Innovative Customer Retention Strategies for Beauty Brands in 2025

As acquisition gets pricier and signals get fuzzier, the beauty brands that win in 2025 are the ones that operationalize retention, not just talk about it. What follows is a practitioner’s playbook: concrete workflows, test designs, KPIs, and pitfalls I’ve seen across DTC and Shopify-based beauty teams. Use this to implement, not just to ideate.

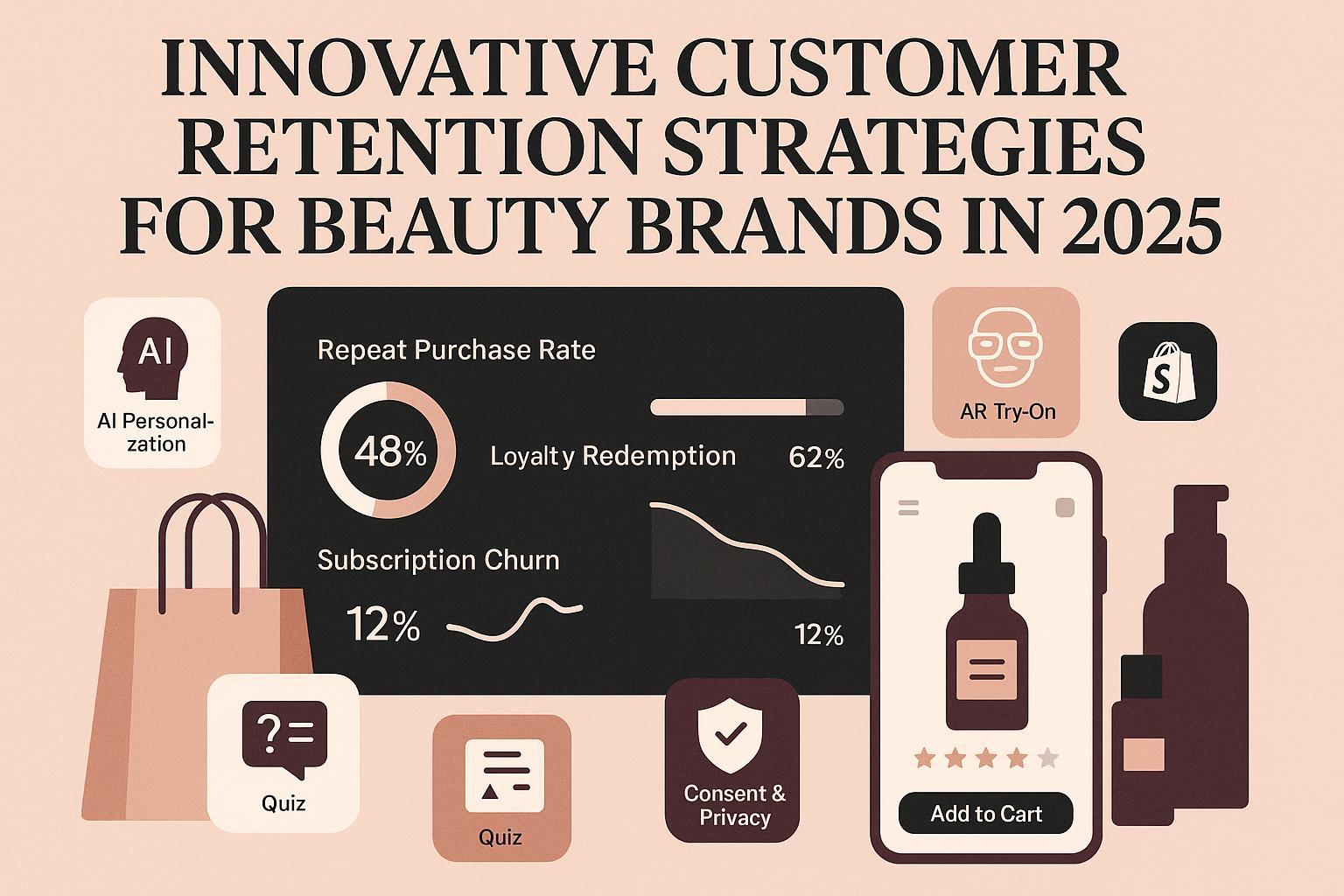

Calibrate Expectations with 2024–2025 Benchmarks

Before changing a single flow, align on baselines so you can calculate lift and decide where to invest.

- Email automation still outperforms broadcast. In the Omnisend 2025 Ecommerce Marketing Report (based on 2024 performance data), automated emails posted materially higher engagement and conversion versus scheduled campaigns; the report highlights large deltas in opens, clicks, and conversion for automations relative to batch sends. See the methodology and ranges in the Omnisend 2025 Ecommerce Marketing Report (2025).

- Loyalty pays when customers actually redeem rewards. Across industries, the Antavo Global Customer Loyalty Report (2025 survey) cites positive ROI and associates redemption with higher LTV; the directional takeaway is clear: optimize for redemption, not just enrollment. Review the headline findings in the Antavo Global Customer Loyalty Report 2025 (2025).

Use these as guardrails, not guarantees. Your stack, audience, and merchandising will influence outcomes.

Foundation First: Four Systems That Quietly Drive 60–70% of Retention Gains

You don’t need 20 initiatives at once. Execute these four with discipline and you’ll bank compounding gains.

1) Onboarding That Leads to First Routine, Not Just First Sale

- Trigger: Immediately after signup or first purchase.

- What to send (3–5 touches over 14 days):

- Day 0: Brand values and product education mapped to a simple routine (AM/PM). Include FAQs on shade/fit, patch tests, storage.

- Day 3–5: Social proof and short-form how-tos (30–60s). Surface UGC with skin type/concern context.

- Day 7–10: Cross-sell only if it completes the routine; avoid discounting before value is proven.

- Offer: Light incentive only for completing a quiz or adding shade/skin profile (zero-party data). Keep discounting minimal to prevent anchoring.

- Measure: 14-day placed order rate, first-to-second order conversion, time-to-second order.

- Pitfalls: Over-discounting in email 1; no education for first-time users of actives (leads to returns or churn).

2) Post-Purchase Education That Prevents Buyer’s Remorse

- Trigger: Transaction + fulfillment events (ordered, shipped, delivered, 7-day usage mark).

- What to send:

- Shipped: Application tips and a 30-second video; set outcome expectations honestly (e.g., “expect visible results in 2–4 weeks for hyperpigmentation”).

- Delivered: Quick-start guide, patch test reminders, storage and shelf-life.

- Day 7: Troubleshooting and routine pairing suggestions.

- Offer: Access to a community Q&A or virtual consult; avoid immediate discounting.

- Measure: Product return rate, first 30-day support tickets per 1,000 orders, 60-day repeat purchase rate.

- Pitfalls: Silence post-delivery; support overwhelmed because CX insights aren’t fed back into flows.

3) Replenishment Windows That Respect Real Usage

- Trigger: Expected depletion window by SKU (e.g., 30/45/60 days based on typical usage).

- What to send:

- T-7 days: Reminder with “skip this time” control; optional trial-size add-on.

- Day 0: One-click reorder or subscribe-and-save offer.

- Day +7: Winback with education, not just a discount.

- Measure: Reorder rate by SKU at 30/45/60 days, reorder margin vs. discount cost, opt-in to subscribe.

- Pitfalls: Uniform timing for diverse SKUs; no skip/swap options leading to overstock frustration.

4) Support-to-Marketing Feedback Loop

- Trigger: Support tags (shade mismatch, sensitivity, breakouts, pump issues).

- What to do:

- Pipe tagged reasons into lifecycle segments. If “shade mismatch” is frequent, insert a shade tool in onboarding and a free exchange policy into post-purchase flows.

- Publish public fixes (e.g., new pump) with a proactive check-in to affected cohorts.

- Measure: Ticket volume per 1,000 orders, repeat purchase rate within affected cohorts, NPS/CSAT trend.

- Pitfalls: Keeping CX as an isolated function; untagged tickets that never inform marketing.

2025 Plays That Differentiate: Step-by-Step and Test-Ready

These are the levers we see moving the needle most when layered on top of strong foundations.

A) AI Personalization and Predictive Churn You Can Actually Ship

- Start points:

- Data: Use first- and zero-party signals you already own—skin type, sensitivity flags, shade, routine length—and behavioral events (pages, products, time since purchase).

- Flows to augment first: welcome, post-purchase education, replenishment.

- Execution: Create “next best action” rules by segment (e.g., high-churn-risk + sensitive skin = more education, no acids cross-sell).

- Testing: Holdouts at the segment level; 60–90-day windows to see repeat effects.

- Expected impact: Cross-industry analyses attribute material revenue and efficiency gains to personalization when implemented well; treat these as ceilings and validate with your data. See high-level ranges summarized in the McKinsey-cited personalization uplift discussions (referenced in 2025 coverage).

- Pitfalls: Models trained on sparse or biased data; over-targeting deep discounts to high-risk users.

B) Zero-Party Data via Quizzes and Diagnostics (Value Exchange First)

- Why: With third-party cookies deprecating, explicit preference data enables transparent personalization. Forrester’s 2024 perspective frames zero-party data as strategically central. See the Forrester zero-party data overview (2024).

- What to collect: Skin type, shade family, sensitivity, routine length, budget range, goals (e.g., hyperpigmentation, acne), fragrance tolerance.

- UX rules: 6–10 questions, visual choices, progress bar, and immediate value—shade match, regimen, or content library.

- Reuse: Map outputs to tags for onboarding, post-purchase, replenishment timing, and loyalty perks.

- Measure: Quiz completion rate, email/SMS opt-in rate, first-to-second order conversion for quiz completers vs. non-completers.

- Pitfalls: Asking for too much without clear payoff; not honoring privacy preferences in downstream messaging.

C) AR Try-On and Live Shopping to Reduce Friction and Boost Confidence

- Where it shines: Color cosmetics (lip, foundation, brows) and brow mapping; decision support that reduces returns and increases confidence.

- Evidence snapshot:

- Media coverage of vendor-reported data suggests significant conversion uplift from virtual try-on; RetailDive’s 2024 brief on Perfect Corp cites notable increases in conversion among brands adopting VTO. Read the context in RetailDive on virtual try-on conversion (2024).

- Complementary 2025 sector reporting also notes that AR try-on cohorts can be more likely to purchase and may spend more; review directional ranges in the BrandXR 2025 AR in retail report (2025).

- Implementation:

- Start with a single high-volume category to avoid spread-thin ops. Add A/B on PDP with and without VTO.

- Track conversion, return rate, and 60/90-day repeat purchase deltas for AR users vs. non-AR users.

- Pitfalls: Cannibalizing PDP traffic without incremental lift; not tracking cohorts beyond the first order.

D) Gamified Loyalty That Optimizes for Redemption, Not Just Enrollment

- North star: Redemption. Cross-industry survey data in 2025 ties reward redemption to higher LTV and positive ROI for program owners; see summarized findings in the Antavo Global Customer Loyalty Report 2025 (2025).

- Design:

- Three tiers with clear experiential perks (early access, mini consultations, free shade swaps).

- Earning beyond spend: UGC, reviews with skin type context, quiz completion, attending live events.

- Personalized rewards: rotate benefits based on sensitivity flags or shade families.

- Measure: Enrollment → first redemption rate, LTV of redeemers vs. non-redeemers, breakage, cost per point redeemed, ROAS by perk.

- Pitfalls: Hoarding points due to irrelevant rewards; hidden redemption friction.

E) Subscriptions and Refills with Real Control

- Why: Beauty replenishment SKUs lend themselves to subscribe-and-save, but churn control is everything.

- Controls: Skip, swap, pause, and frequency sliders; prepay with bonus; proactive dunning (smart retries, card updater).

- Benchmarks: In physical-goods subscriptions, 2025 snapshots place average monthly churn in the low single digits; treat as directional and benchmark your model type. See context in the Recurly State of Subscriptions (2025).

- Measure: Voluntary vs. involuntary churn, save rate after skip/swap/offer, contribution margin net of discount.

- Pitfalls: One-size cadence; heavy discounts masking poor product-market fit.

Measurement and Attribution: How to Prove Incremental Retention Lift

A retention strategy without measurement is just a to-do list. Build a simple, repeatable attribution and cohorting workflow.

- Cohort design:

- Define cohorts by first touch/first purchase month, acquisition channel, and key behaviors (AR user vs. non-AR, quiz completer vs. none, loyalty redeemer vs. non-redeemer).

- Track 30/60/90-day repeat purchase, AOV, and contribution margin per cohort.

- Test design:

- Use holdouts for each major tactic (e.g., 10–20% no-AR exposure, no-loyalty-perk, or generic vs. personalized content) to isolate incremental lift.

- Identity and multi-touch:

- Resolve cross-device and cross-channel journeys to avoid last-click bias, especially when live shopping, AR, and social-driven discovery are in play.

Example, tool-assisted workflow: We’ve used Attribuly to connect identity-resolved journeys with cohort-level LTV, comparing AR try-on users versus non-users and isolating incremental effects from loyalty reward redeemers across channels. Disclosure: Attribuly is our product.

- Reporting cadence:

- Weekly: leading indicators (quiz completion, redemption rate, subscription save rate).

- Monthly: cohort LTV deltas, 60/90-day repeat purchase, margin impact.

- Pitfalls: Declaring victory on week-one conversion; not reconciling subscription revenue with one-off orders in cohort LTV.

Case Notes and Common Failure Modes in Beauty

- Shade/fit churn: Missing shade exchanges compound returns and negative reviews. Add free exchanges into post-purchase and loyalty perks; track exchange-to-repeat purchase conversion.

- Over-discounting: Training VIPs to wait for 25–30% off erodes contribution. Shift value to experiential perks and early access.

- AR cannibalization: If AR merely shifts purchases earlier, run holdouts and compare 60/90-day retention.

- Consent drop-offs: Consent Mode v2 and stricter privacy regimes can shrink remarketing pools. Implement properly and monitor measurement impacts.

Privacy and Consent: Make It a Retention Advantage

Compliant, transparent data practices improve trust and future engagement. Treat privacy as a product feature.

- Consent Mode v2 for EEA and beyond

- Implement consent flags for ad_user_data and ad_personalization with a CMP; confirm data flows through your tag manager and server-side pipeline. For a practical technical walkthrough, see Simo Ahava’s Consent Mode v2 guide (2024).

- Verify GA4 consent diagnostics and ensure events are properly consented; review steps in Google’s GA4 consent help center (2024).

- CPRA/GDPR operating principles

- Data minimization and purpose limitation; disclose retention periods and provide self-serve rights (access, deletion, opt-out of sharing).

- Bake consent into quizzes and signup forms, and store logs. Update privacy notices to include zero-party data collection and loyalty.

- Practical checklist

- CMP implemented across web/app, mapping purposes to tags.

- Consent passed to ads/analytics via GTM or server-side tagging.

- Retention schedules and purge cycles maintained.

- Vendor/subprocessor audit and cross-border transfer assessment.

KPI Scoreboard and Review Cadence

Track inputs and outputs; kill what doesn’t work and double down on what does.

- Repeat purchase rate (RPR) = returning customers / total customers over a period. Segment by acquisition cohort and primary SKU category.

- 60/90-day reorder rate for replenishable SKUs.

- LTV by cohort at 30/60/90/180 days; break out AR users, quiz completers, loyalty redeemers, and subscribers.

- Loyalty redemption rate = redemptions / members. Also track time-to-first redemption and LTV delta of redeemers.

- Subscription churn, voluntary vs. involuntary; save rate after skip/swap or save-offer; dunning recovery rate.

- Email/SMS flow revenue contribution vs. broadcast; use automation share of revenue as a target informed by the Omnisend 2025 Ecommerce Marketing Report (2025) data patterns.

- Consent and addressability: percentage of identifiable traffic/orders post-Consent Mode v2; remarketing audience size trend.

Review rhythm

- Weekly: Leading indicators (quiz completion, AR engagement, subscription saves, consent rates).

- Monthly: Cohort RPR/LTV and loyalty redemption cohorts.

- Quarterly: Strategic resets—trim flows, rebalance perks, revisit AR/live content ROI with holdouts.

30/60/90-Day Execution Plan

A pragmatic rollout sequence that balances speed with measurement quality.

-

Days 1–30: Stabilize and measure foundations

- Refresh onboarding and post-purchase education (3–5 touches each). Add shade/fit guidance and free exchange policy.

- Implement replenishment windows per SKU with skip/swap.

- Stand up core dashboards: cohorts by month/channel; 30/60/90-day RPR; loyalty enrollment and first redemption.

- Privacy: finalize CMP and Consent Mode v2 piping; verify GA4 consent diagnostics.

-

Days 31–60: Layer high-impact innovations with holdouts

- Launch zero-party quiz (6–10 questions) with immediate value (shade match or regimen). Map tags to flows.

- Pilot AR try-on on one hero category with A/B on PDP and holdout. Track returns and 60/90-day repeat deltas.

- Loyalty revamp focused on redemption: define three tiers, experiential perks, and non-spend earners (UGC, reviews). Ship frictionless redemption UX.

-

Days 61–90: Personalize and scale subscriptions

- Add AI/predictive rules to onboarding and replenishment (e.g., education-first for sensitive skin; no-acid cross-sell).

- Launch subscribe-and-save with skip/swap/pause and proactive dunning. Monitor voluntary vs. involuntary churn.

- Attribution: formalize cohort reporting and holdout analysis; review AR/quiz/loyalty incremental LTV. Consider adding an identity-resolved, multi-touch analytics layer to keep last-click bias in check. We often use Attribuly internally here to stitch journeys and compare cohort LTV across tactics.

What to Communicate Upwards

- Expected ranges, not promises: tie each initiative to benchmarks and your own pre/post tests.

- Confidence grows with time: treat 60/90-day readouts as the first meaningful signal for retention initiatives.

- Privacy is a growth enabler: higher trust leads to more zero-party data, which improves personalization and reduces returns.

Additional Resources and References

- Email automation performance patterns: Omnisend 2025 Ecommerce Marketing Report (2025).

- Loyalty ROI and redemption/LTV linkages: Antavo Global Customer Loyalty Report 2025 (2025).

- AR try-on conversion context: RetailDive on virtual try-on conversion (2024) and directional 2025 sector ranges: BrandXR 2025 AR in retail (2025).

- Zero-party data primer: Forrester zero-party data overview (2024).

- Subscription churn context: Recurly State of Subscriptions (2025).

- Consent implementation and verification: Simo Ahava’s Consent Mode v2 guide (2024) and Google GA4 consent help center (2024).

If you implement the foundations, layer the 2025 plays with disciplined testing, and keep your privacy house in order, your retention curve will get healthier quarter by quarter. And if you need a single source of truth to measure incremental lift across AR, loyalty, quizzes, and subscriptions, consider adding a multi-touch, identity-resolved analytics layer; our team often relies on Attribuly for this purpose.