Customer Segmentation Strategies for Furniture Ecommerce Email Marketing (2025)

If your furniture brand is still blasting the same email to everyone, you’re leaving serious revenue on the table. In 2025, automated, behavior-led, and segmented emails materially outperform batch-and-blast. For example, Omnisend reports in its 2025 ecommerce marketing report (covering ~24B emails from 2024) that automated flows drive outsized engagement and orders relative to their tiny send volume, with open rates around 40% and click rates near 13% for automations—dramatically higher than generic campaigns, and with far better purchase odds from clicks, according to the publisher’s dataset for 2024 (Omnisend 2025 report). Klaviyo’s 2024 industry benchmarks and 2025 guidance likewise show flows and segmented sends outperform broad campaigns across core metrics (open, click, and placed-order rates) per the platform’s published methodology (Klaviyo 2024 industry benchmarks; Klaviyo 2025 automation examples).

This playbook distills what consistently works for furniture ecommerce—high AOV, long consideration cycles, and margin-sensitive promotions—so you can execute now, not “research later.”

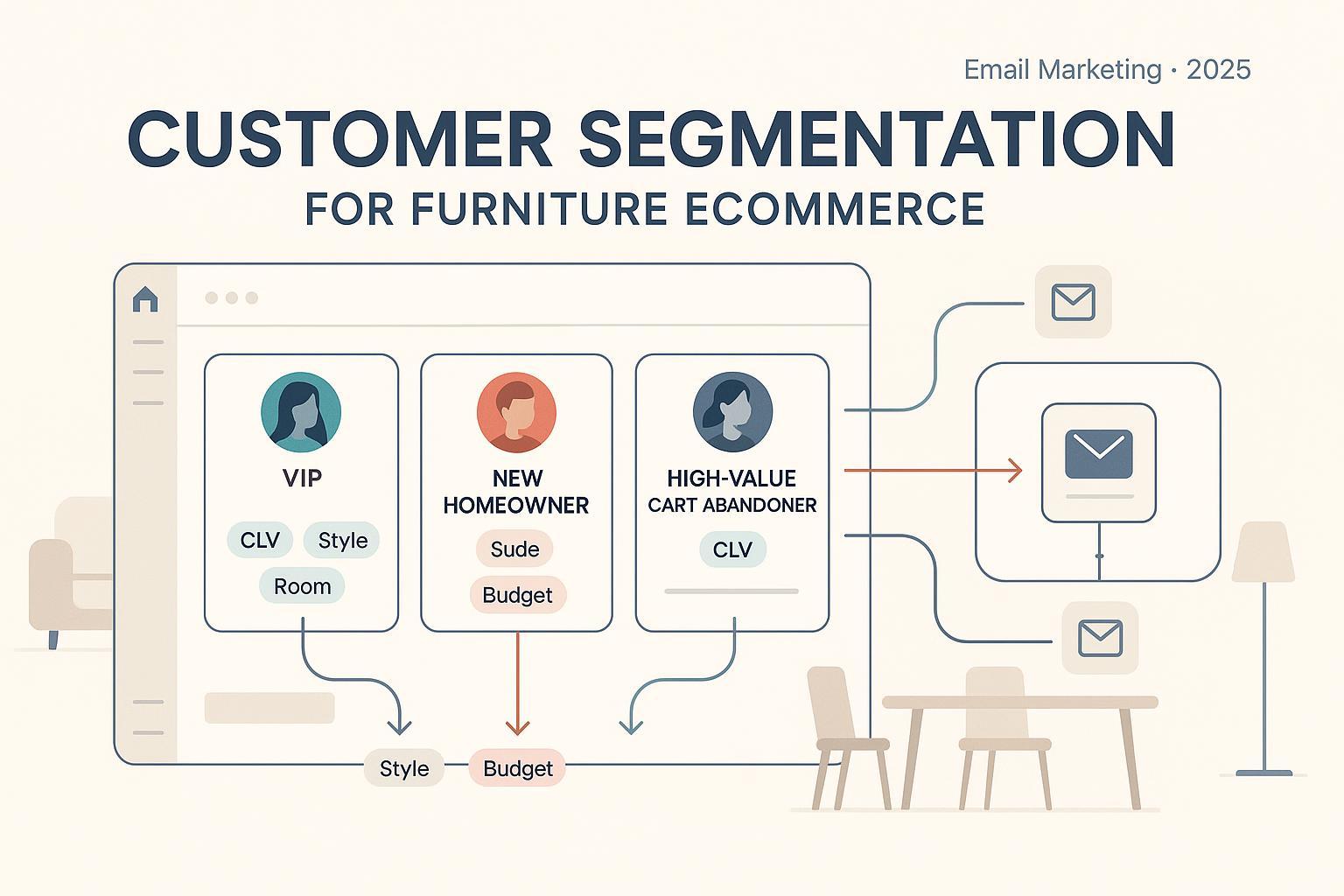

A practical framework for furniture segmentation

Segmenting for furniture is about timing, intent, and value density. The following layers work best when orchestrated together:

- Behavioral intent

- Signals: category views (sofas vs. dining), return visits, add-to-cart value, checkout starts

- Use for: browse/cart triggers, educational content, financing prompts

- Demographics/geography

- Signals: shipping region, urban vs. suburban delivery feasibility

- Use for: delivery timelines, white-glove availability, store events

- Psychographics/style

- Signals: preferred aesthetics (mid-century, modern farmhouse), sustainability interest

- Use for: collection curation, material education, UGC

- CLV/VIP tiers

- Signals: lifetime spend, margin contribution, frequency

- Use for: concierge offers, early access, non-discount perks

- Lifecycle and events

- Signals: new homeowner, renovation, new baby, move date

- Use for: room-by-room guides, bundled sets, time-based reminders

Trade-offs to manage:

- Over-segmentation increases ops burden—prioritize segments with clear actions and enough volume

- Margin erosion from blanket discounts—lead with financing, bundles, and experiential perks

- Deliverability risk—mail engaged tiers first; maintain sunset policies

Capture the right data (zero/first-party) and stay compliant

Your best segments come from data customers willingly share and the events they generate on-site and in email/SMS.

- Zero/first-party capture

- Post-purchase survey fields: room type, style, budget band, materials preference

- On-site quiz or popup: “Planning a move?” “Which room first?” “Financing interest?”

- Preference center: topics (living, dining, bedroom), frequency, channels

- Event data to persist

- View by category, add-to-cart value and items, checkout started, purchase (SKU/category), delivery status

- Engagement tiers: last opened/clicked windows (30/60/90 days)

Compliance essentials (US):

- Email: Follow the FTC’s requirements (clear opt-out, physical address, truthful headers) per the official guidance in the CAN-SPAM Act compliance guide (FTC, 2025).

- SMS: As of 2025, the FCC’s final rule requires prior express written consent that names the specific seller, with simple opt-out and Do-Not-Call protections for texts; see the Federal Register entry on TCPA updates (2024, effective 2025).

For transparency in how you handle data, maintain an accessible, plain-English policy and consent logs. See the internal reference to our Privacy Policy: data handling.

Implementation stack: Shopify + ESP + attribution (and when to enrich with server-side)

Start simple and add sophistication iteratively.

- Shopify + ESP (e.g., Klaviyo) setup

- Sync customer, product, and order data; map key events (viewed category, added to cart, checkout started, purchased)

- Implement core flows first (welcome, browse, cart, post-purchase) and layer segmentation rules

- Identity resolution and server-side tracking (when warranted)

- Benefits: more reliable event capture across devices/browsers, better match rates for paid audiences, and more dependable multi-touch ROI measurement; validate with before/after tests because impact varies by stack and traffic mix

- Attribution and measurement

- Track revenue per recipient, conversion from send, click-to-purchase odds, and 90-day CLV velocity by segment; run periodic holdout tests

When you’re ready to unify journeys across email, ads, and on-site events without heavy engineering, consider a purpose-built attribution and tracking layer like Attribuly. Disclosure: Attribuly is our product.

For Shopify-specific setup guidance, see our internal primer on Shopify Integration for Attribution and Email Marketing.

8 segmentation recipes that move the needle in furniture

Each recipe includes trigger(s), content direction, cadence, and primary KPIs. Start with 2–3, prove lift, then expand.

- High-Value Cart Abandoner (≥ $1,000 cart)

- Trigger: 2–4 hours after abandonment; reminder at 24 hours

- Content: financing options, delivery timelines, assembly/white-glove notes, trust badges; consider a room-bundle suggestion (sofa + rug + lighting) instead of a discount

- Cadence: 2–3 emails over 48 hours

- KPIs: recovery rate, revenue per recipient (RPR), margin

- New Homeowner / Mover

- Trigger: declared via quiz/checkout or inferred (address change, multiple large-category views)

- Content: 8–12 week nurture by room priority; planning checklists; AR/visualizer links; curated bundles

- Cadence: weekly early on, then biweekly; pause if purchase

- KPIs: multi-item attach rate, AOV uplift, time-to-first purchase

- Style Upgrader (premium intent, no purchase)

- Trigger: browsed premium collections 3+ sessions within 14 days

- Content: material education (leathers, woods), sustainability credentials, side-by-side collection comparisons, premium buyer UGC

- Cadence: 2–3 emails in 10 days

- KPIs: conversion within 14 days, gross margin

- Post-Purchase Care + Cross-Sell

- Trigger: delivery +7 days, +30 days, +90 days

- Content: care guides, assembly tips, accessory upsells (protectors, covers), referral prompt with UGC showcase

- Cadence: 3–4 touchpoints over 90 days

- KPIs: repeat purchase rate, attach rate, NPS/CSAT

- VIP by CLV (top 10% revenue, margin filter)

- Trigger: lifetime spend/frequency threshold; exclude coupon-only buyers if margins are tight

- Content: early access to collections, design consults, exclusive finishes; minimal discounts

- Cadence: monthly VIP digest + triggered invites

- KPIs: rolling 90-day CLV velocity, churn reduction

- Warranty/Service Milestone

- Trigger: 9–11 months post-purchase or ownership milestones by category

- Content: extended warranty, proactive care to reduce claims, service scheduling

- Cadence: 2 reminders

- KPIs: warranty attach rate, support ticket reduction

- Seasonal Refresh (ownership ≥ 18 months)

- Trigger: last major purchase date and category seasonality

- Content: seasonal styling guides, slipcovers, cushions, trade-in programs, reupholstery options

- Cadence: 2–3 emails around season change

- KPIs: reactivation rate, AOV, margin

- Room Completion Push

- Trigger: purchased key item (e.g., sofa) but missing complements within 30 days

- Content: curated “complete the room” sets, free shipping threshold, visual set builder

- Cadence: 1–2 nudges in 10 days

- KPIs: bundle attach rate, AOV

Tip: Flows and lifecycle segmentation consistently outperform batch sends in ecommerce; the 2024 dataset analyzed in the Omnisend 2025 report highlights that automated flows capture a disproportionate share of orders relative to send volume.

Automation and orchestration that protect deliverability and margins

Build your automation backbone first, then layer segments.

-

Must-have flows

- Welcome: educate on materials, delivery, and financing; gather zero-party data via a brief quiz

- Browse abandonment: collection or category-specific content; one-click “save for later”

- Cart abandonment: tiered by cart value; financing and delivery reassurance first, discount only as last resort

- Post-purchase: care, assembly, UGC, cross-sell accessories; warranty and service milestones

- Win-back: style refreshes, financing reminders, new collection spotlights

-

Engagement governance

- Tier lists by activity (opened/clicked in 30/60/90 days); mail highly engaged tiers first to protect sender reputation

- Sunsetting: suppress chronically unengaged contacts to avoid spam-folder drift

-

Channel coordination

- Use segments across SMS and paid retargeting with frequency caps; map journeys to avoid bombarding customers during delivery windows

Practical example: If a shopper abandons a $1,500 cart without logging in, identify them via server-side events and resolve identity where possible to trigger a cart flow without waiting for a form submit. A platform like Attribuly can help you recognize returning visitors and feed your ESP audiences for recovery while respecting consent and frequency rules.

Data you need on every profile (and how to store it)

| Category | Field examples | Why it matters |

|---|---|---|

| Intent & behavior | last category viewed, sessions in last 14 days, last cart value, checkout started | Power browse/cart triggers and prioritize high-intent segments |

| Preferences | room priority, style, budget band, materials | Enable relevant content and bundles, reduce discount dependence |

| Value & risk | lifetime spend, margin proxy, predicted CLV/churn | Govern VIP perks and discounting; concierge routing |

| Logistics | region, delivery constraints, lead time tolerance | Set expectations, avoid churn from long lead times |

| Consent | email/SMS opt-ins, topics, frequency | Legal compliance and deliverability |

Keep schemas lean. If a field isn’t actionable in the next 90 days, don’t collect it yet.

Measurement that ties to profit (not just opens)

- Core KPIs per segment: revenue per recipient, conversion from send, click-to-purchase odds, AOV, and 90-day CLV velocity

- Tests that matter: segmented vs. non-segmented sends, frequency tests by engagement tier, financing messaging vs. discounting, bundle vs. single-item merchandising

- Reconcile ESP and attribution: compare ESP-reported revenue with multi-touch attribution and run periodic holdout tests to validate incremental lift. For a sense of how better tracking clarifies ROI for Shopify brands, see our internal Sylvox case study on 5x ROI growth.

Klaviyo’s published benchmarks underscore that top performers in flows materially outpace median campaigns; consult the platform’s 2024/2025 benchmark resources to calibrate target ranges for your category before and after segmentation.

Risk and compliance checklist (use this in your playbook)

- Data minimization: capture only what fuels current segments; review quarterly

- Consent sync: unify opt-ins and preferences across email, SMS, and ads audiences

- Discount governance: set margin floors per segment; favor value props (financing, bundles, service)

- Deliverability: mail engaged tiers first; sunset non-engagers; monitor spam complaints

- Legal: adhere to the FTC’s email rules (CAN-SPAM, 2025) and the FCC’s TCPA text consent requirements effective 2025; maintain audit-ready logs

For a lifecycle overview that complements this checklist, see the practitioner-friendly customer lifecycle segmentation guide by Litmus (2024).

Advanced: Omnichannel activation and server-side tracking, without the dogma

- Activate segments beyond email: sync VIP, high-intent browsers, and cart abandoners to paid media with frequency caps and exclusion logic

- Sequence by journey: pause promotional pushes around delivery dates; switch to care content post-delivery

- Server-side events: test before/after uplift in captured conversions and match rates for audience sync; results vary, so instrument cleanly and evaluate on RPR and blended CAC/ROAS, not just clicks

Klaviyo’s omnichannel guidance around high-traffic periods (2025) provides practical orchestration patterns you can apply year-round to reduce overlap and improve frequency control (Klaviyo omnichannel strategies).

Bring it all together (what to do this quarter)

- Ship: welcome, browse, cart, and post-purchase flows with 30/60/90 engagement tiers

- Launch: 2 segmentation recipes (e.g., High-Value Cart Abandoner and Room Completion)

- Capture: zero-party fields (room, style, budget) and “moving soon?” prompt

- Measure: RPR and CLV velocity by segment; run a 10–20% holdout for lift

- Iterate: add VIP by CLV and New Homeowner flows after you validate the first two

Ready to unify journeys and prove incremental revenue? Try Attribuly for accurate attribution and segment activation across channels. (Soft CTA)