Best Back-in-Stock Email Campaign Examples for Apparel Brands (2025)

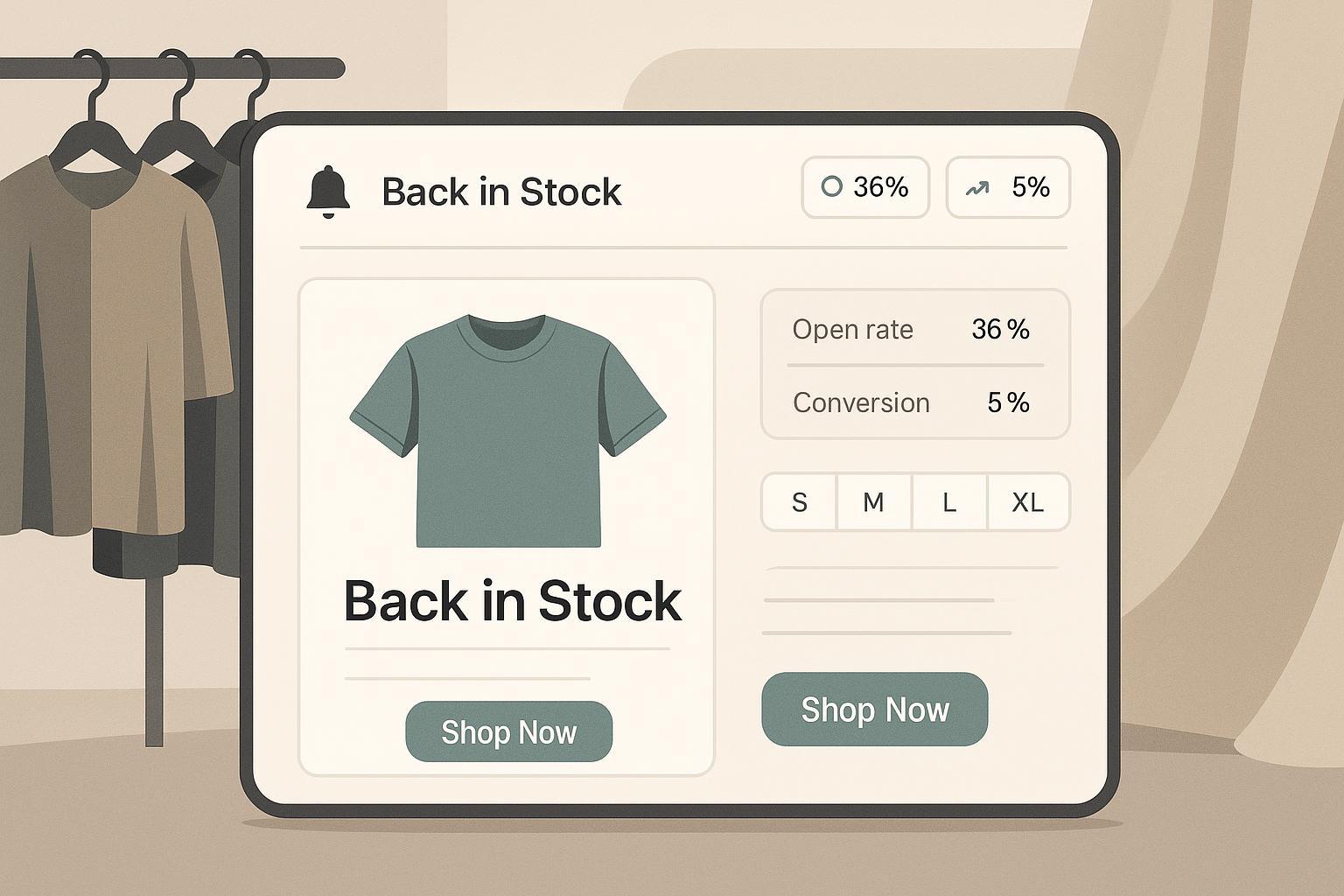

Back‑in‑stock (BIS) emails are quiet revenue machines for fashion brands. When you do them right—SKU/size‑specific, fast, and mobile‑first—they convert at rates most campaigns can’t touch. According to the Omnisend 2025 Ecommerce Marketing Report, BIS emails see about 59.19% opens and 5.34% conversion (2025). That’s why this play belongs in every apparel lifecycle stack.

This roundup focuses on apparel‑only examples you can actually copy, with quick implementation notes for Shopify + ESP. Where relevant, we include cautions so you can avoid common pitfalls like oversending or generic copy.

How we chose (quick criteria)

- Apparel relevance and real‑world screenshots/examples

- Clear BIS trigger and SKU/size specificity in copy or layout

- Mobile-first creative that respects small screens and thumbs

- Urgency/personalization mechanisms that drive immediate action

- Credible evidence or gallery pages we can point to

How back‑in‑stock flows work in 30 seconds

- Capture intent on out‑of‑stock PDPs via a “Notify me” form that records product variant (size/color).

- When inventory for that variant flips from 0 to available, trigger an alert (often SMS first, then email) to that waitlist segment.

- Batch notifications and set inventory thresholds to avoid overselling.

- Attribute and compare performance against the Omnisend BIS open and conversion benchmarks above.

For teams that need reliable identity resolution and server‑side Shopify event capture alongside your ESP, tools like Attribuly can help unify visitors across devices and feed accurate triggers to your stack. Disclosure: Attribuly is our product.

8 apparel back‑in‑stock email examples to copy now

Each example includes: what stands out, where it works best, watch‑outs, and quick setup notes for Shopify + your ESP (e.g., Klaviyo).

1) Anthropologie — playful subject + single‑SKU focus

- Why it works: Anthropologie leans into a witty subject line and centers one returning bestseller, reducing choice friction. Social proof (“bestselling”) and dual CTAs nudge fast clicks.

- Evidence: See the treatment in the Drip back‑in‑stock examples article (Anthropologie section).

- Best for: Hero products with strong brand love; dress or denim restocks.

- Watch‑outs: Don’t bury size availability—call it out up top if you can.

- Setup notes: In Klaviyo, trigger on “Subscribed to Back in Stock,” hold until the variant is available, then send the alert. Consider an SMS step for waitlisters who opted in. Reference the Klaviyo “How to build a back in stock flow” guide (updated frequently).

2) Aritzia — “They’re back” FOMO with editorial visuals

- Why it works: Clear headline and unmistakable scarcity—“They sold out once.” High‑gloss imagery fits the brand’s editorial feel and makes the restock feel like a drop.

- Evidence: Featured in the Popupsmart roundup of back‑in‑stock email examples (Aritzia section).

- Best for: High‑demand seasonal capsules; fashion‑forward SKUs.

- Watch‑outs: Keep copy tight so the visuals and CTA take center stage on mobile.

- Setup notes: Use batch‑size throttling so your email doesn’t overrun limited inventory; Shopify Flow’s “product variant back in stock” trigger can kick off the automation. See Shopify’s Flow trigger changelog note for how the event fires.

3) Everlane — minimalist, product‑first clarity

- Why it works: Clean layout, simple headline, big product hero. It respects Everlane’s brand while making the action obvious.

- Evidence: Included in the Popupsmart roundup (Everlane section).

- Best for: Core wardrobe staples with repeat demand.

- Watch‑outs: Minimalism still needs urgency—add “limited quantities” or an expected sell‑out note if true.

- Setup notes: Include dynamic blocks that pull the exact variant name/color; keep the email under ~100KB for deliverability.

4) True Religion — incentive on restock

- Why it works: Pairing a limited‑time perk (discount or free shipping) with a restock can tip fence‑sitters.

- Evidence: Appears in the Popupsmart roundup (True Religion section).

- Best for: Price‑sensitive audiences; older SKUs that need a push.

- Watch‑outs: Incentives can train wait behavior and impact margins; reserve for specific segments.

- Setup notes: Segment waitlisters vs. broader shoppers. Send the perk only to waitlisters and lapsed customers to protect AOV.

5) Lazy Oaf — bold creative + explicit scarcity

- Why it works: Playful, high‑contrast visuals and bold copy like “available in limited quantities” drive immediate clicks.

- Evidence: See Lazy Oaf in Panoramata’s back‑in‑stock gallery.

- Best for: Brands with strong creative identity; collabs and statement pieces.

- Watch‑outs: Don’t over‑animate—ensure the main CTA is visible without scrolling.

- Setup notes: If inventory is ultra‑limited, prioritize SMS first for speed, then email as follow‑up.

6) Margin — “today only” free‑shipping accelerator

- Why it works: A time‑bound perk layered on a restock nudges immediate action without deep discounting.

- Evidence: Highlighted in SmartrMail’s apparel back‑in‑stock examples.

- Best for: Smaller catalogs where shipping cost is a known friction.

- Watch‑outs: Keep the window truly short; otherwise urgency fades.

- Setup notes: Add a timer block if consistent with brand. Ensure the perk auto‑applies to minimize checkout drop‑off.

7) Single‑SKU spotlight with tasteful cross‑sell

- Why it works: Leading with the exact item a shopper wanted, then surfacing one complementary product, boosts basket size without distraction.

- Evidence: The single‑SKU spotlight pattern and complementary recommendation are discussed in the Drip article linked above (Anthropologie example).

- Best for: Outfits and matching sets (e.g., tee + overshirt, dress + belt).

- Watch‑outs: Don’t crowd the layout; one cross‑sell is plenty.

- Setup notes: Use product recommendations filtered to the same collection or “frequently bought together.” Keep the main restock item above the fold.

8) Minimal copy, maximum clarity (brand‑consistent)

- Why it works: Some apparel brands win by stripping copy down to a headline, product name, sizes available, and one primary CTA. It feels fast—because it is.

- Evidence: The Everlane treatment in the Popupsmart roundup shows how minimal layouts still convert when the product is the hero.

- Best for: Brands with strong visual identity and recurring staples.

- Watch‑outs: Minimal still needs clarity: size/variant in the subject line or preheader helps.

- Setup notes: Include the variant (e.g., “The Relaxed Blazer — Size M is back”) in the subject or preheader dynamically.

Your stack, simplified (Shopify + ESP)

- Triggering: Use Shopify’s product‑variant back‑in‑stock signal to start your flow. If you’re on Klaviyo, the “Subscribed to Back in Stock” event is the standard entry point; hold until available, then send.

- Channels: If you’ve collected consent, send SMS first for speed, then email as the follow‑up. Cap frequency and respect quiet hours.

- Batching and thresholds: Avoid overselling by throttling notifications (e.g., notify X customers every Y minutes) and setting minimum on‑hand counts.

- Measurement and attribution: Track opens, clicks, and orders; benchmark against the 2025 Omnisend BIS open (59.19%) and conversion (5.34%). Use UTMs plus server‑side events to keep your data clean.

- Integrations: If you’re connecting Shopify, your ESP, and ad platforms, keep an eye on identity graphs and event mapping. Browse the Attribuly integrations list to see common ecommerce, ESP, and ads connections for a BIS‑ready data pipeline.

Implementation quick hits (copy/paste friendly)

- Subject line ideas

- It’s back: [Product name] in [Size]

- Back in your size: [Product] — [Variant]

- They sold out once. They’re back.

- Preheader

- Limited quantities — don’t wait

- Your waitlist alert: ships today

- Body copy micro‑lines

- “This restock won’t last.”

- “Only a few units per size.”

- “Added by popular demand.”

- CTA labels

- Get it now

- Shop your size

- Grab the restock

Common pitfalls to avoid

- Generic alerts: “It’s back” without SKU/size context wastes the shopper’s time.

- Oversending: Respect caps; once per restock per variant is usually enough.

- Inventory whiplash: Don’t fire alerts if you have only 1–2 units; set minimum thresholds.

- Deliverability drift: Keep templates lean (under ~100KB), authenticate domains (SPF/DKIM/DMARC), and avoid spammy discount language if off‑brand.

Measurement, benchmarks, and next steps

- Benchmarks: Compare your BIS open and conversion to the 2025 figures cited from Omnisend above. If you’re underperforming, test subject line specificity (include product + size), SMS‑first sequencing, and urgency language.

- Reporting hygiene: Keep UTMs consistent and map placed‑order events to your analytics. Server‑side event forwarding can reduce loss from ad blockers and iOS privacy.

- Retargeting cohorts: People who click BIS emails but don’t purchase are high‑intent. Build audiences off those engagements for paid social. If you need a clean Conversions API setup for Meta, see Attribuly’s Meta Ads Integration to pass enriched events and build smarter audiences.

If you haven’t shipped a BIS flow yet, start with a single‑SKU alert and minimal layout, then layer on SMS, batching, and urgency once you’ve validated demand. Keep it simple—and fast.