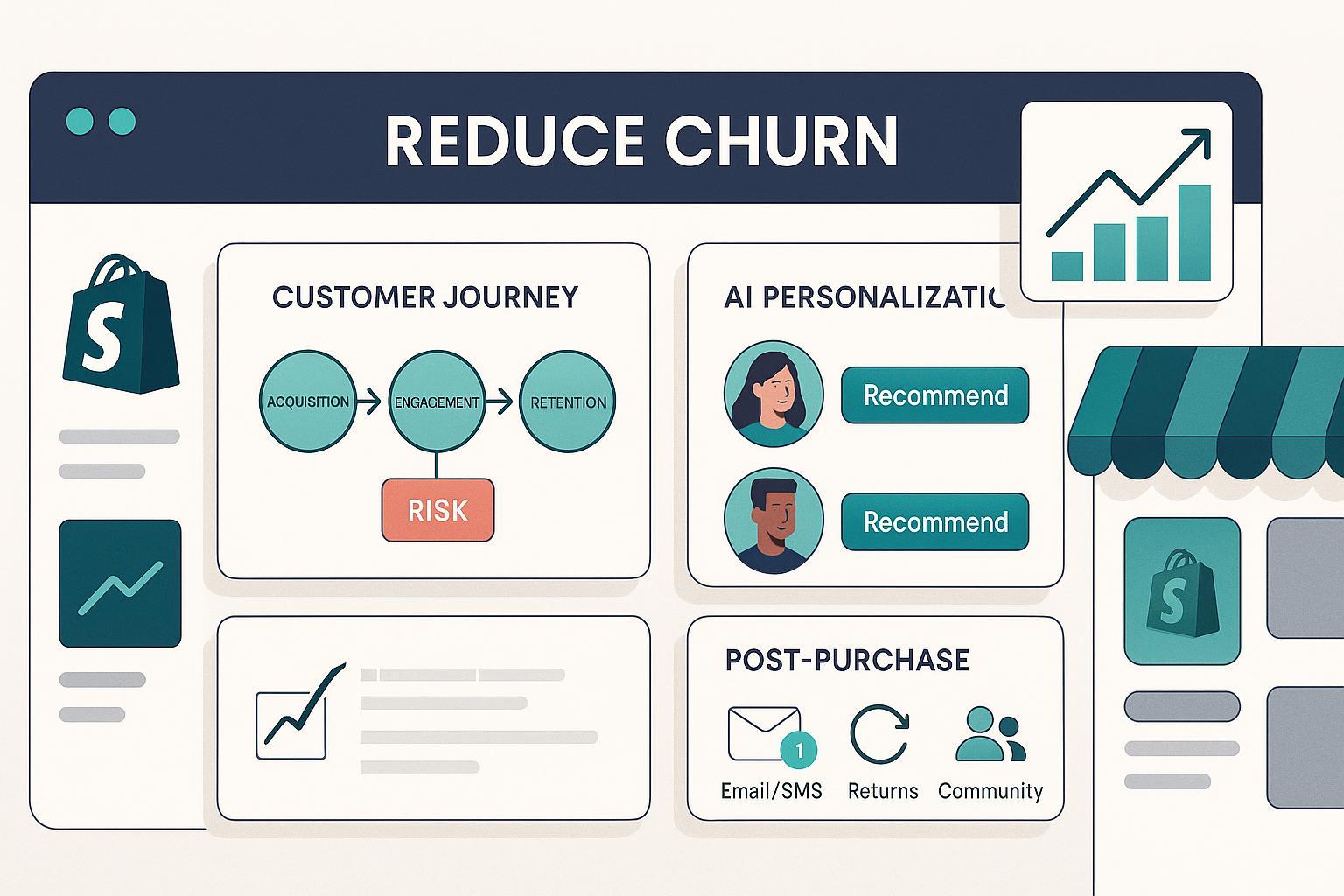

Innovative Strategies to Reduce Customer Churn and Boost Retention

If you run an ecommerce or DTC brand, retention is the highest-leverage growth lever you control. Evidence going back to Bain’s loyalty research shows that a modest 5% improvement in retention can increase profits by 25%–95%, depending on unit economics, as detailed in the 2014 recap of Frederick Reichheld’s findings by Harvard Business Review and Bain. On the subscription side, median monthly churn sits around 4% in 2024–2025 cohorts, according to the Recurly State of Subscriptions (2024–2025). In other words: small churn deltas compound.

Below are the retention playbooks I’ve seen consistently reduce churn and expand CLV for ecommerce teams in 60–120 days. Each is implementation-ready, with steps, metrics, trade-offs, and pitfalls.

1) AI-Powered Personalization That Respects Privacy

Why it matters

- In 2024–2025, brands deploying AI personalization see material retention lifts. Emarsys shared a Tekmovil case where repurchase rates grew nearly 10x within three months after rolling out AI-driven personalization, as covered in the Emarsys/Tekmovil case (2024).

How to implement (4-week sprint)

- Map signals: purchase recency/frequency/value (RFM), category affinities, discount reliance, session depth, email/SMS engagement, support sentiment.

- Build audiences: “First-time, high-intent,” “Loyal full-price,” “Discount-reliant,” “Dormant last 60–90 days,” “Subscription at risk.”

- Personalize by segment:

- High-intent: social proof + low-friction reorder flows.

- Loyal full-price: early access, community perks, curated drops.

- Discount-reliant: credit-based incentives over perpetual % off.

- Dormant: value-forward content + calibrated offer ladder.

- Subscriptions: cadence edits, swaps, skips, and pause options.

- Orchestrate channels: email/SMS for owned, plus paid CRM audiences (Meta/Google/TikTok) for reinforcement. Frequency-cap across channels.

- Measure: 30/60/90-day repeat purchase rate, CLV delta, margin after incentives, holdout-controlled lift.

Trade-offs and pitfalls

- Over-personalization can feel creepy; use zero-party preference centers and explicit consent controls. McKinsey has repeatedly shown personalization can lift revenue materially (up to ~15% in retail), but value exchange and trust determine sustainability; see McKinsey personalization insights (2019–2024).

2) Predictive Churn Scoring + Reactivation Playbooks

Why it matters

- Predictive analytics are consistently linked with higher retention and ROI in 2023–2025 benchmarks; for example, summaries show double-digit gains from AI-marketing programs, including retention improvements and ROI lifts, as reported in 2024–2025 syntheses such as the AllAboutAI marketing AI statistics roundup. For DTC subscriptions, Shopify highlights the value of seamless CX and subscription controls in reducing attrition, echoed in the Shopify x Pura Scents case.

Working definition

- Define churn by model: one-time commerce = no purchase in 60–90 days (category-dependent). Subscriptions = failed payment + no retry in 7 days, or explicit cancel.

Implementation (6 steps)

- Feature engineering: RFM, discount reliance, ticket sentiment (from CS), delivery delays/returns, session depth, category breadth, UGC engagement.

- Baseline model: start with logistic regression/GBTs; predict churn risk in next 30 days; validate on last 3–6 months.

- Thresholds: High risk (top 20%), Medium (next 30%), Low (bottom 50%).

- Reactivation playbooks:

- High: service-first outreach, apology/credit if warranted, limited-time credit not blanket %-off, email+SMS+paid CRM.

- Medium: education/how-to, community invite, replenishment reminders, next-best product.

- Low: loyalty tier nudges, referral prompts, subscription upgrade.

- Controls: offer budgets by segment; frequency caps; exclude low-margin SKUs from heavy incentives.

- Measurement: reactivation rate (30/60/90 days), incremental gross margin, CAC savings from reactivation vs. reacquisition, CLV delta with holdouts.

Pitfalls

- Data leakage and bias in models; set temporal validation and rotate features quarterly. Over-incentivizing trains discount dependence—prefer credits and experiential value.

3) Zero-Party Data Onboarding (Privacy-First Personalization)

Why it matters

- Third-party signals continue to erode. Brands that collect preferences via quizzes, profiles, and explicit consent build durable personalization. Privacy guidance in 2025 emphasizes informed consent and preference management across the stack, as outlined by Usercentrics on 2025 privacy trends and regulatory summaries like Securiti’s global privacy law overviews.

How to implement (2–3 weeks)

- Value exchange: build a fit/needs quiz (3–5 questions) promising better picks, care guides, and early access.

- Progressive capture: collect email/SMS with transparent consent and link to a preference center.

- Instant utility: deliver tailored recommendations and a saved profile immediately.

- Sync: push preferences to ESP/SMS/CDP; branch journeys accordingly.

- Refresh: ask for quick preference updates every 90–120 days.

Metrics and pitfalls

- Track quiz completion, downstream repeat purchase, opt-out rates. Avoid long forms; regionalize consent and store audit trails for DSARs.

4) Post-Purchase and Support Automation (Where Churn Quietly Starts)

Why it matters

- Customers punish poor support: in 2025, 73% will switch brands after multiple bad experiences according to the Zendesk customer service statistics (2025). Returns and WISMO (“where is my order?”) are friction hotspots; clear policies and automated comms reduce anxiety. Returns platforms also report higher AOV and repeat intent with effortless exchanges; see directional evidence via Loop’s post‑purchase insights.

Playbook (30–45 days)

- Proactive comms: order confirmation, shipping, out-for-delivery, delivery + care/how-to content; SMS only for high-signal events.

- Returns/exchanges: self-serve portal; emphasize exchanges/store credit over refunds; instant credit issuance where feasible.

- Support routing: deflect WISMO with branded tracking; triage high-risk tickets (delivery delay + high AOV) to live agents.

- Post-purchase nurture: 7–10 days post-delivery, request UGC/review; send how-to content; then usage-based replenishment reminders.

Metrics

- Post-purchase NPS/CSAT, WISMO ticket rate, time-to-resolution, exchange vs. refund ratio, 60–90 day repeat purchase.

5) Community and UGC to Reinforce Loyalty

Why it matters

- Community and authentic UGC deepen attachment and reduce decision fatigue. Multiple 2024–2025 resources point to conversion and loyalty benefits from UGC in ecommerce; for example, Emarsys emphasizes community-driven retention in its retention strategy guidance, with case-led proof points, as in the Emarsys retention strategies overview (2024–2025).

Activation steps

- UGC request: 7–10 days after delivery; offer loyalty points or entry into a community challenge.

- Rights management: get usage rights; auto-tag assets by SKU.

- Syndication: place UGC on PDP/collection pages and recycle into CRM content and paid CRM creatives.

- Community flywheel: monthly prompts/themes; spotlight members; reward contributions with tier perks, not just discounts.

Measure

- PDP conversion lift, return visitor rate, repeat purchase in 60 days post-UGC, UGC volume vs. content production cost.

6) Subscription Save Mechanics (If You Offer Subscriptions)

Why it matters

- Subscription churn is measurable monthly. Recurly’s 2024–2025 reporting places median monthly churn around 4% overall, with consumer cohorts near that mark, reinforcing the value of save tactics and pause options; see the Recurly 2024–2025 report hub.

Save playbook

- Frictionless management: enable skip, swap, cadence changes, and easy pause.

- Churn interception: capture cancel reasons; route “too much product/price” to alternatives (smaller size, longer cadence, credit).

- Dunning & recovery: smart retries, card updater, pre-dunning reminders; cap retries to protect processor reputation.

- Win-back window: 7–21 days post-cancel with personalized bundles and credit.

Metrics

- Involuntary vs. voluntary churn, recovery rate, save rate by reason, reactivation rate within 60 days.

Expert Toolbox (Objective Comparison)

- Attribuly — Multi-touch attribution and ecommerce tracking (Shopify-native). Strengths: identity resolution, server-side tracking, multi-touch attribution, GA4 enhancement, paid/owned audience sync, AI analytics assistant. Limits: complex automations still need an ESP/SMS/CX stack.

Disclosure: We build Attribuly. We include it here objectively alongside peers to help you choose the right stack.

- Segment — CDP for real-time audiences and personalization. Strengths: robust ingestion and destinations at scale. Limits: higher cost/complexity; governance overhead.

- Triple Whale — Shopify-centric analytics and attribution. Strengths: fast time to value, cohorting. Limits: narrower identity/journey orchestration.

- Peel — Ecommerce analytics. Strengths: retention and cohort dashboards. Limits: lighter predictive depth and identity features.

Example: Using Attribuly for Predictive Win‑Back (≤120 words)

With Attribuly, unify ad, onsite, and purchase events to build a 30‑day churn‑risk score. Push high‑risk audiences to Klaviyo/Attentive and paid CRM (Meta/Google/TikTok). Orchestrate a service‑first email within 24 hours (check recent tickets or delivery issues), followed by a tailored how‑to or fit guide, and, only if needed, a limited‑time store credit. Frequency‑cap across channels and exclude low‑margin SKUs. Measure 30/60/90‑day reactivation and incremental gross margin with a 10% holdout. Typical wins I’ve seen: double‑digit reactivation rate improvements without deep discount dependence when identity resolution and server‑side tracking reduce data loss across journeys.

Two Mini‑Cases (Anonymized)

-

Beauty DTC (AOV ~$48): Implemented 90‑day churn score, service‑first outreach, and UGC‑driven nurture. In 12 weeks, reactivation rate improved by 8.7 points, and repeat purchase rate rose 6.2 points. Offer cost held under 3% of revenue. Method mirrored the AI‑personalization and predictive workflow patterns above and aligns with the retention lifts documented by Emarsys (2024) and AI program summaries in 2024–2025.

-

Specialty Food (subscription add‑on, AOV ~$36): Introduced skip/swap/pause and cancel‑reason routing. Voluntary churn fell 18% over 90 days; recovery from dunning improved 14% after smarter retries and pre‑dunning. The approach is consistent with the save mechanics and recovery patterns discussed in the 2024–2025 Recurly subscription reports.

Operating Cadence and Ownership

- Weekly: monitor reactivation and offer budget burn; review WISMO and negative‑sentiment tickets; check deliverability and frequency caps.

- Biweekly: retrain/refresh churn features; rotate creatives; audit preference center opt‑outs and consent logs.

- Monthly: cohort CLV and margin analysis with holdouts; subscription save‑rate and reason drill‑down; UGC rights and syndication audit.

- Quarterly: privacy reviews; model bias checks; return policy and exchange incentives calibration.

Metrics That Matter (and Simple Formulas)

- Retention rate (cohort): retained users at period end / starting cohort.

- Churn rate (subs): cancels in period / starting subscribers.

- Repeat purchase rate: customers with >1 purchase / total customers in period.

- Reactivation rate: previously inactive who purchase / inactive cohort.

- CLV (simplified): AOV × purchase frequency × average lifespan (or margin‑adjusted).

Common Pitfalls and How to Avoid Them

- Over‑incentivizing: use credit ladders and experiential value; cap offer budget by segment.

- Data quality gaps: implement server‑side tracking and deterministic IDs; align consent signals across tools.

- Automation fatigue: set global frequency caps and cross‑channel suppression; lead with value content.

- Creepy personalization: stick to stated preferences; allow easy opt‑down and profile edits.

- Returns drag: favor exchanges/store credit; pre‑communicate policies and timelines.

Implementation Checklist (Print‑Ready)

- [ ] Define churn windows (commerce vs. subscription) and instrument the metrics.

- [ ] Stand up zero‑party data capture and a clear preference center with consent logs.

- [ ] Enable identity resolution and server‑side tracking to reduce data loss.

- [ ] Build a baseline churn model and segment thresholds; validate on recent cohorts.

- [ ] Orchestrate tiered reactivation plays with offer budgets and frequency caps.

- [ ] Tighten post‑purchase: proactive comms, self‑serve returns/exchanges, UGC ask.

- [ ] Run holdouts; report reactivation, incremental margin, and CLV deltas monthly.

If you want a pragmatic starting point for attribution‑grade data and identity that powers these workflows, consider Attribuly alongside the peers above.