How Beverage Brands Use Omnisend To Launch Seasonal Campaigns (2025)

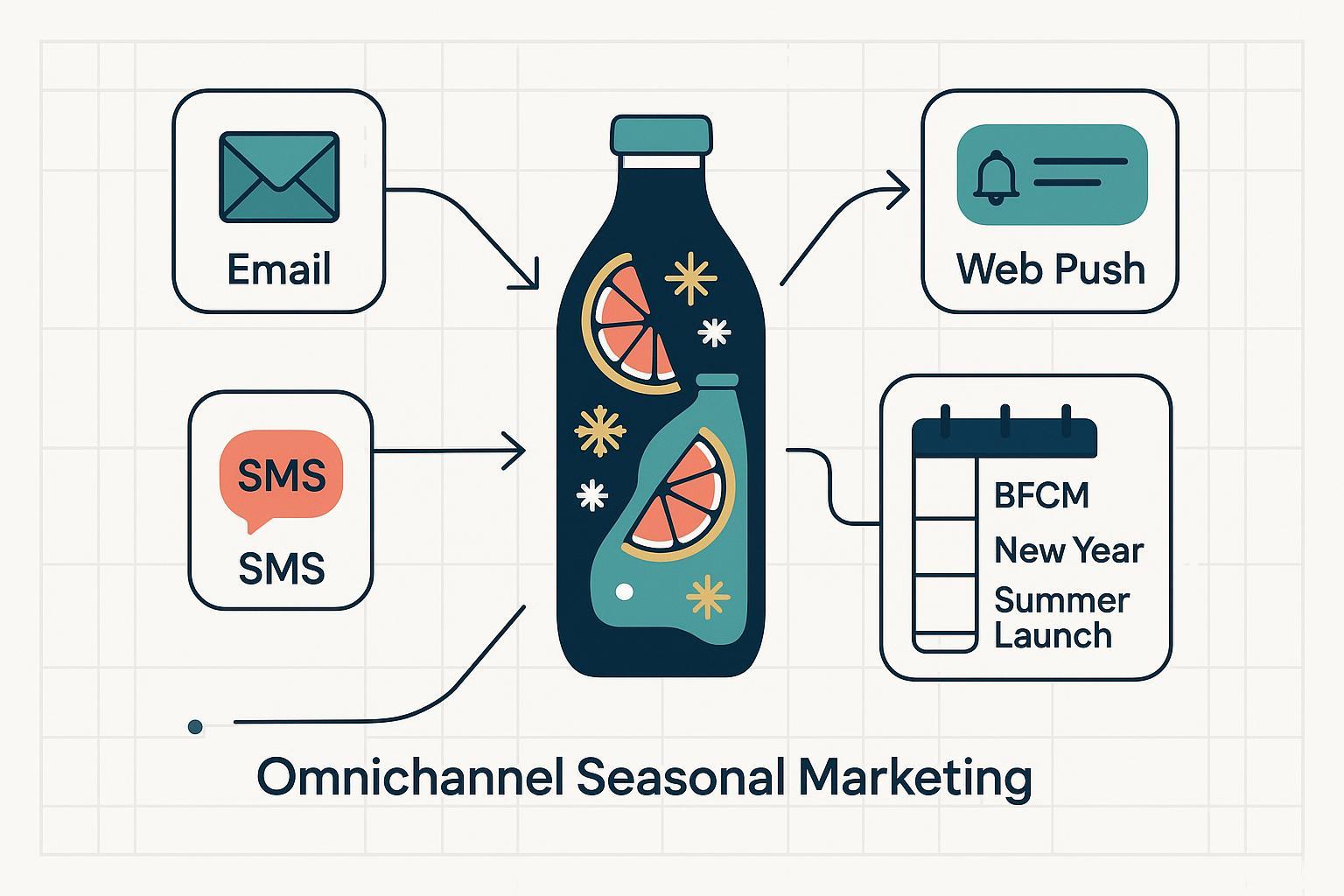

Seasonality drives beverage purchasing more than most categories—think summer launches, holiday gift packs, and new year wellness lines. In 2025, beverage brands using Omnisend can turn these peaks into predictable revenue by orchestrating email, SMS, and web push with tight segmentation, smart timing, and rigorous measurement. Below is a practitioner-grade playbook: real workflows you can implement, compliance guardrails to avoid unnecessary risk (especially for alcohol), and optimization loops that compound gains across seasons.

Omnisend setup essentials for beverage brands

A strong seasonal program starts with setting channels and segmentation correctly in Omnisend. These are the pieces that keep you compliant, reduce fatigue, and ensure messages land at the right time.

- Channel delivery and consent: Configure unified flows so each contact only receives messages via the channels they’ve opted into. Review consent indicators before enabling SMS or push in your automations; Omnisend details this in the Workflow Channel Settings (support, 2025).

- Segmentation foundations: Build behavior-led cohorts (VIPs, seasonal-flavor fans, gift buyers, at-risk/lapsed). Omnisend’s 2025 guidance on audience criteria and dynamic updates is outlined in Email list segmentation.

- Send-time testing: Seasonal performance varies by audience. Omnisend’s 2025 recommendations point to mid-afternoon and late evening testing windows; see Increase email open rate and validate with your own A/Bs by segment.

Playbook 1: Summer limited release (email + SMS + push)

Goal: Build anticipation for limited flavors (RTDs, seltzers, functional drinks) and convert high-intent buyers on launch day.

Audience slices:

- VIPs (top 10–20% by revenue/LTV)

- Known fans of similar flavors or categories

- High-engagement subscribers (opened/clicked in the last 60 days)

Cadence and timing (relative to launch day T0):

- Teaser email (T−7 to T−3): Tell a short origin story, show lifestyle imagery, tease bundle pricing. Include a sign-up for early access.

- Early-access SMS (T−2): Send only to SMS-consented VIPs; short, urgency-led copy. Be sure compliance checks are in place for alcohol.

- Launch email (T0): Hero image, limited-run badge, social proof, and clear CTAs. Use dynamic product recommendations and an inventory-aware message.

- Back-in-stock push/SMS (T+3 to T+10): If stock fluctuates, trigger alerts to engaged segments not yet converted.

Omnisend build steps:

- Create a unified automation with email, SMS, and push branches governed by consent.

- Add split conditions for VIP vs. general audience; layer product-interest tags for flavor fans.

- Insert time delays and throttles to avoid overlapping sends.

Reference implementations and creative: Omnisend’s 2025 examples of launch storytelling and modular templates are covered in Product launch email examples.

Optimization checkpoints:

- A/B test subject lines (story vs. scarcity), hero images, and bundle positioning.

- Monitor conversion by segment; if VIPs underperform on SMS, test offers and send time.

- Add replenishment reminders for non-alcoholic limiteds expected to repeat.

Playbook 2: Holiday gifting (Q4) with calendarized orchestration

Goal: Maximize Q4 revenue from gift packs, bundles, and subscriptions while staying ahead of shipping cutoffs.

Audience slices:

- Gift buyers (purchased in previous Q4s)

- VIPs and loyalty members

- Last-minute shoppers (high recent engagement, no purchase)

Calendar and sequence:

- Pre-BFCM teaser (early November): Gift guide, early-access waitlist.

- BFCM multi-day promos: Daily themes; highlight bundles and free shipping.

- Shipping deadline sequence: Email + SMS reminders tied to ground/express cutoffs.

- Post-purchase upsell: Accessories, mixers, or subscriptions.

Omnisend build steps:

- Use date-based triggers to schedule pre-holiday and shipping-deadline automations in a single flow.

- Segment frequency caps: VIPs can receive higher cadence; low-engagers filtered into fewer touchpoints.

- Add push notifications for limited-time drops and low-stock alerts.

Creative and timing notes: Omnisend’s 2025 holiday guidance emphasizes pre-holiday sends and urgency mechanics; see Holiday email campaigns (2025) for planning pointers and cutoff messaging.

Optimization checkpoints:

- Run A/Bs on subject lines with seasonal keywords/emojis.

- Test the mix of promos vs. content-led messages (recipes, pairing ideas) to mitigate fatigue.

- Monitor per-message revenue and unsubscribe rates to balance cadence.

Playbook 3: Replenishment and subscription reminders

Goal: Lift repeat purchase rates for consumables (coffee, kombucha, functional sodas, mixers) through lifecycle messaging.

Audience slices:

- Recent buyers (within typical consumption window)

- Subscribers approaching renewal

- Lapsed buyers (past seasonal-only behavior)

Cadence and sequence:

- Post-purchase email (T+7/T+21): Care tips, recipes, and complementary cross-sells.

- Replenishment reminder (timed to average consumption): Add SMS nudge for high-engagers.

- Subscriber renewal prompt (T−5 before renewal): Benefits recap; loyalty points boost for early renewals.

Omnisend build steps:

- Use product-level delays based on SKU consumption profiles.

- Create branches for subscribers vs. one-time buyers; adjust incentives accordingly.

- Add dynamic product blocks for personalized cross-sell.

Why it matters: Omnisend’s 2025 reporting highlights how automations punch above their weight—“automated emails can drive a disproportionate share of sales compared to send volume”—covered in the Email marketing report & analytics (2025).

Orchestration, timing, and frequency controls

Unified flows: Coordinate email, SMS, and push in single workflows where consent controls channel delivery. This prevents double-sending and keeps experiences coherent—see Workflow Channel Settings (support, 2025) for how Omnisend handles per-contact channel eligibility.

Timing principles:

- Pre-event emphasis: Send major messages before key holidays rather than on the day itself; this aligns with 2025 holiday execution advice from Omnisend referenced above.

- Segment-based send times: Evening/mid-afternoon often perform well across ecommerce audiences; confirm for your cohorts with iterative tests, as suggested in Increase email open rate (2025).

Frequency caps:

- Define caps per segment (e.g., VIPs can receive 1–2 extra touches during peak weeks; low-engagers receive fewer).

- Blend batch campaigns with behavior-triggered automations (abandoned cart, shipping deadlines) to maintain relevance.

Segmentation templates you can copy

Use these criteria as starting points; adapt thresholds to your data scale and SKU economics.

- VIPs: Last 12 months revenue in top 10–20% OR 3+ purchases, with engagement in last 60 days.

- Seasonal flavor fans: Viewed or purchased relevant SKUs/categories in the past 6–12 months.

- Gift buyers: Purchased bundles or gift SKUs in prior Q4; engaged in the last 90 days.

- At-risk/lapsed: No purchase in 120–180 days, but opened/clicked within the last 60 days.

- Compliance-friendly audiences (alcohol): Age-verified, SMS double-opt-in stored; exclude underage regions or contacts.

To implement quickly, lean on Omnisend’s audience builder and dynamic criteria described in Email list segmentation (2025).

Creative principles for beverage seasonality

- Mobile-first blocks: Use concise sections with scannable headlines and strong CTAs.

- Product storytelling: Origin stories, tasting notes, pairing ideas, and recipes outperform sterile promo copy for beverages.

- Urgency and scarcity: Limited-run badges, countdowns, and stock-aware messaging.

- Personalization: Dynamic product blocks and SKU-specific recommendations.

- Accessibility and load speed: Optimize image weight; include live text for key copy.

For examples and modular layouts tailored to launches, refer to Product launch email examples (Omnisend, 2025).

Measurement and optimization in Omnisend

Set up reporting with the KPIs that actually drive decisions:

- Message-level metrics: Open rate, CTR, conversion rate

- Revenue per send and per recipient

- Automation vs. campaign contribution

- Segment-level ROI and unsubscribe rates

In 2025, Omnisend’s reporting shows how automations can generate outsized revenue relative to send volume; use that to prioritize lifecycle flows in your roadmap, as detailed in the Email marketing report & analytics (2025).

Practical optimization loops:

- Test the thing that moves revenue: Subject lines (seasonal keywords/emojis), hero modules, offer framing (bundle vs. percent-off), and send time.

- Scale what works: Promote the best automation branches (e.g., cart/replenishment) and tighten underperforming ones.

- Clean segments regularly: Prune chronic non-openers to protect deliverability.

- Align incentives to audience value: VIPs respond better to exclusivity; last-minute shoppers prefer shipping guarantees.

Set expectations for what your analytics can answer. Omnisend’s campaign setup and reporting features support channel-level attribution and device breakdowns—see Campaigns features (Omnisend, 2025)—but keep your tests large enough to be statistically meaningful.

Compliance and deliverability guardrails (alcohol-focused)

This section is not legal advice; consult counsel. The following primary frameworks govern email/SMS for marketing in key regions and are critical for beverage brands, especially those selling alcohol.

United States:

- SMS: The TCPA requires prior express written consent for promotional messages, clear identification, and easy opt-out. The FCC’s overview is the canonical reference: Telephone Consumer Protection Act (FCC, 2025).

- Email: The CAN-SPAM Rule mandates honest headers/subjects, a physical address, and honoring unsubscribes within 10 business days; refer to CAN-SPAM Rule (FTC, 2025).

Canada:

- Email/SMS: CASL requires express consent, identification, and simple unsubscribe per CASL overview (CRTC, 2025).

European Union and United Kingdom:

- Consent and privacy: GDPR and the ePrivacy Directive require explicit, informed consent and easy withdrawal; start with GDPR text (EU, consolidated).

- Alcohol advertising standards (UK): CAP/ASA rules prohibit targeting under-18s and glamorizing irresponsible drinking; see Alcohol — General (ASA/CAP, 2025).

Practical implementation in Omnisend:

- Use double opt-in for SMS where feasible; store consent logs.

- Age gate alcohol landing pages (21+ US; 18+ EU/UK/Canada) and maintain region-based exclusions.

- Include clear unsubscribe links and “Reply STOP” instructions; honor promptly.

- Register A2P 10DLC for SMS to minimize carrier filtering.

- Avoid creative that could appeal to minors; add responsible drinking statements in alcohol promotions.

Common pitfalls and fixes

- Over-messaging in peak weeks: Solve with segment-level frequency caps and by prioritizing behavior-triggered automations over generic blasts.

- Ignoring age gating/SMS consent: Implement age verification and double opt-in for alcohol audiences; keep consent records.

- Weak post-purchase flows: Add care tips and replenishment reminders tied to consumption windows.

- Unbalanced channels: If email is overloaded, move urgent alerts to SMS/push for better timeliness.

- Heavy/slow creative: Optimize images and keep live text for speed and accessibility.

Forward-looking tactics for 2025

- AI assistance: Use Omnisend’s AI content and audience tools to accelerate iteration and discover micro-segments; validate outputs with tests.

- Predictive audiences: Combine purchase probability with category interest to pre-qualify seasonal offers.

- Privacy trends and new formats: Keep an eye on evolving guidance for alcohol alternatives and regional privacy rules; maintain clean consent flows and preference centers to future-proof campaigns.

Implementation checklist (quick start)

- Configure consent-aware unified workflows for email/SMS/push.

- Build core segments: VIPs, flavor fans, gift buyers, at-risk/lapsed.

- Draft three seasonal playbooks (summer limited, Q4 gifting, replenishment) with explicit timing.

- Stand up reporting dashboards for per-message revenue, automation contribution, and segment ROI.

- Launch A/B tests on subject lines, hero modules, and send times; schedule reviews weekly during peak season.

- Validate compliance: TCPA, CAN-SPAM, CASL, GDPR/UK CAP for alcohol messaging.

By grounding your seasonal program in consent-aware orchestration, sharp segmentation, and disciplined analysis, beverage brands can reliably turn seasonal demand into durable growth. Omnisend provides the rails; your execution and learning loops make the difference.