Leveraging Behavioral Data for Effective Abandoned Cart Retargeting

When ~70% of online carts are abandoned, the brands that win are those that turn raw behavior into timely, relevant reminders across email, SMS, and ads—while staying compliant and measuring true lift. This playbook distills field-tested methods to segment, orchestrate, and measure abandoned cart retargeting with practitioner-level rigor.

What “behavioral data” really means in cart recovery

Behavioral data is the stream of actions a shopper takes before, during, and after they load a cart. Focus on signals you can act on within 72 hours:

- Cart value and margin tier: split high AOV vs. low AOV; suppress blanket discounts where margin is thin.

- Product/category sensitivity: limited drops and replenishable goods need different urgency and proof points.

- Device and session depth: mobile abandoners favor SMS/push and concise CTAs; desktop favors detail (reviews/specs).

- Traffic source and campaign UTM: align tone and incentive with the promise that brought them in (e.g., discount-led social vs. organic search).

- Known vs. anonymous visitors: tailor flows based on whether you can tie the session to an identity.

- Intent indicators: number of items, time on PDP/checkout, return visits, reaching payment step—stacked signals justify faster cadence.

Why it matters: These variables let you decide “who should get what message, when, and via which channel,” instead of blasting everyone with the same offer.

Segmentation blueprint and trigger windows

Use simple, explicit rules you can implement in your ESP/CDP today:

-

AOV tiers

- High AOV (>$200): concierge/help-first messaging; delay incentives; consider live chat or callback within 24 hours.

- Low/medium AOV ($50–$200): standard cadence; test free shipping as first incentive.

-

Device cohorts

- Mobile: front-load SMS/WhatsApp (if consented); keep copy <160 characters and deep link back to cart.

- Desktop: richer email content with social proof, FAQs, and comparison snippets.

-

Product/category sensitivity

- Limited stock/new drops: faster first touch (30–60 minutes), explicit scarcity.

- Regulated/complex: emphasize trust, warranty, return policy; avoid urgency that feels pushy.

-

Source-aware messaging

- Discount-led ads: reiterate the promised value; avoid double-discounting.

- SEO/organic: focus on benefits, fit, and reviews before incentives.

-

Known vs. anonymous

- Known profile: personalize by name, past purchases, and preferences.

- Anonymous: lean on dynamic cart items, delivery reassurance, and simple return policy.

Trigger windows and cadence (baseline)

- First touch: 30–90 minutes post-abandon, email or SMS based on consent/preferences.

- Second touch: 12–24 hours, add assistance (FAQ, sizing, UGC) and light urgency.

- Final touch: 36–72 hours, optional incentive; cap total touches to reduce fatigue.

Evidence-backed note: In 2024 data, abandoned cart flows rank among the highest-yield automations, with robust open and conversion metrics according to the Klaviyo Abandoned Cart Benchmark (2024). Balance cadence with unsubscribe and complaint rates.

Orchestration playbooks you can deploy this week

Baseline 72-hour sequence (AOV $50–$200)

- T+45–60 min: Email 1 — dynamic items, clear CTA, delivery/returns reassurance; no discount.

- T+6–12 h: SMS 1 (consent required) — short reminder + deep link; include opt-out language; respect quiet hours.

- T+24 h: Email 2 — objection handling (size/fit, warranty), social proof; test free shipping vs. small % off.

- T+36–48 h: Dynamic product ads — Meta/Google/TikTok; frequency cap 1–2/day; auto-exclude purchasers.

- T+48–72 h: Email 3 — last-chance reminder; A/B incentive ladders; suppress for low-margin items.

High-AOV/consideration (>$200)

- Extend to 5–7 days; offer expert help (chat/call) before any incentive.

- Use educational creatives in ads; email with comparison guides and reviews.

Mobile-first brands

- Emphasize SMS/WhatsApp early; ensure deep links to app or cart; add push if you have an app.

- Unify suppression when a purchase happens; cap frequency; coordinate ad and messaging timing to avoid stacking touches in the same hour.

Implementation: Shopify, ESP, and ads stack

Get your data plumbing right before you scale spend.

-

- Capture “Begin Checkout” and cart line items; build flows with 2–3 emails plus optional SMS branch.

- For step-by-step platform setup and event consolidation with Web Pixels, see the Attribuly Shopify Integration Guide.

-

Server-side events and Meta CAPI

- Send PageView, ViewContent, AddToCart, Purchase server-side with deduplication; verify via Test Events; align firing with consent. Official implementation details live in Meta’s Conversions API docs.

-

GA4 audiences and Google Ads dynamic remarketing

- Enable GA4 Enhanced Ecommerce and build audiences like “Add to Cart, no Purchase within 3 days.” Link to Google Ads and launch dynamic remarketing or PMax using Merchant Center feeds. See Google Ads dynamic remarketing help and GA4 audience creation guidance.

-

Consent gating (EEA/UK/CH)

- Implement Consent Mode v2 so tags respect user choices; Google outlines regional updates in the Tag Manager Consent Mode update. Ensure your CMP blocks non-essential trackers pre-consent.

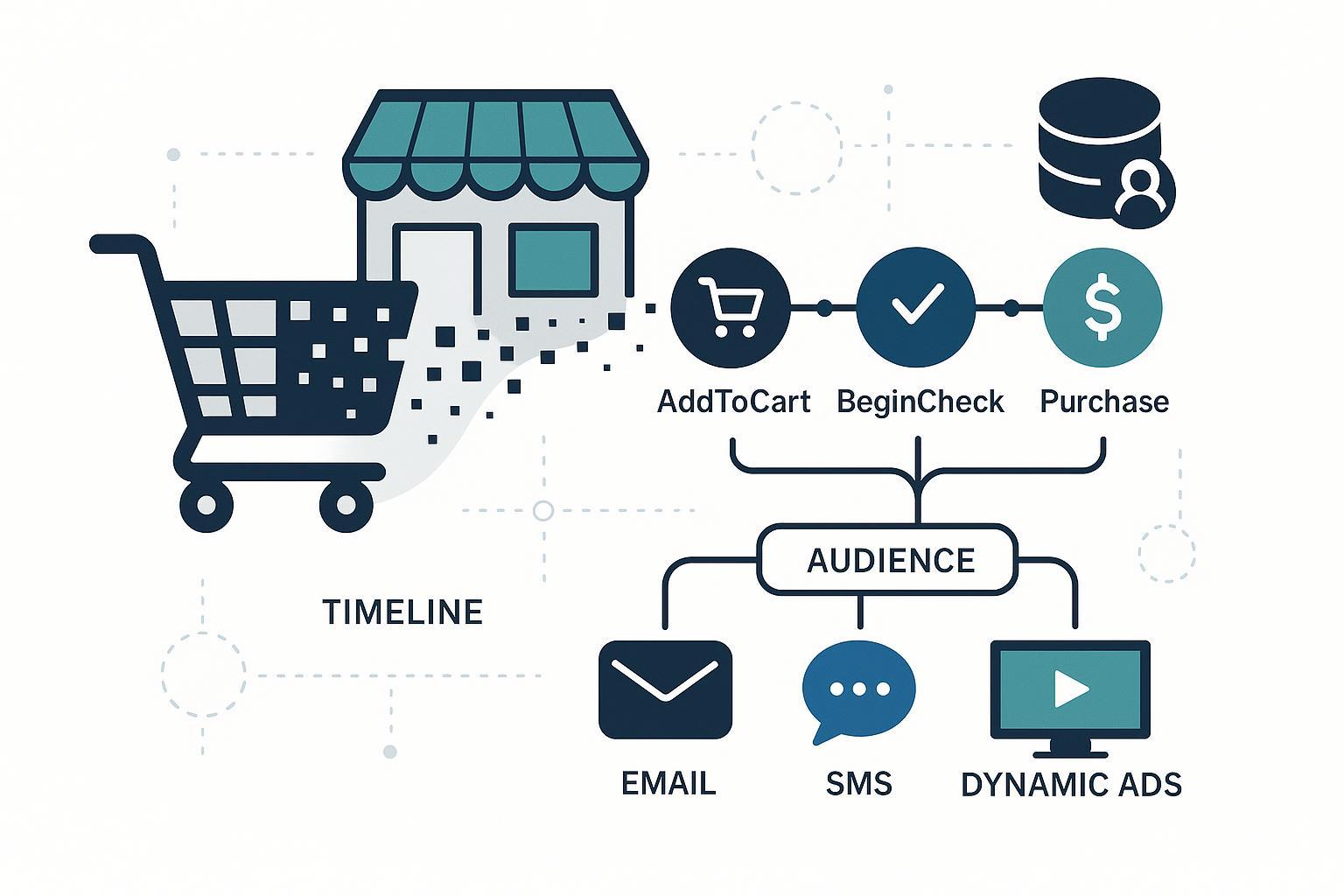

Example workflow: identity-aware, multi-channel recovery

Disclosure: Attribuly is our product; the workflow below is shared for educational purposes, not a solicitation.

Here’s a replicable pattern I’ve used with Attribuly:

- Event consolidation: Capture ViewContent, AddToCart, BeginCheckout, and Purchase across client and server, deduplicated via first-party IDs. Tie anonymous sessions to identities when emails are collected (newsletter, checkout, or pop-up).

- Audience logic: Build “ATC no Purchase” cohorts in 1/3/7-day windows; segment by AOV tier, device, and source (UTM). Suppress known low-margin SKUs from incentive branches.

- Orchestration: Trigger email at 60 minutes with dynamic cart items; SMS at 12 hours for mobile-consented profiles; auto-sync dynamic remarketing audiences to Meta/Google with frequency caps; enforce real-time purchase exclusions.

- Compliance: Gate server-side events and audience sync behind consent signals; document SMS opt-ins and STOP handling to comply with TCPA.

- Measurement: Hold out 10–20% of eligible abandoners from each channel; reconcile platform attribution with measured lift weekly.

This workflow is effective because it aligns channel timing with intent signals, keeps incentives proportional to margin, and prevents fatigue via unified suppression.

Creative and messaging patterns that consistently work

- “You left something great behind” — dynamic product names increase relevance.

- “Size, fit, and delivery—answers inside” — addresses typical objections.

- “Still deciding? See what buyers say” — leads into UGC/reviews.

Email body angles

- Reassure: delivery windows, returns/exchanges, warranty.

- Social proof: star ratings, recent customer quotes.

- Objection handling: sizing charts, compatibility notes, assembly or care guides.

SMS copy (keep it brief)

- “Still interested in [Product]? Your cart’s ready: [deep link]. Reply STOP to opt out.”

- “We saved your cart—free shipping today: [deep link]. Reply STOP to end.”

- “Need help choosing size? Chat now: [link]. Reply STOP to end.”

Incentive guardrails

- Start with value props (free shipping or extended returns) before % discounts.

- Use graduated incentives only on segments that demonstrate lift in holdouts.

- Suppress incentives for high-intent return visitors or high-margin categories.

Measure incrementality, not just attribution

If you don’t measure causal lift, you’ll overcredit last touches and underprice fatigue.

-

Audience holdouts

- Randomly exclude 10–20% of eligible abandoners from email/SMS/ads and compare conversions. This isolates lift without platform bias. Methodology guides from analytics teams echo this approach; Klaviyo’s 2024 benchmarks justify early-touch strength but don’t replace lift tests.

-

Platform lift experiments

- Use Meta’s Conversion Lift and Google Ads experiments for ad channels; validate results with your own holdouts when feasible.

-

Geo-lift (when user-level tests are constrained)

- Assign matched test/control geos; run retargeting only in test markets; compare normalized sales.

ROI model (weekly roll-up)

- Recovered orders = abandoners × exposure rate × incremental conversion lift

- Incremental revenue = recovered orders × AOV

- Incentive cost = recovered orders × incentive value × redemption rate

- Channel cost = email/SMS cost + ads cost

- Incremental profit = incremental revenue × gross margin − incentive cost − channel cost

- ROI = incremental profit / channel cost

Interpretation tips

- Use confidence intervals and minimal detectable effect to judge whether a laddered incentive is profitable.

- Align attribution windows with your test windows; report both platform-reported conversions and measured lift.

Compliance essentials you can’t ignore

EU/EEA/UK

- Prior, informed, opt-in consent is required for non-essential identifiers and personalized remarketing under ePrivacy. The 2024 final guidance in the EDPB Guidelines 2/2023 clarifies scope and consent patterns.

- Implement Google’s Consent Mode v2 so personalization is gated by consent; see the Tag Manager Consent Mode update. Ensure reject and withdraw options are first-class in your CMP.

US (CCPA/CPRA + TCPA)

- Provide “Do Not Sell or Share” and honor GPC signals; treat ad tech contracts as service provider agreements when applicable.

- For SMS marketing, prior express written consent is required; document opt-ins and promptly honor STOP. The FCC TCPA overview explains requirements and enforcement.

Operational guardrails

- Respect quiet hours for SMS; suppress all channels on purchase.

- Log consent timestamps and source; audit tag firing against consent states monthly.

Common pitfalls and how to avoid them

- Over-incentivization: Discounts that “seem to work” in attribution often degrade margin when lift is modest. Prove lift via holdouts before scaling incentives.

- Frequency fatigue: Uncoordinated emails, texts, and ads stack too many touches. Cap ads at 1–2/day, limit to 2–3 total emails, and unify suppression.

- Audience leakage: Missing server-side events or weak consent gating means profiles don’t update fast enough; verify setups with platform test tools and CMP logs.

- One-size messaging: Mobile users need brevity and deep links; desktop users benefit from richer context.

Role-specific checklists

Marketing Data Analyst

- Define event taxonomy (ViewContent, AddToCart, BeginCheckout, Purchase) and parameters (product IDs, value, currency).

- Validate identity resolution and deduplication across client/server.

- Build ATC-no-Purchase audiences by 1/3/7-day windows and value tiers.

- Design holdout tests; compute lift and confidence intervals weekly.

Growth/Campaign Manager

- Set the 72-hour baseline sequence; A/B test cadence (30 vs. 60 minutes), subject lines, incentives.

- Establish frequency caps across email/SMS/ads; unify suppression immediately on purchase.

- Allocate budget by margin tiers; monitor fatigue (unsubscribes, complaints, ad frequency).

Compliance/Privacy

- Verify CMP behavior in EEA/UK/CH; ensure Consent Mode v2 is implemented.

- Maintain TCPA-compliant SMS opt-in records; implement quiet hours and STOP handling.

Engineering/Martech

- Implement Meta Conversions API and GA4 Enhanced Ecommerce; verify Test Events.

- Ensure real-time audience sync and purchase exclusions across platforms.

Next steps

Run the baseline 72-hour sequence for one product category with clean measurement and consent gating. Expand only after your first lift test shows positive incremental profit. If you need unified identity resolution, compliant server-side tracking, and cross-channel audience sync out of the box, consider exploring Attribuly in your Shopify stack.

References and supporting sources embedded above:

- In 2025, Shopify Enterprise summarizes Baymard’s long-standing ~70% abandonment average in its checkout optimization guidance, useful context for problem sizing.

- 2024 Klaviyo benchmarks substantiate strong early-touch performance for abandoned cart flows.

- 2024 EDPB guidance and Google Consent Mode v2 updates anchor EU consent practices; FCC TCPA overview grounds SMS compliance in the US.

- Meta Conversions API docs, Google Ads dynamic remarketing help, and GA4 audience guidance cover technical implementation details.