Leveraging Customer Retention Automation to Enhance Customer Loyalty

Retention automation pays off when it’s mapped to real customer moments and governed carefully. Two anchor points set the tone for 2025: automated lifecycle messages dramatically outperform batch sends—Omnisend’s 2025 analysis of billions of messages shows automations drive a disproportionate share of orders and that “1 in 3 clicks from automations leads to purchase,” far ahead of scheduled blasts (end of 2023 data in the 2025 report) according to the Omnisend 2025 benchmarks. See the detailed breakdown in the Omnisend 2025 email & SMS benchmarks. In parallel, cross‑channel personalization correlates with measurably higher retention; the Braze Global Customer Engagement Review (2025) highlights significant gains in 90‑day retention as brands add channels and orchestrate messages.

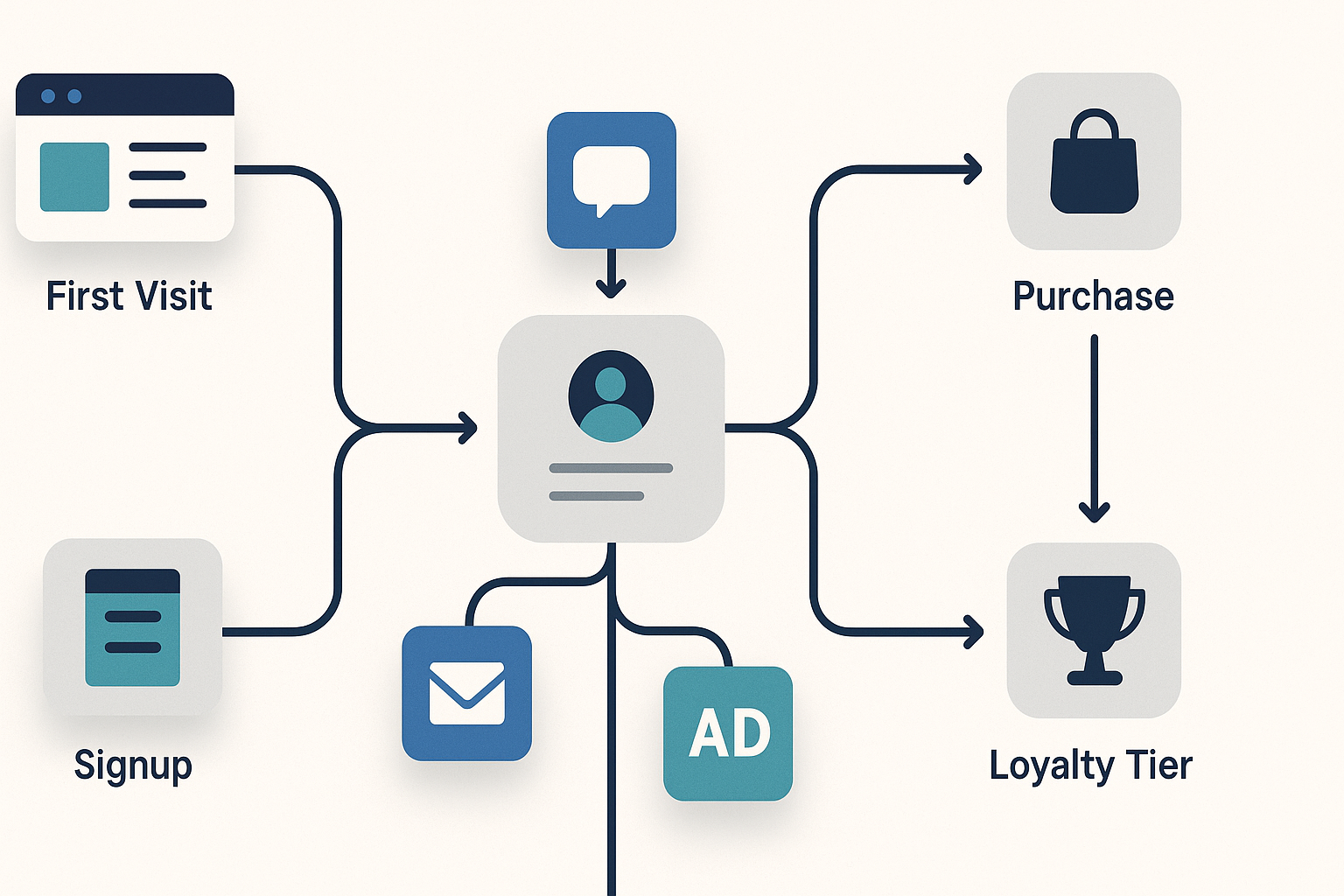

Foundation first: data, identity, and deliverability

Before turning on new automations, get the plumbing right. I’ve seen more programs stall from shaky foundations than from creative gaps.

-

Identity resolution and events

- Unify identities across email, SMS, site, and support tickets; de‑duplicate profiles so the same person isn’t treated as multiple contacts.

- Stream key events in near real time: signup, viewed product, added to cart, order created/paid/fulfilled, delivered, return initiated, NPS/submitted ticket.

- Track channel consent states; store proof of consent with timestamps to support opt‑in compliance.

-

Deliverability governance (2024–2025 bulk‑sender standards)

- Authenticate your domain: aligned SPF, DKIM, and DMARC; implement one‑click list‑unsubscribe; monitor complaint rates—aim for ~<0.1% and never exceed ~0.3% to avoid filtering. A practical overview of the 2024 Gmail/Yahoo requirements is outlined in the Amazon SES guide to navigating bulk sender requirements and the Mailgun State of Email Deliverability chapter on “Yahoogle” bulk senders. Cross‑check with your ESP’s latest docs.

- Use Postmaster Tools, seed testing, and suppression rules to keep your sender reputation healthy.

-

Safety rails

- Frequency caps per channel (and global caps across channels) to prevent collisions.

- Quiet hours for SMS and time‑zone aware sending for email.

- A governance doc that maps who sends what, from which system, and how conflicts are resolved.

Lifecycle automation playbooks that actually move the needle

Each workflow below includes trigger, timing, channel mix, core messages, and KPIs. Treat them as starting points—A/B test into your best variants.

1) Welcome and onboarding

- Trigger: New email/SMS signup or first purchase.

- Timing: First message immediately; 2–3 follow‑ups over 5–7 days.

- Channels: Email primary; SMS optional with consent.

- Core messages: Brand promise, best sellers, UGC, and a quick preferences prompt.

- KPIs: Open rate (welcome often reaches 50%+), CTR, first‑purchase conversion, revenue per recipient.

- How to build (3–5 steps):

- Send a “you’re in” with a clear value prop and social proof.

- Ask for intent/preferences in message 2; use a short quiz or single‑click tags.

- Showcase top categories and a gentle incentive (if brand‑appropriate).

- Branch: new purchasers exit to post‑purchase; non‑purchasers receive one more education/nudge.

Reference implementation details are covered in the Klaviyo Welcome series documentation and reinforced by the high performance of welcome flows highlighted in the Omnisend 2025 benchmarks.

2) Post‑purchase journey

- Trigger: Order placed; ship and delivery events.

- Timing: Confirmation immediately; delivery confirmation; review request 7–14 days post‑delivery; cross‑sell 7–14 days after the review request.

- Channels: Email; SMS for time‑sensitive updates.

- Core messages: Thank‑you, care/how‑to content, review/UGC request, tailored cross‑sell or accessories.

- KPIs: Review submission rate, CSAT, repeat purchase rate, revenue from cross‑sell.

- How to build:

- Confirmation and “what to expect” timeline.

- Delivery confirmation with product care/use tips.

- Review/UGC request with friction‑free submission.

- Cross‑sell based on item purchased and category affinities.

Helpful patterns and timing cues are outlined in the Klaviyo post‑purchase flow guide and validated by automation performance in the Omnisend 2025 report.

3) Replenishment / reorder

- Trigger: Predicted next order date (PNOD) for consumables or time‑since‑purchase heuristics.

- Timing: Reminder a few days before predicted depletion; follow‑up 5–7 days later if no action.

- Channels: Email + SMS.

- Core messages: “Running low?” prompt, 1‑click reorder, subscription option for convenience.

- KPIs: Reorder rate, subscription sign‑ups, revenue per recipient.

- How to build:

- Use your platform’s predictive property or a simple 30/45/60‑day cadence by SKU.

- Include a 1‑click reorder link tied to the last SKU(s).

- Offer a friction‑free subscription toggle with flexible cadence.

Practitioners commonly leverage PNOD and similar AI features to power these flows; see discussions of predictive properties in practitioner explainers such as the Magnet Monster overview of Klaviyo AI functions and PNOD usage in 2024–2025 (context guide, not official docs): Magnet Monster’s PNOD guide.

4) Churn prediction and deflection

- Trigger: Inactivity thresholds (e.g., 45–60 days post‑purchase), negative NPS, high return rates, or a support complaint.

- Timing: Immediate check‑in; follow‑ups 3–7 days apart.

- Channels: Email + SMS; optional paid audience sync for retargeting.

- Core messages: Empathetic “we noticed,” friction removal (FAQ/support), relevant product recommendations, occasionally a targeted incentive.

- KPIs: Reactivation rate, time‑to‑repeat, unsubscribe/complaint rate (guardrail).

- How to build:

- Score customers using RFM and engagement; flag “at‑risk” cohorts.

- Send a helpful check‑in with support links and non‑pushy recommendations.

- If no response, test a time‑bounded incentive or “exclusive access.”

- Sync the at‑risk cohort to paid channels to align ads with messaging.

Braze’s orchestration and personalization concepts give a practical blueprint for timing and channel selection; the Braze e‑commerce personalization guidance (2025 library) provides useful patterns to adapt.

5) Win‑back

- Trigger: Prolonged inactivity (e.g., 60–90+ days since last purchase or engagement).

- Timing: Initial win‑back at 60–90 days; follow‑up 7–14 days later; a final “we’ll pause” message ~30 days after that.

- Channels: Email + SMS; optional paid retargeting.

- Core messages: New arrivals, curated picks, social proof; consider non‑discount incentives (early access, bundles) for high‑LTV segments.

- KPIs: Win‑back conversion rate, revenue recovered, deliverability health.

- How to build:

- Segment dormant customers by prior AOV/LTV.

- Offer non‑discount value first; reserve discounts for price‑sensitive cohorts.

- End with a gentle pause/welcome‑back option to protect sender reputation.

Omnisend’s best‑practice posts provide timing and content guardrails for win‑back flows; see the Omnisend e‑commerce best practices hub.

6) Subscription pause/save (for DTC subscriptions)

- Trigger: Pause or cancel intent from the subscriber portal or a support event.

- Timing: Immediate acknowledgment; save offer within 24 hours; follow‑up 3–7 days later.

- Channels: In‑portal modals + Email/SMS.

- Core messages: Skip/shorten cadence, product swaps, downsell plan, loyalty perks.

- KPIs: Save rate, time‑to‑reactivation, subscriber LTV.

- How to build:

- Present “skip,” “delay,” and “swap” options at cancel intent.

- Offer a right‑sized downsell (smaller pack, extended cadence).

- Reinforce loyalty benefits tied to active subscription.

Recharge and similar platforms provide patterns for these flows; adapt to your catalog and churn reasons.

Where AI helps today (and where to proceed with caution)

-

Proven levers with broad support in 2025 research

- Channel orchestration and personalization: As brands add channels and coordinate timing/content, retention improves, as highlighted in the Braze Global Customer Engagement Review 2025.

- Automation vs. batch: Automated lifecycle sends outperform scheduled campaigns by wide margins, per the Omnisend 2025 benchmarks.

-

Practical AI you can deploy now

- Predictive churn cohorts using RFM + behavior signals; treat scores as triggers, not verdicts.

- Next‑best‑offer recommendations for post‑purchase and win‑back.

- Send‑time and frequency optimization under global caps.

- Generative copy for subject lines and variants—always A/B test.

-

Caution areas

- Vendor‑specific “X% lift” claims are often not universally verified in public 2025 sources. Treat such figures as hypotheses to test in your store. Focus on your own cohort baselines and incremental lift.

Neutral toolbox (data and activation)

Disclosure: The following vendor mentions include Attribuly, the publisher’s product; descriptions are neutral for implementation planning.

- Attribuly — Multi‑touch attribution and cross‑device journey tracking with server‑side integrations; can enrich segments for retargeting and coordinate paid channels with lifecycle messaging.

- Triple Whale — Shopify‑centric analytics and attribution with first‑party tracking and visual dashboards; useful if your team prioritizes consolidated performance views.

- Littledata — Client + server‑side Shopify event capture to GA4/Segment/Meta; strong if you need reliable data transport across a headless or multi‑tool stack.

(Choose based on channel coverage needs, Shopify/DTC depth, learning curve, and whether you need activation, analytics, or data transport.)

Example implementation: churn‑deflection workflow (tool‑agnostic concept)

Use your at‑risk cohort (e.g., 60 days since last purchase + low engagement) to coordinate paid and owned channels. For example, sync that audience to paid platforms and align on‑site/email/SMS messaging for two weeks; include educational content first, incentive second. In this step, a segment sync via Attribuly can help pass enriched cohorts to ad platforms neutrally to keep ads and lifecycle messaging consistent. Keep frequency caps in place and monitor unsubscribe/complaint rates closely.

Loyalty programs: automate the moments that matter

Tiered programs pair naturally with automation: welcome to program, tier‑progress nudges, point‑expiry reminders, member‑exclusive drops, and referrals.

-

Evidence from recent brand cases

- A well‑executed tiered program can materially increase spend and order frequency. The apparel brand Lucy & Yak reports large uplifts among members (higher frequency and AOV) with a tiered program, as shown in LoyaltyLion’s case library; see the examples in the LoyaltyLion “customer loyalty program examples” collection for 2024–2025 summaries.

- Yotpo’s 2024–2025 cases illustrate revenue quality gains when shifting from blanket discounts to loyalty rewards. For instance, ThirdLove publicly cites 19% loyalty participation with notable ARPU and AOV lifts after emphasizing rewards over discounts; the case is detailed on the Yotpo ThirdLove case study page. Another example from Muscle Republic highlights higher repeat purchase rates among loyalty members, summarized on the Yotpo Muscle Republic case page.

-

Automation you should wire in

- Enrollment: “You’ve joined” with benefits overview and first action.

- Tier progress: Personalized “you’re X points from…” nudges.

- Point expiry: Reminder sequence at 30/7/1 days pre‑expiry.

- Member exclusives: Early access events with on‑site personalization.

- Referral loop: Simple, shareable links; attribute referrals accurately.

-

Guardrails

- Avoid discount addiction: prioritize experiential or value‑add rewards for high‑LTV cohorts.

- Keep tiers meaningful: ensure each level unlocks clear, valued benefits.

Measurement that ties to loyalty, not vanity

Define success in cohorts and dollars, not just opens.

-

Core KPIs

- Repeat purchase rate and time between orders.

- CLV by cohort (new vs. returning; loyalty member vs. non‑member).

- Reactivation and win‑back conversion rates.

- Subscription save rate and churn.

- Deliverability health (inbox placement, complaint rate, list growth vs. churn).

-

Benchmarks and context

- Shopify’s retention guidance underscores that “typical” repeat rates vary widely by vertical; use your own baselines and strive for steady cohort improvement rather than chasing a single generic benchmark. For context and program ideas, see the Shopify Enterprise ecommerce customer retention overview (2025) and the broader discussion of averages by industry in Shopify’s retention by industry article.

-

Diagnostics cadence

- Weekly: Deliverability and frequency guardrails; cart/checkout recapture performance.

- Bi‑weekly: Flow‑level revenue per recipient, reactivation rates, cohort moves.

- Monthly: CLV trajectory by acquisition source; loyalty vs. non‑loyalty cohorts; identify flows that over‑message.

Common pitfalls and how to avoid them

-

Over‑automation and message collisions

- Symptom: Customers receive overlapping messages across channels.

- Fix: Implement global frequency caps, set flow priorities, and use exclusion logic (e.g., suppress win‑back if the user is in an active post‑purchase branch).

-

Discount dependency

- Symptom: Repeat purchases only when discounts are offered; margins erode.

- Fix: Shift to value‑add perks and member‑exclusive access; reserve discounts for price‑sensitive cohorts identified by prior behavior.

-

Shallow personalization

- Symptom: Generic content regardless of product history, size/color, or preferences.

- Fix: Inject product‑aware content blocks; use browse/purchase signals and stated preferences to change the creative, not just the subject line.

-

Dirty data and identity fragmentation

- Symptom: Duplicate profiles, wrong channel consents, broken attribution.

- Fix: Regular deduping rules; consent reconciliation; event monitoring with alerting.

-

Deliverability neglect

- Symptom: Falling open rates, rising spam complaints.

- Fix: Authenticate domains, maintain list hygiene, sunset the unengaged, and monitor using tools referenced earlier (e.g., Postmaster Tools); review 2024–2025 bulk‑sender rules outlined by AWS SES and Mailgun.

-

“Set and forget” mentality

- Symptom: A flow hasn’t been audited in months; performance drifts down as product mix changes.

- Fix: Quarterly flow audits; retire low‑performers; refresh content and offers tied to current inventory and seasons.

15‑point implementation checklist

- Verify SPF, DKIM, DMARC alignment; enable one‑click list‑unsubscribe.

- Stand up identity resolution and de‑duplication; unify consent states.

- Stream critical events (orders, delivery, returns, support tickets) in near real time.

- Establish global and per‑channel frequency caps; define quiet hours for SMS.

- Build the welcome series with preference capture and branching.

- Implement post‑purchase with review requests and tailored cross‑sells.

- Add cart/checkout abandonment if not already live.

- Launch replenishment flows using PNOD or time‑since‑purchase by SKU.

- Score churn risk using RFM + behavior; trigger deflection sequences.

- Configure win‑back at 60–90+ days with tiered incentives.

- Wire subscription pause/save flows with skip/swap/downsells.

- Introduce loyalty automations: enrollment, tier progress, point expiry, exclusives.

- Test AI‑assisted send‑time and content variants under strict caps.

- Review deliverability weekly; sunset unengaged contacts; monitor complaints.

- Measure by cohort: repeat rate, CLV, reactivation, and subscription save rate.

Closing thought

Automation doesn’t replace empathy; it scales it. Start with the highest‑impact lifecycle flows, keep your data clean, respect channel guardrails, and iterate toward cohort‑level improvements. The evidence from 2024–2025 shows that thoughtful orchestration across channels and moments is what turns first‑time buyers into loyal customers—see the performance deltas in the Omnisend 2025 benchmarks and the retention gains noted in the Braze 2025 engagement review.