Why Consumer Electronics Brands Need Abandoned Cart Flows

If you sell phones, headphones, or smart home gear, you’re competing in one of the highest-consideration categories in e-commerce. That’s exactly why abandoned cart flows aren’t a “nice to have”—they’re a core revenue system. Across retail, cart abandonment averaged roughly the mid-70% range in the 12 months ending July 2024, per the eMarketer summary of Dynamic Yield’s dataset in 2024 (eMarketer/Dynamic Yield 2024 cart abandonment benchmark). Consumer electronics often skews even higher, especially on mobile, so treating 70–80%+ as baseline is pragmatic.

Why electronics carts are abandoned more often

- Cost surprises and friction at checkout are the top reasons shoppers bail in the U.S., including unexpected fees, forced account creation, and limited payment options. The 2025 breakdown by Statista highlights extra costs as the leading driver and account/payment friction close behind (Statista 2025 reasons for abandonment in the U.S.).

- Mobile intensifies the problem. Aggregated device-level analyses consistently show abandonment approaching or exceeding ~80% on mobile across categories, reflecting smaller screens and higher friction (VWO’s 2024 aggregation of device-level cart abandonment).

- Consideration and trust needs are higher in CE. Shoppers compare specs, warranties, service options, and compatibility (e.g., codecs, smart assistant ecosystems). They often step away to research—so your flow must reduce uncertainty, not just push urgency.

What this means in practice: your recovery program should lower cognitive load (clear specs, compatibility), reduce risk (warranty/returns clarity), and address affordability (financing, installments) while preserving margins.

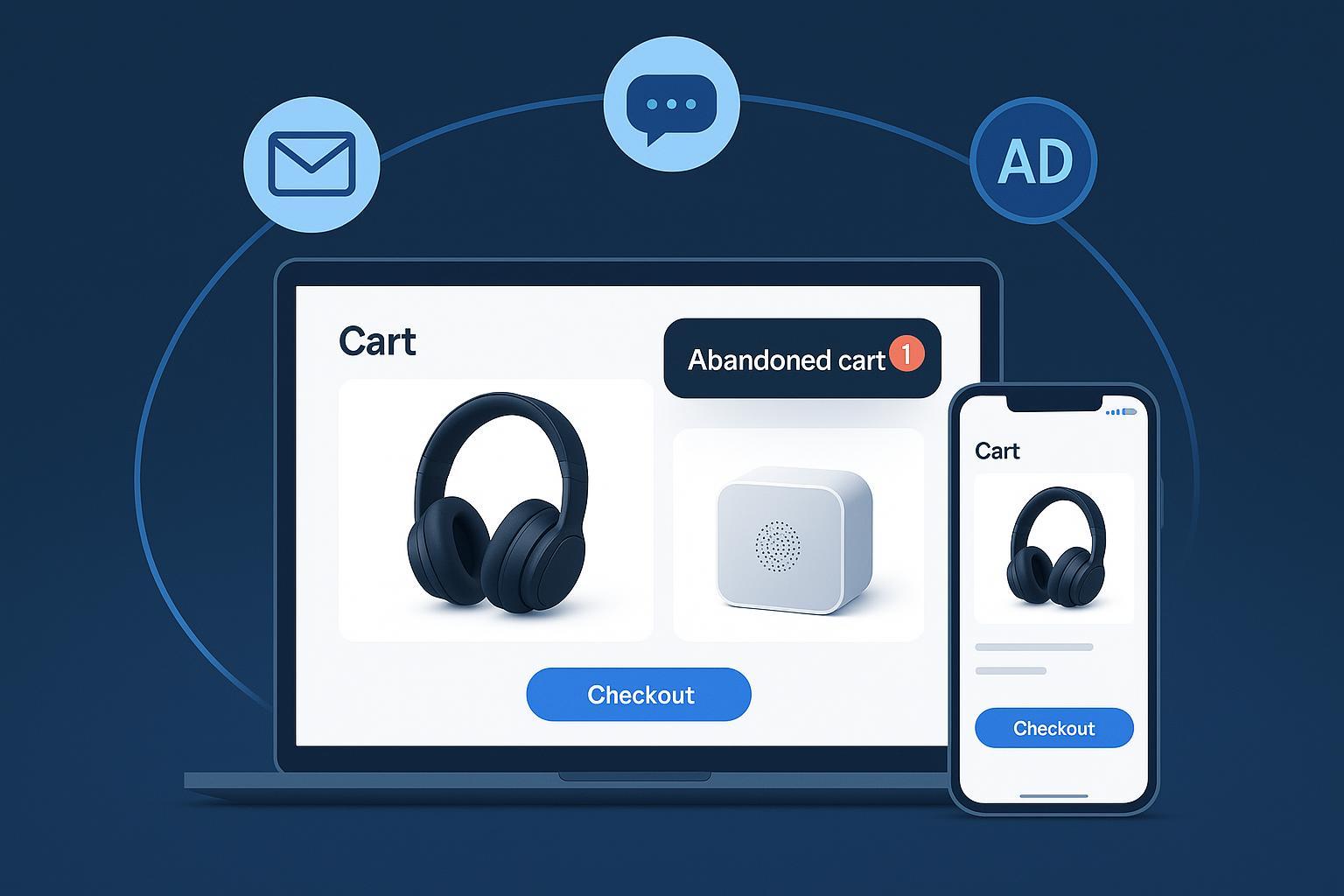

What a modern CE abandoned cart program looks like

Here’s a conservative orchestration that respects consent, margins, and the longer CE decision cycle. Adjust timing to your data.

- Email #1 (1–3 hours): Friendly reminder, product image, spec highlights, “what’s included,” returns/warranty snippet, and a clear checkout button. No discount yet.

- SMS #1 (if opted-in; within 24 hours): Short reminder with a direct link and delivery ETA note. Respect quiet hours and local rules.

- Email #2 (24–36 hours): Address objections—warranty length and coverage, delivery estimates, compatibility, and social proof (reviews). If you must incentivize, try a perk that protects margin (e.g., free shipping on accessories).

- Retargeting ads (24–72 hours, then taper up to 7 days): Dynamic product ads with frequency capping. Suppress if the shopper recently opened email or clicked SMS to avoid channel collision.

- Email #3 (48–72 hours, optional): Final nudge. For high-AOV items, offer help over hard discounts: “Book a consult,” “Chat live about setup,” or “See side-by-side comparisons.”

Segmentation rules that matter in electronics:

- First-time vs. returning: First-timers need trust (returns, warranty, support). Returning customers respond to loyalty perks or accessory bundles.

- Cart value tiers: >$500? Lead with financing, service, and setup reassurance. <$200? Simplicity and speed often win.

- Category nuance: For audio, call out codec and device compatibility; for smart home, highlight platform support (Alexa/Google/Apple), install guides, and network requirements.

KPI orientation: Track recovery rate (placed orders per abandoned carts), revenue per recipient (RPR), unsubscribe/complaint rates, and the overlap between channels (e.g., converters who saw both ads and email). As a directional anchor, Omnisend reported about a 2.7% conversion for cart emails in their 2023 data (Omnisend 2023 cart conversion). Use it as a sanity check while you build your own baseline.

Practical content checklist per touch

- Email #1: Product hero + “What’s included” bullets; 2–3 spec highlights; warranty/returns icon row; financing mention (if applicable); checkout button.

- SMS #1: “You left X in your cart. Ships in 24–48h. Finish here: {short link}. Reply STOP to opt out.”

- Email #2: Address objections with micro-proof: reviews, expert quote, delivery timeframes; link to quick-start/setup.

- Ads creative: Alternate spec callouts (e.g., “LDAC/AAC support,” “Matter-compatible”), lifestyle imagery, and trust badges. Rotate creatives every 5–7 days.

Example: Coordinating server-side triggers and identity for better eligibility

Linking click and server events reliably prevents missed cart triggers—especially with ad blockers. A typical Shopify + Klaviyo setup benefits from a server-side layer that captures AddToCart/BeginCheckout even when client-side pixels fail, and resolves identities to known profiles for email/SMS eligibility and cleaner ad suppression.

- How teams do it: Route key events server-side, tie sessions to hashed emails/customer IDs, and sync to ESP and ad platforms.

- Resulting capability: Fewer “ghost” carts, better suppression for purchasers, and less channel collision.

First mention: Attribuly can provide this server-side tracking and identity resolution within a Shopify/Klaviyo stack to increase trigger reliability and cross-channel coordination. Disclosure: Attribuly is our product.

The CE content playbook: what to say (and when)

High-AOV, high-consideration products need more than “you forgot something.” Use your flow to remove risk and friction.

- Financing and price framing: “Make it yours from $49/mo” with a clear, interest-free installment explanation for qualified shoppers. Mention it in Email #1 and on the cart page.

- Warranty and service clarity: Spell out coverage duration and what’s included (battery, drivers, sensors), and link to the service network—right in Email #2.

- Compatibility and specs: Add concise bullets like “Supports LDAC/AAC,” “Works with Google Home and Alexa,” or “Wi‑Fi 6E ready.” Don’t make people hunt.

- Setup confidence: Link quick-starts and 90‑second demo videos; offer live chat or a callback for premium devices.

- Accessory attach: For carts with a flagship device, nudge essential add-ons (case, surge protector, cables) with “bundle and save” language; protect your core device margin by discounting accessories instead.

Copy snippets you can test today:

- Subject lines:

- “Still deciding? Compare X vs. Y in 30 seconds”

- “Your [Product] is reserved—see warranty + delivery details”

- “Make it yours monthly from $X—no interest for qualified buyers”

- SMS lines (opt-in only):

- “You left [Product]. Delivers in 2–4 days. Complete checkout: {short link} Reply STOP to opt out.”

- “Need help on compatibility/warranty? Chat live: {link} Reply STOP to opt out.”

Tracking and identity resolution: make triggers trustworthy

Pixel-only setups miss events due to browser changes and blockers. For abandoned cart flows, that means people who should receive a reminder won’t—or they’ll receive it late.

- Implement server-side event collection for AddToCart, BeginCheckout, and Purchase to stabilize triggering and attribution. Meta’s official documentation explains how server events improve matching and measurement (Meta Conversions API guide).

- On Shopify, ensure your backend can retrieve and act on checkout/cart data reliably. The platform’s Admin GraphQL documentation outlines the data model and access patterns your developers will use (Shopify Admin GraphQL API overview).

- Identity resolution matters: tie first-party signals (hashed email, customer ID, login) to sessions so ESP automations and ads audiences stay in sync. This reduces duplicate touches and wasted spend.

Internal resources for implementation depth:

- Explore your options across platforms in the Attribuly integrations list to plan data flows.

- If you’re leaning into paid social recovery, review the Attribuly Meta Ads integration for audience sync and suppression considerations.

- To diagnose where shoppers drop off and how to segment cart abandoners, see this Shopify data optimization tutorial.

Compliance essentials you can’t ignore

This section isn’t legal advice—work with counsel—but here are the operational guardrails we apply:

- Email (U.S.): Follow sender identification, honest subject lines, a physical mailing address, and fast unsubscribe processing as outlined by the FTC’s CAN-SPAM guidance (2025) (FTC CAN-SPAM compliance guide).

- SMS (U.S.): Abandoned cart texts are marketing. You need prior express written consent, must include opt-out language (e.g., STOP), and should respect quiet hours. The FCC’s 2024 update reinforces TCPA enforcement across text messaging programs (FCC 2024 TCPA update in the Federal Register). Carrier policies also commonly limit frequency—confirm with your provider.

- EU/UK: PECR/ePrivacy and GDPR typically require opt-in for marketing email/SMS (with limited soft opt-in cases for existing customers). Maintain records of consent and make opting out effortless.

Guardrails that protect both revenue and brand

- Frequency and suppression: Cap retargeting at ~2–3 impressions/day during the first 3 days. Suppress ads for 24 hours after an email open or SMS click when your stack supports it.

- Discount discipline: Avoid conditioning buyers to wait for a code on high-AOV items. If you offer incentives, prioritize accessory discounts, free expedited shipping, or extended returns over device price cuts.

- Message diversity: Rotate ad creatives every 5–7 days. In email, vary angles—specs, service, social proof—rather than repeating the same “You left something” template.

- QA rigor: Seed inboxes across providers, test links on iOS/Android/desktop, and validate suppression by converting test profiles to ensure the flow stops correctly.

Implementation blueprint (7 steps)

- Baseline and goals

- Measure current abandonment, recovery rate, RPR, and complaint rates. Set guardrails (e.g., unsubscribe <0.3%, spam complaints <0.08%).

- Data and tracking hardening

- Implement server-side events for AddToCart/BeginCheckout/Purchase; confirm event parity between client and server; test identity resolution.

- Segmentation design

- Map first-time vs. returning, high vs. low AOV, and category nuances (audio vs. smart home). Define incentives per segment, if any.

- Channel orchestration

- Build the sequence: Email #1, SMS #1 (consent permitting), Email #2, Ads window, Email #3. Set frequency caps and suppression logic.

- Content and creative

- Draft copy variants for specs, warranty, delivery, financing, and accessory attach. Prepare at least two ad creative themes.

- Compliance review

- Validate consent language and records, quiet hours, and opt-out handling. Align with counsel on edge cases (e.g., soft opt-in).

- Launch, monitor, and iterate

- Ship to 10–20% traffic for a week; check deliverability, conversion, and overlap. Scale, then run structured A/B tests (timing, subject lines, perk types).

Decision mini-checklist for incentives:

- Is the product high AOV or margin-sensitive? Prefer accessory perks over device discounts.

- Is the shopper first-time and price-sensitive? Consider free shipping, not a broad % off.

- Is support anxiety the blocker? Offer setup help or extended returns instead of a coupon.

Common pitfalls (and how to avoid them)

- Over-discounting: Erodes margins and trains waiting behavior. Use financing, accessories, or service perks.

- Channel collision: Uncoordinated email/SMS/ads annoys shoppers and adds cost. Implement suppression and frequency caps.

- Incomplete tracking: Pixel-only detection misses triggers. Add server-side collection and identity resolution to improve eligibility.

- One-size-fits-all messaging: Specs and compatibility matter. Tailor flows to category and AOV.

Final take

Consumer electronics buyers need reassurance as much as reminders. A well-built abandoned cart program respects that reality: it reduces risk and friction, coordinates channels, protects margins, and runs on reliable first-party data. Start with the basic sequence and CE-specific content above, harden your tracking, and then iterate toward tighter segmentation and smarter suppression. The result isn’t just recovered revenue—it’s a buying experience worthy of your brand.

References for key facts mentioned:

- Global/category abandonment: eMarketer’s 2024 summary of Dynamic Yield data; device-level aggregates via VWO (2024).

- U.S. reasons for abandonment: Statista (2025).

- Cart email conversion: Omnisend (2023).

- Compliance: FTC CAN-SPAM guide (2025); FCC TCPA update (2024).

- Server-side/Shopify: Meta Conversions API guide; Shopify Admin GraphQL API overview.