Customer Retention Email Strategies for Lifestyle Shopify Brands (2025)

Lifestyle brands win retention by systemizing the customer lifecycle, not by blasting more campaigns. In 2025, automated flows consistently outperform one-off sends on opens, clicks, and conversions. The playbook below distills what’s working right now for Shopify merchants—triggers, cadences, segmentation, deliverability guardrails, and measurement—so you can ship improvements this quarter, not “someday.”

The only KPIs that matter (and how to read them in 2025)

- Revenue per recipient (RPR) or revenue per send: primary efficiency metric for flows and campaigns.

- Click-to-open rate (CTOR) and conversion rate: better quality indicators than opens post-privacy updates.

- Contribution to repeat purchase rate and lifetime value: track in your retention scorecard.

Across ecommerce ESP datasets in 2025, automated flows materially outperform campaigns. For example, Klaviyo reports automated flows averaging higher engagement and conversion than campaigns in their 2025 dataset, with flows showing stronger open, click, and conversion performance than one-off sends according to the Klaviyo 2025 email benchmarks. Omnisend’s 2025 analysis similarly shows automated emails delivering outsized revenue relative to send volume and highlights welcome, browse, and cart flows as top order drivers in their 2025 email statistics roundup.

If you need a simple business lens to prioritize, align your goal stack to RPR and profit: see our primer on Revenue Per Visitor (RPV) for ecommerce and how to pull the levers.

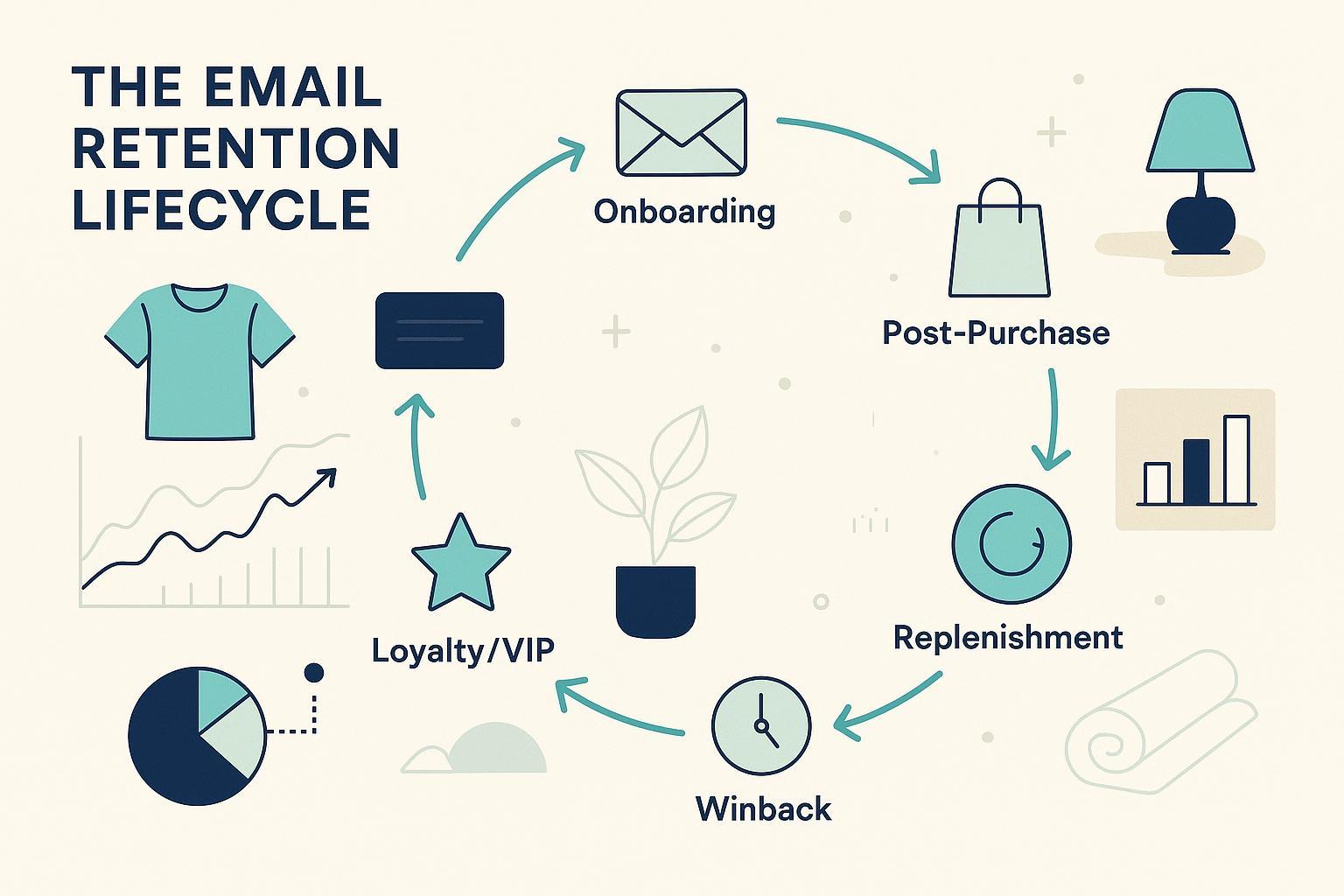

Lifecycle backbone for lifestyle brands: five flows to operationalize

Below are the flows we install first for Shopify lifestyle stores (apparel, wellness, home, beauty). For each: trigger, cadence, content checklist, segmentation rules, and quick tests.

1) Welcome and Onboarding

- Trigger: New subscriber or first-purchase customer.

- Cadence: 1st send immediately; 2–3 follow-ups over 3–7 days. Test spacing by AOV and purchase urgency.

- Content:

- Story and proof: why the brand exists, quality cues, social proof.

- Preference capture: style/size/scent interests; link to a preference center.

- First value: a non-discount “win” (fit guide, routine builder) before promos.

- Segmentation:

- Split paths for “subscriber only” vs. “first-time purchaser.”

- Suppress if they’ve started checkout or purchased since entering.

- Tests:

- Lead with story vs. lead with product curation.

- Incentive placement (email 1 vs. email 2) and size tiers by margin.

Reference patterns and examples are compiled in the Klaviyo welcome email examples (2025).

2) Post‑purchase (education, care, cross‑sell, reviews)

- Trigger: Order Placed → Fulfilled → Delivered events.

- Cadence:

- Transactional confirmations as events occur.

- Care/how‑to: 2–5 days after delivery.

- Review/UGC ask: 5–10 days post‑delivery (longer for slow-to-experience products).

- Content:

- Setup and care instructions; reduce buyer remorse.

- Community and social: how to share or get support.

- Tasteful cross‑sell: complementary items or bundles; avoid discounts for full-price VIPs.

- Review request: clear CTA; optional UGC incentive per platform rules.

- Segmentation:

- Branch by SKU or category; avoid recommending what they already own.

- Exclude customers with open support tickets from review requests.

- Tests:

- Video vs. step-by-step care guides.

- Review request at day 5 vs. day 10 vs. tied to “Delivered” confirmation from the carrier.

Shopify’s automation capabilities and ecommerce events make these flows straightforward to build; see the Shopify Enterprise overview of automation complexity (2024).

3) Replenishment and subscription nudges

- Trigger: Estimated depletion windows by SKU (e.g., 25–35 days for serum, 60–75 for supplements), based on cohort behavior.

- Cadence:

- T‑7 days pre‑depletion and day‑of reminders.

- Add an SMS reminder only for consented, high-intent segments.

- Content:

- One‑click reorder; subscription benefits (skip, swap, save).

- Non‑discount perk first (free shipping or early access); reserve % off for lower‑margin cohorts.

- Segmentation:

- Different windows for heavy vs. light users.

- Suppress if already subscribed or if inventory constraints apply.

- Tests:

- Dynamic timing (based on last usage survey) vs. static intervals.

- “Subscribe & save” vs. “bulk and save.”

For more tactics, this breakdown of Amazon‑inspired replenishment and review plays for DTC in 2025 shows proven patterns to borrow responsibly.

4) VIP and loyalty tier communications

- Trigger: Tier attainment, spend thresholds, anniversaries, birthdays.

- Cadence:

- Monthly or quarterly value drops; event‑based triggers for launches and early access.

- Content:

- Recognition: “You’re in,” “Anniversary unlocked.”

- Perks first: early access, limited collabs, concierge support.

- Monetary incentives last, and only where margin allows.

- Segmentation:

- Treat VIPs without constant discounting; use perks and exclusivity.

- Separate “silent VIPs” (high spend, low engagement) with lower-frequency, higher-value touchpoints.

- Tests:

- Perk-first vs. discount-first.

- Exclusive content drops vs. private sale invites.

Omnisend’s 2025 dataset surfaces strong engagement from birthday and back‑in‑stock automations within loyalty programs; see the Omnisend 2025 ecommerce email statistics.

5) Churn risk and winback

- Trigger:

- Inactivity windows: 30/45/60 days since last purchase or engagement (calibrated to your buying cycle).

- Predictive risk scores where available.

- Cadence:

- Progressive: value reminder → new-in/category curation → incentive test → opt-down/sunset.

- Content:

- “We miss you” with fresh reasons to return.

- Preference-update and opt‑down (e.g., “monthly digest only”).

- Segmentation:

- Exclude recent purchasers.

- Separate high-LTV lapsed customers for white‑glove outreach.

- Tests:

- Incentive presence and size by margin tier.

- Product-first vs. story-first winbacks.

Klaviyo’s community guidance and benchmarks consistently show winback flows performing above comparable campaigns; see the 2025 guidance linked from the Klaviyo benchmarks article.

Orchestrating email and SMS without cannibalization

Roles:

- Email: rich storytelling, education, post‑purchase care, loyalty benefits.

- SMS: time‑sensitive alerts (cart, restock, flash), delivery updates, two‑way support.

Consent and compliance:

- Collect SMS consent at Shopify checkout and thank‑you pages; sync consent to profiles and honor STOP/HELP.

- Reference implementation guidance in Klaviyo’s Shopify checkout SMS consent docs (2024) and their thank‑you page/consent articles.

Orchestration rules that prevent fatigue:

- Mutual exclusions: if a cart‑abandon SMS fires within 60 minutes, delay the cart‑abandon email 12–24 hours.

- Frequency caps: max N promotional touches per 7 days, with flow priorities for transactional and post‑purchase education.

- Channel affinity: send via the channel the customer tends to engage with; many ESPs offer predictive/channel‑affinity options.

Klaviyo outlines omnichannel messaging capabilities and channel affinity in its solutions hub; see Klaviyo omnichannel messaging.

Deliverability guardrails (Gmail/Yahoo 2024–2025)

If you send ~5,000+ emails/day to Gmail/Yahoo, you must comply with tightened rules that rolled out in 2024. Core requirements consistently confirmed across reputable sources:

- Authenticate with SPF and DKIM, and publish DMARC with alignment (p=none minimum; stronger policies preferred).

- Enable one‑click unsubscribe (List‑Unsubscribe header) and honor within 2 business days.

- Keep spam complaints low (stay well under ~0.3%; aim <0.1%) and maintain list hygiene.

Clear overviews are available from AWS’s 2024 explainer of Gmail/Yahoo bulk‑sender changes and timelines in the AWS bulk‑sender changes overview (2024), and Yahoo’s own Sender best practices hub. Klaviyo also summarizes the 2024 requirements for marketers in their Google & Yahoo sender requirements guide (2024).

Operational tips for Shopify brands:

- Use a branded sending domain; align From: with your authenticated domain.

- Run a rolling sunset for chronic non‑engagers; don’t wait for spam spikes.

- Add a visible preferences link and keep the footer crystal‑clear.

- QA templates for headers and rendering before big pushes.

Segmentation that actually moves retention

Use RFM + engagement + zero‑party data as your base, then layer SKU lifecycle signals.

- RFM tiers: recency windows (e.g., 0–30, 31–60, 61–120+), frequency thresholds (1, 2–3, 4+), and monetary bands by AOV.

- Engagement: recent site visits, clicks, or replies; suppress chronic non‑openers after re‑engagement attempts.

- Zero‑party: size, shade, scent, style, or routine preferences captured via quizzes or preference centers.

- SKU lifecycle: consumption‑based timing for replenishment; “owned items” filters for cross‑sell relevance.

- Predictive: where available, use churn propensity or expected order date to sequence.

If you’re still defining the lifecycle model vs. journeys, this primer clarifies the difference and how to deploy both: Customer lifecycle vs. customer journey for ecommerce (2025).

Practical incentive logic by segment:

- New buyers: emphasize education, care, and social proof; keep incentives light.

- VIPs: perks/priority over discounts; reserve cash incentives for clearance or reactivation.

- Lapsing mid‑tier: time‑boxed offers tied to categories they browsed.

Creative patterns that fit lifestyle brands

- Educate first: care cards, routines, lookbooks, or “how we make it” content.

- Community: show real customers; include UGC highlights and micro‑features.

- Copy templates you can adapt today:

- Welcome #1 subject: “Let’s find your perfect [category]” → Content: 3 curated fits + 1‑minute preference capture.

- Post‑purchase care: “Everything you need for day 1 with [product]” → Content: setup checklist + 30‑second video.

- Replenishment: “Running low? 1‑click to restock” → Content: reorder button + skip/swap/subscription perks.

- VIP drop: “Early access unlocked (48 hours)” → Content: limited items + no code needed + concierge link.

- Winback: “We saved your favorites” → Content: 3 new‑in picks + opt‑down to monthly digest.

Measuring retention impact and attribution (without over‑crediting)

Relying on last‑click alone will systematically over‑credit the final touch (often a discount email) and under‑value upstream flows like onboarding and education. A practical approach:

- Track RPR and conversion per flow email.

- Attribute at the customer level for repeat purchase rate and time‑to‑second order.

- Use multi‑touch or position‑based models to value nurturing touches.

Practical example (workflow, 90 seconds):

- Build segments (e.g., High RFM, Predicted Churn) and trigger flow webhooks to your ESP; record touchpoints and revenue back to your attribution layer.

- First‑mention disclosure and product reference: We use Attribuly in-house for multi‑touch attribution and audience syncing. Disclosure: Attribuly is our product.

- Readout weekly: RPR by flow, incremental revenue vs. pre‑period, and margin‑aware incentive ROI.

Troubleshooting: five issues I see most (and quick fixes)

- Flow collisions cause over‑messaging.

- Fix: Add mutual exclusions and a global frequency cap; prioritize transactional and post‑purchase.

- Blanket discounts erode margin.

- Fix: Use perk‑first for VIPs; gate incentives by margin tiers and segment value.

- Static replenishment windows miss the moment.

- Fix: Move to cohort‑based depletion timing from SKU lifecycle data.

- Deliverability drifts after list growth.

- Fix: Enforce weekly sunset of non‑engagers; monitor complaints; keep DMARC aligned and List‑Unsubscribe active.

- Vanity metrics stall decisions.

- Fix: Optimize to CTOR, conversion, and RPR; review by segment, not list‑wide averages.

A 90‑day rollout plan (ship value every two weeks)

Weeks 1–2: Foundation and compliance

- Authenticate SPF/DKIM/DMARC; enable one‑click unsubscribe; verify complaint monitoring per the 2024 Gmail/Yahoo rules cited above.

- Implement a basic preference center and consent capture for SMS (checkout + thank‑you).

- Ship Welcome v1 (2–3 emails) and Post‑purchase v1 (care + review request).

Weeks 3–4: Orchestration and hygiene

- Add frequency caps and mutual exclusions across flows; define SMS windows.

- Launch Review/UGC request and a simple Cross‑sell branch by category.

Weeks 5–6: Replenishment and early VIP

- Build SKU‑based replenishment (T‑7 and day‑of); test a “subscribe & save” variant.

- Draft VIP tier definitions; soft‑launch an early access email to top 5% spenders.

- For added ideas, skim the Amazon‑inspired DTC retention tactics (2025).

Weeks 7–8: Winback and sunset

- Implement 45/60‑day winback with opt‑down and progressive incentive logic.

- Launch a rolling sunset for chronic non‑engagers to protect deliverability.

Weeks 9–10: Measurement and iteration

- Create a weekly retention dashboard: RPR, CTOR, conversion, and repeat purchase contribution by flow.

- Add cohort analysis for time‑to‑second order and LTV movement.

Weeks 11–12: Scale and polish

- Expand VIP comms (birthday, anniversary, early access schedule).

- Test creative: video care guides vs. static, different subject framings by segment.

- Tighten incentive governance by margin tier and inventory position.

Operational playbooks and role setup are outlined in our practitioner guide: Customer retention manager best practices for 2025.

Implementation notes for Shopify + common ESPs

- Shopify Email/Automations: Build under Marketing → Automations; templates exist for welcome, abandoned checkout, and thank‑you. The Shopify article on automated email campaigns provides patterns you can adapt.

- Klaviyo flows: Use Shopify triggers (Placed Order, Fulfilled Order, Delivered via integrations), add product recommendation blocks, and branch by SKU. Their help center and 2025 benchmark references show why flows outperform; see the Klaviyo 2025 benchmarks hub.

- SMS consent: Reconfirm collection at checkout/thank‑you using Klaviyo’s Shopify blocks; start with cart/re‑stock SMS, then add VIP alerts. Implementation guidance at Klaviyo’s Shopify checkout SMS consent (2024).

What success looks like by quarter

- Operational: Five core flows live; mutual exclusions and caps enforced; consent and preferences functioning.

- Performance: RPR trending up, CTOR stable or improving, complaint rate below 0.1%. Repeat purchase rate improves vs. last quarter for comparable cohorts.

- Creative: Education‑first templates in place; VIP perks calendar scheduled.

- Measurement: Weekly readouts with multi‑touch context; incentives governed by margin and segment value.

By anchoring your program on these five flows, enforcing deliverability and consent discipline, and reading performance through RPR and multi‑touch lenses, you’ll compound retention gains quarter after quarter—without burning lists or margins. Ship the first two flows this week, then iterate.