Abandoned Checkout Emails That Recover Sales for Beverage Brands

Beverage brands aren’t just another DTC vertical. You juggle age gates, regional shipping constraints, cold‑chain or perishability, and subscriptions—all while competing for attention on a mobile checkout that’s one thumb‑tap from being closed. That context changes how you structure abandoned checkout emails. Below is the field‑tested playbook I use with beverage teams to recover more carts without creating compliance risk or discount addiction.

According to recent industry tracking, global cart abandonment sits around the 70% mark, so even modest improvements in recovery flows pay off quickly. For context, Klaviyo’s 2024 analysis of 143k abandoned‑cart flows reported average open ≈ 50.5%, click ≈ 6.25%, and placed‑order ≈ 3.33%—with top decile flows far higher, making this one of the most lucrative automations you can run (see the publisher’s breakdown in the Klaviyo 2024 abandoned cart benchmarks).

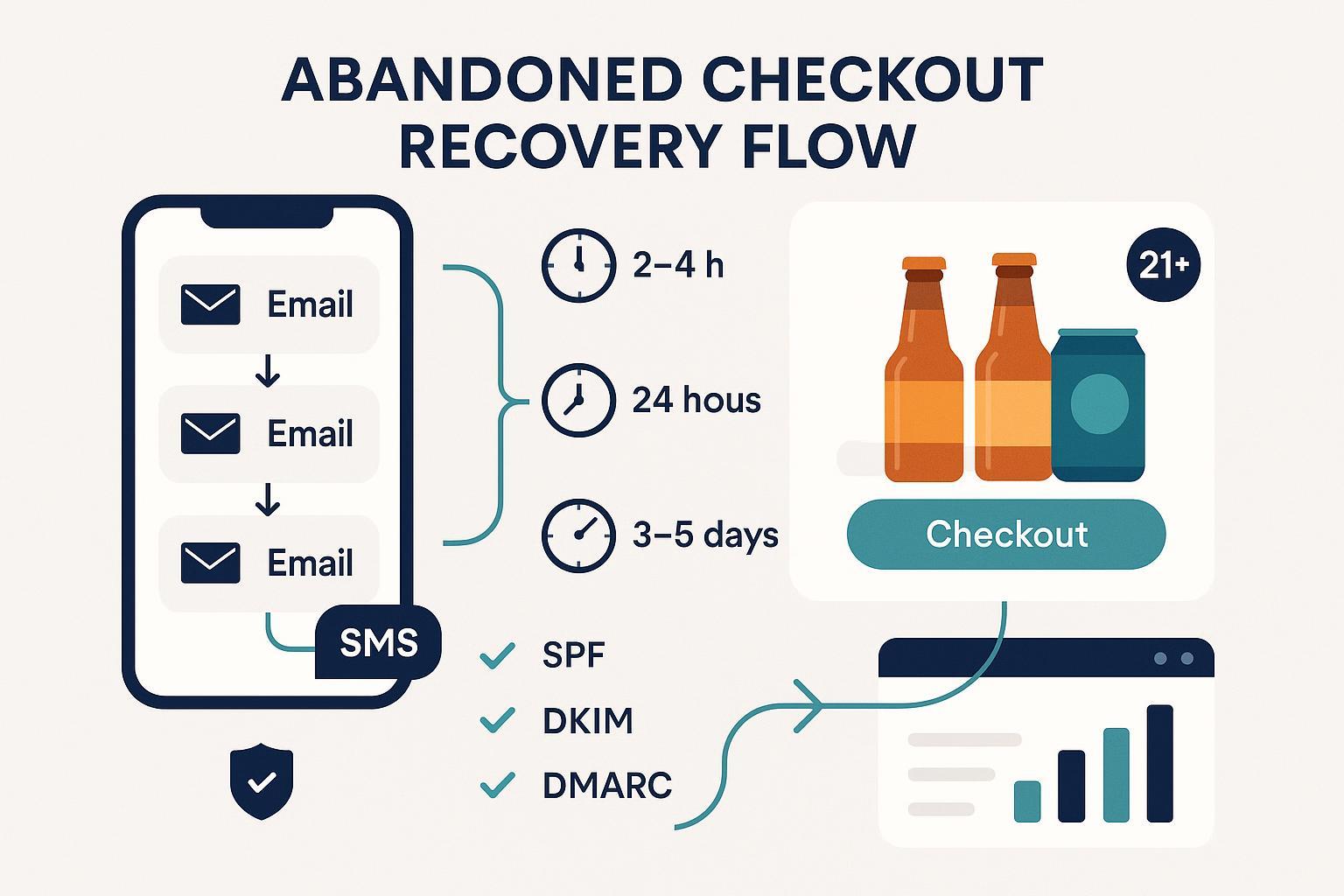

1) The proven 3‑email recovery flow (with optional SMS)

Start with a three‑touch cadence. It’s simple, resilient, and easy to A/B test.

-

Email 1 (2–4 hours after abandonment)

- Goal: Get them back to checkout with minimal friction.

- Copy: “We’re holding your [Item Name].” Show product image, price, and a single bold CTA back to the cart.

- Add-ons: Shipping ETA estimates, inventory/low‑stock cues if truthful, and mobile‑friendly layout (finger‑sized CTAs, 16px+ body type).

-

Email 2 (18–24 hours later)

- Goal: Address objections.

- Copy: Highlight reviews or UGC for the exact items, FAQs on shipping/cold‑chain, returns, and what’s inside bundles.

- Add-ons: A soft sweetener that doesn’t train discount expectation (e.g., recipe card download, pairing guide for alcohol, or a free sample for non‑alcoholic powders when margin allows).

-

Email 3 (3–5 days later)

- Goal: Create a respectful last nudge.

- Copy: Social proof + brand value + one modest incentive for eligible SKUs if necessary (e.g., free shipping threshold reminder, bundle bonus). For alcohol, lean into non‑price value (virtual tasting, pairing concierge, limited‑release note) to avoid promoting over‑consumption.

Optional SMS if consented (follow TCPA/CTIA):

- SMS 1 within 15–60 minutes can outperform an early email in some stacks. Keep it short, clearly branded, with a direct cart link and STOP language. Then proceed with Email 1 at 2–4 hours.

Why this works: The first email capitalizes on short‑term intent. The second reduces friction with targeted reassurance. The third captures procrastinators who needed a little extra context or value. Multi‑message sequences tend to outperform single reminders in 2024–2025 ESP data, as summarized in the Omnisend 2025 abandoned cart best practices.

2) Segmentation blueprint that actually moves the needle

Avoid sending the same message to everyone. Beverage brands benefit from a few high‑leverage splits:

-

Shopper status

- Guest vs. logged‑in: If you captured only an email pre‑checkout, skip deep personalization claims you can’t fulfill and lean on universal FAQs.

- Subscriber vs. non‑subscriber: Avoid discounting subscription SKUs; favor value‑adds (first delivery bonus item, recipe pack, or flexible cadence tips).

-

Intent and product type

- Alcohol vs. alcohol‑free: Include age‑appropriate messages and responsible‑drinking notes where required. For 0.0–0.5% ABV, clarify ABV to prevent confusion.

- One‑off vs. bundle vs. subscription: Tailor benefits—bundle savings clarity, or “how a 30‑day supply fits your routine” for replenishable non‑alcoholic drinks.

-

Value and risk tiers

- High‑AOV carts: Add a direct support channel (chat/concierge) and delivery guarantees where possible.

- Restricted shipping geos (alcohol): If you can’t ship to their state, gracefully state options (store locator, local retailer partners) rather than pushing checkout.

-

Lifecycle

- First‑time vs. repeat: First‑timers want proof and policies; repeat buyers respond well to “you loved X—here’s how this compares,” or bundle switches.

This segmentation increases relevance without bloating ops. Start with two or three splits and expand based on impact.

3) Creative and personalization checklist (mobile‑first)

-

Dynamic cart contents

- Use product images, variants, quantity, and current price. Make the checkout link prominent and session‑resilient.

-

Trust and reassurance

- Shipping costs and ETA up front; cold‑chain handling steps where applicable.

- Returns or replacement policy in one sentence.

- Reviews for the exact product(s), not generic brand love.

-

Compliance cues (beverage‑specific)

- Alcohol: “21+ only. Drink responsibly.” or regionally appropriate wording near footer.

- Zero/low ABV: Clearly state ABV (e.g., “0.0% ABV”).

-

Cross‑sell logic that respects intent

- If they abandoned a 12‑pack, suggest a sampler or bundle that solves decision paralysis rather than spamming unrelated flavors.

-

Layout best practices

- Single primary CTA above the fold; repeat once below content.

- 45–75 character subject lines; preheader completes the thought.

- Avoid heavy image‑only emails; include live text for accessibility and deliverability.

-

Accessibility

- Alt text for all images. Color contrast that meets WCAG AA. Buttons ≥44×44 px.

Pro tip: Keep device testing on your preflight checklist—many beverage carts are abandoned on mobile. Klaviyo’s 2024 cohort data shows strong open rates for abandonment flows, but click and conversion depend heavily on frictionless mobile layouts, as noted in the Klaviyo 2024 abandoned cart benchmarks.

4) Incentive strategy without discount addiction

For non‑alcoholic beverage brands:

- Email 1: No incentive—recover on intent.

- Email 2: Value‑add (recipe PDF, hydration plan, or free sample sachet where margin permits).

- Email 3: A modest, tightly framed offer (e.g., free shipping on $X+, or bundle bonus). Set exclusions for subscriptions.

For alcohol brands:

- Emphasize non‑price value, not discounts: pairing guides, tasting notes, virtual events, limited‑release access, concierge support.

- If you must incentivize, use minimal, compliant constructs and ensure language doesn’t promote excessive consumption.

Guardrails:

- Prevent subscribers from receiving percent‑off discounts that cannibalize LTV; apply segment exclusions.

- If you run frequent promos, cap abandoned‑checkout incentives to avoid stacking or training “wait for discount” behavior.

5) Deliverability guardrails you can’t ignore (Gmail/Yahoo 2024 rules)

Bulk sender requirements introduced in 2024 made sloppy automation risky. At minimum:

-

Authenticate and align

- SPF and DKIM must pass; publish DMARC (p=none is acceptable but consider p=quarantine/reject over time). See the official overview in the Yahoo sender best practices and requirements.

-

Make opting out easy

- One‑click List‑Unsubscribe headers are now enforced; honoring requests within 2 business days is expected (enforcement ramped through mid‑2024). A widely referenced summary is the AWS overview of Yahoo/Gmail bulk sender changes.

-

Watch complaint rates

- Keep spam complaints under 0.3% (ideally <0.1%). Use Google Postmaster Tools to monitor domain reputation and spam rate across Gmail cohorts. Access the dashboards via Google Postmaster Tools.

Operational playbook:

- Sunset unengaged profiles from automations after 90 days of no opens/clicks (adjust to your risk appetite).

- If complaint rates spike, pause abandoned‑checkout sends to the riskiest segments first; re‑warm post‑hygiene.

- Send from a branded subdomain (e.g., mail.yourbrand.com) and maintain TLS.

6) Beverage and alcohol compliance: what must be in place

United States (email + SMS):

- Email rules: CAN‑SPAM requires clear sender identity, non‑deceptive subject lines, a physical address, and easy unsubscribe; while prior consent isn’t legally required in the U.S., opt‑in drives better deliverability and customer trust. Review the FTC CAN‑SPAM guide (2024–2025).

- SMS rules: You need prior express written consent (TCPA) for marketing messages, clear STOP/HELP instructions, and quiet hours adherence. Fines can be substantial per violation; see the FCC TCPA overview.

- Alcohol advertising: Align with TTB/FTC guidance. Avoid targeting minors, ensure truthful claims, and implement age verification where applicable. Start with the TTB alcohol advertising standards.

EU/UK (email + SMS):

- Consent‑first regimes: GDPR and PECR typically require prior consent for marketing emails/SMS; certain purely transactional notices may be exempt if they contain no promotional content. See the UK regulator’s overview in the ICO PECR guide.

- Alcohol marketing rules: The UK’s ASA/CAP imposes strict guidelines (e.g., don’t feature people who appear under 25; avoid associating alcohol with social/sexual success; don’t target under‑age audiences). See the ASA alcohol topic hub for current guidance.

Suggested copy elements (adapt with counsel):

- Footer: “21+ only. Drink responsibly.” (US) or “18+ only. Drink responsibly.” (UK/EU where applicable).

- If promoting 0.0–0.5% ABV products, state “0.0% ABV” or actual ABV and avoid implying alcoholic effects.

- SMS: Brand ID up front, frequency disclosure, and “STOP to opt out. HELP for info.”

Operationally, run compliance checks with legal before enabling the flow, and maintain records of consent and age‑verification processes.

7) Cross‑channel orchestration (email + SMS) without stepping on rakes

If you have SMS consent, a short SMS within the first hour often re‑opens the intent window, with Email 1 following at 2–4 hours. If you don’t have SMS consent, push all emphasis to the email cadence and consider on‑site reminders or web push.

- Deduplicate aggressively: Suppress the email if the order is completed via SMS link to avoid awkward “you left something behind” messages post‑purchase.

- Respect channel norms: SMS is interruptive; use sparingly. Email carries richer context (FAQs, reviews) that SMS can’t deliver elegantly.

- Quiet hours: Enforce local‑time quiet hours for SMS and avoid late‑night emails in conservative ISPs to keep complaints down.

8) Measurement and attribution you can trust (no double‑counting)

Recovery flows touch multiple channels. If you credit the last sender only, you’ll over‑attribute whichever channel fires last.

- Favor multi‑touch attribution (MTA): GA4’s Data‑Driven Attribution can distribute credit along the path rather than just last click.

- Right‑size your recovery window: A 7‑day window after the last recovery engagement balances recognition vs. halo inflation for many beverage brands.

- Deduplicate between email and SMS: Use common customer IDs to ensure a single order isn’t credited twice; apply priority or split‑credit rules.

- Validate with holdouts: Keep a small control group out of the flow to estimate incrementality.

Tooling context: Platforms that unify identifiers across channels make deduping and cross‑channel reporting simpler. The first mention of such a tool here is Attribuly, which connects journeys across email, ads, and onsite events to support multi‑touch analysis. Disclosure: This article mentions Attribuly in a contextual, non‑promotional way.

Also remember to use native analytics where relevant; the current GA4 help center explains how its attribution models and lookback windows work (see the overview of GA4 attribution settings).

9) A/B testing roadmap that avoids noise

Test one variable at a time per touch until you have clear winners. Suggested sequence:

-

Subject lines (Email 1)

- We’re holding your [Item] vs. Your [Item] is almost yours

- Include product name vs. value prop

-

Send delay

- Email 1 at 1h vs. 3h; Email 2 at 18h vs. 24h; Email 3 at day 3 vs. day 5

-

Creative density

- Lean, single‑CTA vs. richer FAQ + reviews block

-

Offer constructs (Email 3)

- Free shipping threshold vs. bundle bonus vs. small percent‑off (non‑alcohol only)

-

Cross‑channel

- Email‑only vs. SMS+Email first touch (monitor opt‑outs and complaint rates)

Run each test until each variant hits at least 1,000–2,000 recipients for medium effects, then lock the winner and move to the next lever. Re‑test quarterly as seasonality, inbox rules, and product lines change. For broader context on sequence effectiveness in 2024–2025, see the Omnisend 2025 abandoned cart best practices.

10) Troubleshooting: quick fixes by failure mode

-

Low opens

- Check deliverability (SPF/DKIM/DMARC passing; domain reputation in Postmaster).

- Reduce image‑only headers; add live text. Tighten subject lines; avoid spammy urgency.

-

Good opens, low clicks

- Simplify layout to one CTA above the fold. Show the exact items with clean price/variant info.

- Address top objections (shipping cost/ETA, returns). Add a short review snippet.

-

Clicks but low conversions

- Audit checkout friction: extra costs at the last step, forced account creation, or state shipping restrictions for alcohol.

- Consider a limited value‑add at Email 2 or 3 (see incentive strategy).

-

High unsubscribes/complaints

- Lengthen delays slightly; reduce total touches for sensitive segments.

- Ensure one‑click unsubscribe header is present, and footer clarity (brand, address, preferences).

-

SMS issues

- Verify consent records; add frequency disclosure; ensure STOP/HELP works; respect quiet hours.

-

Compliance flags (alcohol)

- Add or relocate “21+/Drink responsibly” messaging; ensure no youthful imagery; verify shipping eligibility by state.

11) Implementation blueprint: from zero to live in a week

Day 1–2: Foundation

- Authentication and compliance: SPF/DKIM/DMARC passing; one‑click unsubscribe; updated footers; legal review of disclaimers.

- Build core segments: guest vs. logged‑in; first vs. repeat; alcohol vs. NA; subscription vs. one‑off.

Day 3–4: Creative and flows

- Draft Email 1–3 with the personalization checklist, mobile‑first templates, and variant logic embedded.

- Configure optional SMS touchpoint if consented, with quiet hours and STOP/HELP.

Day 5–6: QA and instrumentation

- Litmus‑style device testing; broken link checks; image‑off rendering; accessibility pass.

- Event mapping from checkout to your ESP; ensure abandoned checkout triggers fire reliably.

Day 7: Launch with safeguards

- Set rate limits on early sends; monitor Postmaster and complaint rates daily for the first week.

- Enable a 5–10% holdout to estimate incremental lift.

12) What “good” looks like in beverage

While performance varies by list quality, offer, and product type, directional guardrails help:

- Email 1: Open 40–60%; Click 4–8%; Order 2–4%

- Email 2: Open 30–45%; Click 2–5%; Order 1–2%

- Email 3: Open 25–40%; Click 1.5–4%; Order 0.5–1.5%

Use these as sanity checks. If you’re materially below, start with deliverability and creative clarity before changing incentives. For broader industry context on how abandonment flows perform and why multi‑touch sequences win, review the Klaviyo 2024 abandoned cart benchmarks and the Omnisend 2025 abandoned cart best practices.

13) Governance checklist (pin this for audits)

-

Deliverability

- SPF/DKIM/DMARC passing; one‑click unsubscribe present; complaint rate <0.3%; monitored via Postmaster.

-

Legal/Compliance

- Email: CAN‑SPAM baseline met (sender identity, address, unsubscribe); see the FTC CAN‑SPAM guide.

- SMS: TCPA consent records, STOP/HELP, quiet hours; see the FCC TCPA overview.

- Alcohol: TTB/FTC advertising standards; age‑gating where required; start with the TTB alcohol advertising standards.

- EU/UK: GDPR/PECR consent basis maintained and recorded; see the ICO PECR guide. For UK creative rules (under‑25 depictions, responsibility), refer to the ASA alcohol topic hub.

-

Data and Measurement

- MTA set up; 7‑day recovery window; dedupe rules between email and SMS; GA4 attribution reviewed in the GA4 attribution settings guide.

14) Closing: Make the next four weeks count

- Week 1: Launch the 3‑email flow (and optional SMS), with the segmentation splits that are easiest to implement.

- Week 2: Fix friction based on early metrics—mobile layout, FAQ clarity, and shipping transparency.

- Week 3: Start your first A/B test (subject lines or Email‑1 delay). Monitor deliverability in Postmaster.

- Week 4: Add one value‑add in Email 2 for non‑alcohol SKUs or concierge/virtual tasting invite for alcohol. Review holdout vs. treatment to confirm lift.

Abandoned checkout flows win in beverage when they respect compliance, remove friction, and speak directly to why someone hesitated. Keep the cadence lean, the content specific, and the measurement honest. That’s how you recover revenue without compromising your brand.

References used in context above:

- Global and cohort performance ranges are discussed with benchmarks from the Klaviyo 2024 abandoned cart benchmarks and automation efficacy in the Omnisend 2025 abandoned cart best practices. Deliverability rules are summarized from the Yahoo sender best practices and the AWS overview of Yahoo/Gmail changes, with operational monitoring via Google Postmaster Tools. Compliance references include the FTC CAN‑SPAM guide, FCC TCPA overview, TTB alcohol advertising standards, ICO PECR guide, and the UK’s ASA alcohol topic hub.