs into this workflow to accelerate detection and recovery for Shopify/DTC teams.

The 2025 Hidden Funnel Cost Map

Use this map to orient your weekly audits. For each leakage class, watch for the detection signal and tie it to a business metric you can size.

- Tracking and attribution gaps

- Detection signal: Spikes in “Direct/None” after new campaigns, sudden paid–organic merges, channel ROAS volatility, platform vs. analytics mismatches.

- Root causes: Missing/stripped UTMs (common with iOS private contexts), un-gated tags, duplicate or missing purchase events, inconsistent attribution windows.

- Business impact metric: Misallocated budget; understated ROAS on assist channels; wasted remarketing due to undercounted engagement.

- Identity loss and session discontinuity

- Detection signal: High volume of “unknown” users, sudden drop in returning customer conversion, cross-device inconsistencies.

- Root causes: No identity stitching (hashed email/phone), account-light stores without persistent IDs, consent gating not propagating identity fields.

- Business impact metric: Lower conversion from high-intent cohorts; poor LTV models; weak retargeting match rates.

- Privacy-driven parameter stripping and cookie limits

- Detection signal: Email/SMS clicks landing without campaign parameters; increased “unattributed” traffic in Safari/Apple Mail segments.

- Root causes: Apple iOS 17 Link Tracking Protection removing known tracking parameters in Mail, Messages, and private contexts as explained in Apple’s WWDC23 privacy session on LTP and the Safari advanced privacy protection guide.

- Business impact metric: Understated channel contribution; incorrect cohort attribution; suboptimal budget shifts.

- Bot/fraud contamination

- Detection signal: Surges of high-bounce sessions with non-human patterns; anomalous checkout attempts; inflated top-funnel engagement metrics.

- Root causes: Scrapers, credential stuffing, and sophisticated bad bots (reference the Imperva 2025 Bad Bot Report).

- Business impact metric: Distorted experiments; wasted ad spend; elevated fraud/chargeback risk.

- Authorization declines and payment friction

- Detection signal: Stable add-to-cart and checkout start, but payment success dips; increased “Do Not Honor” codes.

- Root causes: Issuer-side declines, weak retries, lack of network tokens, missing local wallets/BNPL.

- Business impact metric: Recovered revenue potential; Stripe reported billions in recovered false declines through its AI-driven retries in 2024 as part of its Adaptive Acceptance and Payments Intelligence advances.

- On-site instrumentation and headless checkout bugs

- Detection signal: Purchase event counts that don’t reconcile with orders; duplicated event firing; sudden CVR cliffs after a deploy.

- Root causes: SPA/headless routing quirks, un-gated events, consent logic bugs, checkout customizations.

- Business impact metric: Under/over-counted conversions; broken remarketing and modeling.

- Nurture and retargeting breakdowns

- Detection signal: Stagnant revenue from high-intent segments; shrinking matched audiences; deliverability dips.

- Root causes: Identity gaps, list hygiene, frequency capping issues, broken triggers.

- Business impact metric: Lost repeat purchase and AOV uplift; rising blended CAC.

- Walled-garden fragmentation and offline/CTV disconnects

- Detection signal: Platform lift claims with weak corroboration in analytics; spikes in branded search without corresponding attribution.

- Root causes: Incomplete integrations for CTV/offline; lack of code-based or geo-matched experiments.

- Business impact metric: Over/under-investment in upper-funnel channels; missed scale.

First, quantify the leak (so your team prioritizes correctly)

When everything feels urgent, a simple calculator helps you sequence fixes:

Revenue at risk (stage) = Stage traffic × Intent rate × Stage conversion rate × AOV × Estimated leak percentage

Examples to ground the math:

- Checkout friction: Use order attempts and successful payments to estimate loss. If you observe a dip in authorization rate, consult your PSP’s analytics and retry coverage. Stripe disclosed in 2024 that upgrades to Adaptive Acceptance recovered about $6B in previously declined transactions and boosted retry success significantly, detailed in the Stripe AI enhancements to Adaptive Acceptance (2024). Even without exact local figures, your own delta between expected and actual auth rates frames a hard-dollar opportunity.

- Parameter stripping: For email/SMS, compare clickthrough landings with and without UTMs by device/browser to estimate how much attribution clarity you’re losing under Apple’s LTP, per Apple’s iOS 17 Link Tracking Protection documentation.

- Identity gaps: Track the share of sessions turning into “known” profiles over time. If known-user conversion is materially higher, incremental identity resolution (e.g., account prompts, progressive profiling) maps to revenue upside.

The goal is not perfect precision; it’s ranking the biggest dollar drains so engineering, analytics, and marketing can align on the next sprint.

The diagnostics playbook (run it weekly)

What follows is the cadence I’ve found dependable. Do it weekly until confidence stabilizes, then keep light-touch monitors and monthly deep dives.

- Acquisition integrity: UTMs, redirects, and landing continuity

- Pull last 7–14 days by channel/campaign and scan for Direct/None spikes that coincide with launches.

- Validate redirect chains and test top email/SMS templates for stripped parameters in Apple Mail and Safari private contexts (see Apple’s LTP overview).

- Confirm platform-side settings: auto-tagging (Google), click IDs preservation, and consistent attribution windows.

- On-site event health: parity and consent

- Reconcile purchase events with orders daily. Look for duplicates or missing events after code changes.

- Compare client- vs server-side events and ensure consent gates are enforced correctly under your CMP policy.

- Implement server-side or enhanced conversions where possible to improve match quality, referencing Google’s Enhanced Conversions implementation guide.

- Privacy resilience: 2025 realities

- Chrome’s third-party cookies remain while Privacy Sandbox evolves; keep abreast via the Privacy Sandbox 2025 next-steps update and UK regulator monitoring on the CMA’s Privacy Sandbox case page. Ensure you aren’t over-correcting with assumptions that 3P support has ended.

- For Apple devices, assume intermittent parameter loss and optimize your identity and server-side posture to compensate.

- Identity stitching and session persistence

- Ensure hashed email/phone capture at logical points (checkout, account, support chat). Unify profiles across devices.

- Track known vs unknown visitor ratios and conversion. Prioritize prompts and progressive identity where compliant.

- Payments and bot mitigation

- Trend authorization rate, false decline codes, and dispute rates weekly. Where supported, enable intelligent retries/tokens and local wallets.

- Implement a bot defense strategy to keep analytics clean and checkout secure; it’s warranted given the 37% bad-bot share in 2025.

- Attribution triangulation: MTA/DDA + experiments + MMM

- Pair user-level attribution (multi-touch/data-driven) with causal tests. Use holdouts or geo experiments to validate lift.

- Calibrate long-term budgets with MMM. Open-source options like Meta’s Robyn MMM and Google’s lightweight approaches are practical starting points, as discussed across Think with Google measurement resources.

- When models disagree, investigate data loss, identity gaps, or channel overlap as likely culprits—not just “model error.”

Where Attribuly fits in this operating model

For Shopify/DTC brands, Attribuly can be the measurement backbone that makes this cadence sustainable:

- Multi-touch attribution and cross-channel analytics: Attribuly unifies shopper journeys across Google, Meta, TikTok, email, and more—helping teams see when Direct/None is masking real assists and where channels are cannibalizing. This is core to fixing misallocation. Explore the platform at Attribuly’s product overview.

- Server-side tracking and GA4 enhancement: Server-side pipelines reduce client-side loss and improve match rates, feeding cleaner data to ad platforms and GA4 for more reliable optimization. Attribuly’s docs highlight server-side tracking as a pillar of its approach in the real-time visitor behavior page.

- Identity resolution: Stitching known and unknown visitors into persistent profiles increases match rates for retargeting and improves conversion modeling. The Attribuly Shopify app listing cites outcomes like identifying up to a significant share of anonymous visitors and reducing unknown traffic sources, as described on the Attribuly app page on Shopify. Apply these capabilities within your consent framework.

- Automated triggered campaigns and segmentation: Once leak points are known (e.g., high-intent views without add-to-cart), Attribuly can trigger emails/ads to recapture demand from unified segments. This ties diagnostics to action.

- AI analytics assistant and alerts: Use automated anomaly detection and clear explanations for faster time-to-fix when an event breaks or a payment metric drifts.

Verification note: Treat any vendor-quoted uplifts as directional until you reproduce them with your data. The value is in faster detection, better attribution, and the ability to close the loop with targeted recapture.

Mini case: Two leaks, one fix cycle

An anonymized DTC brand (Shopify, mid–seven figures GMV) faced two hidden drains:

- Misattribution from email/SMS traffic landing without UTMs on iOS private contexts, inflating Direct and under-crediting lifecycle marketing.

- A quiet drop in payment authorization rates after a gateway configuration change.

What we did:

- Deployed server-side tracking and ensured enhanced conversions were sending hashed identifiers to ad platforms; inspected consent gating.

- Moved the lifecycle program to use branded short links and ensured redirects preserved key parameters to mitigate LTP stripping as outlined in Apple’s LTP documentation.

- Instrumented weekly attribution triangulation (MTA + geo holdouts) and a simple payments dashboard trend.

- Implemented identity stitching and rebuilt retargeting segments from unified profiles in Attribuly; wired triggered campaigns to re-engage high-intent non-buyers.

Results to watch for (and how to prove you have them):

- A decline in Direct/None share when parameters persist and identity resolution improves; validate with cohort views in your attribution tool.

- Recovery in authorization rate; validate in your PSP analytics and compare to pre-change baselines. Stripe provides context on the upside potential of intelligent retries and network optimizations in its 2024 write-ups on the Payments Intelligence suite.

We avoided quoting a single headline “+X%” because these lifts vary by stack and segment. The important part is the method: measure, isolate, fix, and then lock the improvement with monitors.

Advanced pitfalls and trade-offs (no silver bullets)

- Server-side is powerful but not magic: You still need consent, clean schemas, and parity checks. Some identity signals can’t be sent without user permission. Expect occasional mismatches between server and client until you standardize.

- Identity resolution limits: Cross-device stitching improves with sign-ins and hashed identifiers, but you won’t resolve everyone. Design your experiments to tolerate partial identity.

- MMM needs experiments: MMM can drift without ground-truth. Feed it incrementality tests periodically (geo splits or holdouts) to recalibrate priors.

- Bot mitigation vs friction: Aggressive bot filters can hurt legit users. Start with observation, then selectively enforce and monitor conversion impacts.

- Walled gardens’ models aren’t “wrong”—they’re different: Reconcile platform lift with your own data through experiments; don’t force a single “truth.”

- Privacy shifts continue: Chrome’s cookie timeline changed again in 2025; stay current with the Privacy Sandbox update and regulatory context like the UK CMA’s oversight of Google’s commitments on the CMA case page.

30/60/90-day rollout and weekly ritual

Use this as an operating plan to move from reactive to resilient.

Days 0–30: Stabilize measurement and payments

- Event audit: Reconcile orders vs purchase events; fix duplicates/missing; add server-side/enhanced conversions (see Google’s Enhanced Conversions guide).

- Acquisition hygiene: Standardize UTMs; test email/SMS links under Apple LTP contexts; ensure redirects preserve parameters.

- Payments baseline: Trend authorization/false declines; enable retries/tokens; add local wallets. Reference performance targets using Stripe’s 2024/25 insights on Adaptive Acceptance and intelligence.

- Identity capture: Add friction-light prompts and progressive identity capture; ensure consent flows.

Days 31–60: Unify data and activate recapture

- Identity resolution: Stitch known and unknown visitors; measure known conversion deltas. Use Attribuly’s identity and real-time analytics to surface high-intent unknowns (Attribuly real-time behavior).

- Attribution triangulation: Stand up MTA/DDA for daily ops; run a geo holdout on your biggest channel to calibrate.

- Triggered campaigns: Build segments for cart/product-view abandoners and dormant high-intent users. If using Attribuly, wire automated triggers to email/ads.

- Bot and fraud controls: Deploy bot detection on site and at checkout; monitor bounce and conversion impacts.

Days 61–90: Institutionalize and scale

- MMM baseline: Fit a first-pass MMM (e.g., Robyn MMM) with your last 12–24 months data; use experiment results as priors.

- Alerting SLAs: Create monitors for parameter loss, event parity, auth rate dips, and paid/organic merges; assign on-call ownership across marketing ops and engineering.

- Governance: Document attribution windows, consent policies, and tag governance; set a monthly audit.

Weekly ritual checklist

- Review Direct/None share by device/browser; investigate anomalies.

- Reconcile platform vs analytics conversions; explain gaps.

- Trend payments authorization and top decline codes.

- Check known vs unknown visitor ratios and retargeting match rates.

- Review bot signals and any friction added; confirm no adverse conversion trend.

- Prioritize fixes by revenue-at-risk estimate and assign next sprint tasks.

Tools that earn their keep

- Attribution and identity: Attribuly for multi-touch attribution, server-side tracking, identity resolution, segmentation, and triggered campaigns (Shopify-native). Start at the Attribuly site.

- Ad platform integrations: Meta’s Conversions API documentation and Google Ads’ Enhanced Conversions guide for better match and resilience.

- Experimentation and modeling: Geo holdouts; MMM via Robyn (open-source).

- Privacy tracking literacy: Apple’s LTP overview for iOS 17 and Google’s Privacy Sandbox 2025 update.

- Checkout acceleration on Shopify: Shop Pay shows documented conversion uplift in Shopify’s enterprise resources, including evidence of materially faster checkout and higher conversion, summarized in the Shopify Enterprise CRO guides (2024–2025).

- Payments optimization and fraud: Stripe’s 2024/25 write-ups on AI-driven payments performance and Adaptive Acceptance upgrades.

Final take

The biggest funnel wins don’t come from one more headline A/B test—they come from building a resilient measurement and activation backbone: server-side tracking, identity resolution, attribution triangulation, disciplined audits, and fast recapture loops. In 2025’s privacy and bot-heavy reality, that backbone pays for itself.

If your brand runs on Shopify or a similar DTC stack and you need a turnkey way to get there, evaluate Attribuly. Its multi-touch attribution, server-side tracking, identity resolution, and triggered campaigns help detect and repair leaks quickly—so your budget flows to the channels and customers that actually drive profit. Learn more at Attribuly or install via the Attribuly Shopify app page.