Attribution Rules: What They Are, How They Differ, and Why They Matter for Tax Compliance

Attribution rules—often called constructive ownership rules—are the parts of U.S. tax law that treat you as owning interests held by certain related people or entities so that tax results reflect control and economic reality, not just title on paper. In other words, stock (or other interests) owned by your spouse, parent, child, a corporation you control, or a partnership you belong to may be “attributed” to you for specific tax determinations.

This article focuses on federal income tax attribution rules, primarily under Internal Revenue Code (IRC) sections 318, 267, 1563, and 958(b). It does not address “attribution” in marketing analytics or state-specific tax rules.

Constructive ownership, simply explained

Think of constructive ownership like a shadow: even if an interest isn’t in your name, the law may cast its “shadow” onto you because of family or entity connections.

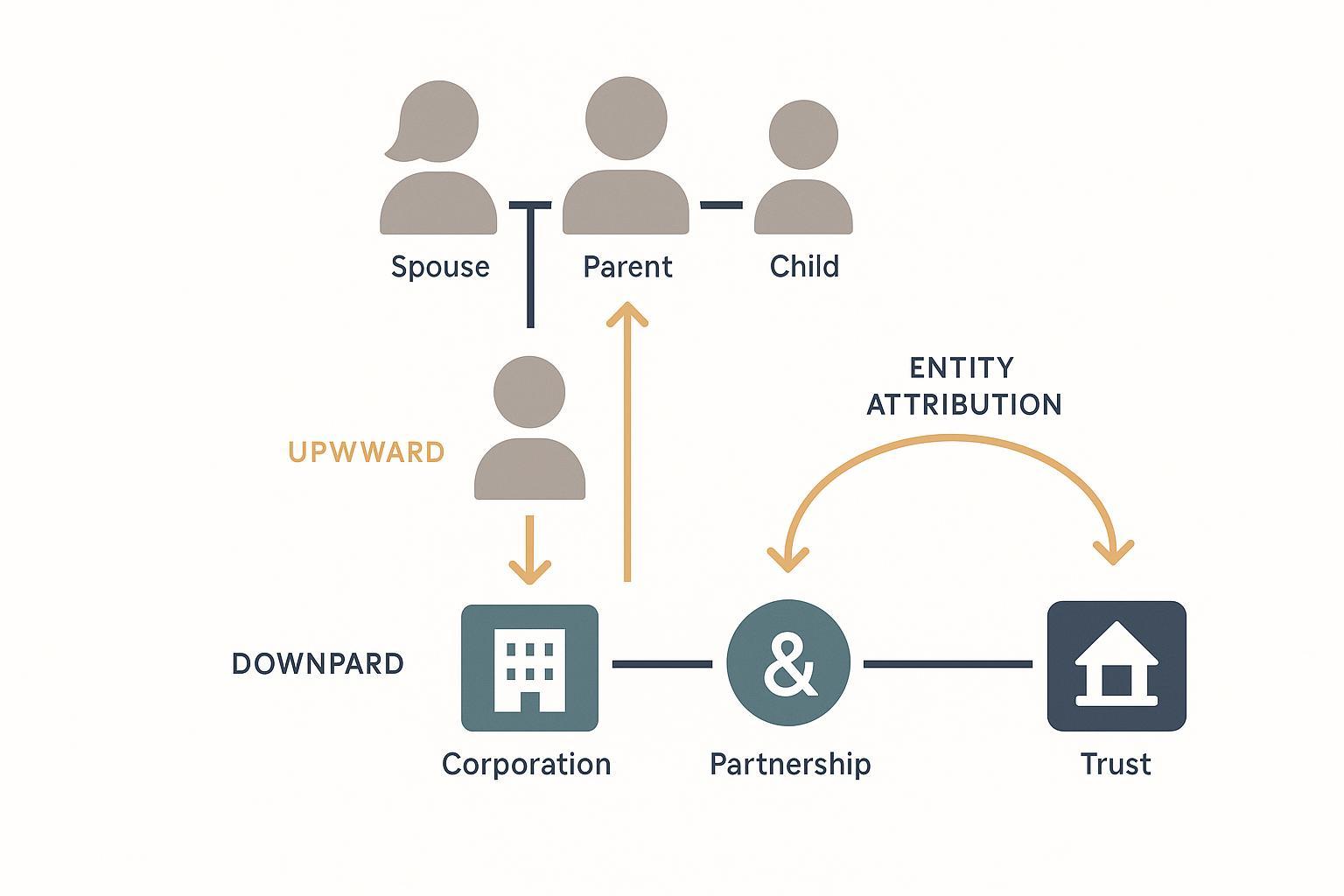

- Family attribution: For some determinations, the law treats you as owning interests held by close family members.

- Entity attribution: Ownership held by corporations, partnerships, trusts, or estates can be treated as owned by their owners, partners, beneficiaries, or sometimes the entity itself.

- Direction of attribution: Rules can flow upward (child to parent), downward (parent to child or entity to owner), or “sideways” across entities, depending on the section.

- No double counting under §318: A crucial limitation under §318 is that constructively owned stock generally is not re-attributed again down the line—the “no double attribution” principle (see the statutory limitation in §318(a)(5) with examples in Treas. Reg. §1.318-2).

Authoritative foundations for these mechanics are laid out in the constructive ownership statute for stock—see the text of 26 U.S.C. §318 and implementation details in Treas. Reg. §1.318-1.

The four big regimes—and how they differ

Different sections serve different purposes and define family and entities differently. The most commonly encountered regimes are:

- §318: Baseline constructive ownership of corporate stock; heavily cross-referenced.

- §267: Related-party transactions (loss disallowance, timing of deductions) with its own family definition.

- §1563: Corporate controlled group determinations, which drive aggregation for various limitations.

- §958(b): International constructive ownership for CFC/U.S. shareholder status—applies §318 concepts with modifications.

Quick contrasts you’ll use often

- Family sets differ: Under §318, “family” includes spouse, children, grandchildren, and parents—siblings are not included (see 26 U.S.C. §318). Under §267, “family” explicitly includes brothers and sisters (whole or half-blood), spouse, ancestors, and lineal descendants (see the definition in §267(c)(4)).

- Controlled groups: Corporate aggregation for parent-subsidiary and brother-sister groups turns on specific thresholds and constructive ownership rules in §1563 (including §1563(e)).

- International overlay: §958(b) imports §318 principles to foreign corporations; after the TCJA repealed former §958(b)(4), downward attribution from foreign persons to U.S. persons can apply, expanding CFC determinations—summarized in the IRS final regulations discussion (IRB 2020-42) and the IRS Practice Unit on IRC 958 stock ownership (2022).

Comparative snapshot

| Code section | Main purpose | Who counts as “family”? | Key mechanics and references |

|---|---|---|---|

| §318 | Constructive ownership of stock (domestic baseline) | Spouse, children, grandchildren, parents (no siblings) | Options, family and entity attribution; no re-attribution under §318(a)(5). See §318 and Treas. Reg. §1.318-1/-2 |

| §267 | Related-party loss/timing rules | Includes siblings, spouse, ancestors, lineal descendants | Loss disallowance between related parties; family definition at §267(c)(4) |

| §1563 | Controlled groups of corporations | Attribution rules in §1563(e) | Parent-subsidiary and brother-sister tests; see §1563 and IRS aggregation explanations in §448/§163(j) FAQs |

| §958(b) | CFC/U.S. shareholder determinations | Imports §318 with modifications | Post‑TCJA downward attribution; see IRB 2020-42, IRS Practice Unit, and Form 5471 Instructions (Dec. 2024) |

Worked examples: how attribution changes outcomes

- Loss disallowance versus stock attribution (siblings)

- Scenario: Alex sells stock at a loss to his sister. Because siblings are related under §267, the loss is disallowed—see the family definition in §267(c)(4).

- Contrast: If you were testing Alex’s constructive ownership of that same stock under §318, his sister would not be a “family” member for attribution (siblings are excluded) per §318 and Treas. Reg. §1.318-1.

- No double attribution under §318

- Scenario: A partnership owns 40% of Corp X. Dana is a 50% partner in the partnership; Dana is constructively treated as owning 20% of Corp X under §318(a)(2). Dana’s spouse does not also get that 20% via re-attribution because §318’s limitation generally prevents passing constructively owned stock through a second time; see the no re-attribution rule in §318(a)(5) and examples in Treas. Reg. §1.318-2.

- Controlled group status

- Scenario: Three individuals own varying percentages of two corporations. After applying §1563(e) constructive ownership, the two corporations meet the “80% test” and the “more than 50% identical ownership test”—making them a brother-sister controlled group. That status can affect tax limitations and elections; see the thresholds in §1563(a) and IRS aggregation explanations in the §448/§163(j) FAQs.

- International downward attribution (post‑TCJA)

- Scenario: Foreign Parent owns Foreign Sub and also owns U.S. Sub. After TCJA repealed former §958(b)(4), stock of Foreign Sub can be constructively attributed downward to U.S. Sub, potentially creating CFC status and Form 5471 obligations; see the final regulations discussion in IRB 2020‑42 and the IRS 958 Practice Unit (2022). The Instructions for Form 5471 (Dec. 2024) also outline exceptions and relief for certain constructive ownership situations.

Where this shows up in compliance (as of 2025-09-21)

- International information returns: Category 1 and 5 filers for Form 5471 must apply constructive ownership tests; the IRS provides exceptions when a filer would be required solely by constructive ownership and certain conditions are met—see the latest Instructions for Form 5471 (Dec. 2024) and relief described in Rev. Proc. 2019-40.

- Corporate controlled groups: Controlled group status affects various corporate limitations and, in some cases, disclosures (e.g., allocations among group members). Determinations rely on the tests and attribution rules in §1563 (including §1563(e)). The IRS provides aggregation context in its §448/§163(j) FAQs.

- Related-party transactions: Loss disallowance and timing rules hinge on whether parties are “related” under §267; remember the broader family definition including siblings in §267(c)(4). The IRS has discussed attribution in this context in bulletins such as IRB 2021-34.

- Employee benefits aggregation: Many benefit plan aggregation rules borrow controlled group and common control concepts by reference to §414 and §1563; plan qualification errors are handled through the IRS correction system (check the latest EPCRS guidance on IRS.gov).

Common pitfalls—and how to avoid them

-

Confusing family sets across sections

- Trap: Assuming siblings count for §318 family attribution. They do not. Cross-check the family set in §318 against the broader set in §267(c)(4).

-

Double attribution mistakes under §318

- Trap: Re-attributing constructively owned stock through another person or entity. Apply the limitation in §318(a)(5) and examples in Treas. Reg. §1.318-2.

-

Overlooking the identical ownership test for controlled groups

- Trap: Meeting the 80% common ownership test but missing the “more than 50% identical ownership” requirement for brother-sister groups; see §1563(a) and IRS aggregation guidance in the §448/§163(j) FAQs.

-

Missing CFC status after TCJA

- Trap: Failing to consider downward attribution from foreign persons to U.S. persons under §958(b), which can create unexpected U.S. shareholder/CFC relationships and Form 5471 filings; review the IRB 2020‑42 final regulations discussion, the IRS 958 Practice Unit (2022), and the Form 5471 Instructions (Dec. 2024).

Practical checklist for first-pass analysis

- Identify the question you’re answering.

- Are you testing related-party loss disallowance/timing (likely §267), stock attribution for domestic corporate tests (§318), controlled group status (§1563), or CFC/U.S. shareholder status (§958(b))?

- Map the relationships.

- Diagram the people and entities. Mark family ties and ownership percentages. Note whether family is analyzed under §318 or §267 (they differ).

- Apply the correct regime’s rules.

- Use the specific family and entity rules of that section. For foreign corporations, remember §958(b) applies §318 concepts with modifications.

- Respect limitations.

- Under §318, avoid re-attributing constructively owned stock again (see §318(a)(5) and Treas. Reg. §1.318-2). For controlled groups, apply both the 80% and the more-than-50% identical ownership tests in §1563(a).

- Check filing consequences and relief.

- For international cases, confirm Form 5471 categories and exceptions in the Instructions for Form 5471 (Dec. 2024) and consult Rev. Proc. 2019‑40 for relief pathways.

Primary sources and further reading

- The constructive ownership statute for stock: 26 U.S.C. §318; implementing guidance in Treas. Reg. §1.318-1 and examples in Treas. Reg. §1.318-2.

- Related-party transactions and family for §267: 26 U.S.C. §267; attribution discussions appear in IRS bulletins like IRB 2021-34.

- Controlled groups of corporations and attribution: 26 U.S.C. §1563; additional aggregation context in the IRS §448/§163(j) FAQs.

- International constructive ownership and CFC determinations: IRS final regulations discussion (IRB 2020‑42); IRS Practice Unit on IRC 958 stock ownership (2022); current Instructions for Form 5471 (Dec. 2024); and relief in Rev. Proc. 2019‑40.

- Employee benefit plan aggregation cross-references: 26 U.S.C. §414.

This educational article is not legal or tax advice. Attribution rules are highly fact-specific and evolve with legislation and guidance. As of 2025-09-21, always consult current Code, regulations, and IRS instructions, and consider engaging a qualified U.S. tax advisor for your specific facts.